Submitted by International Review on

For more than 2.5 years the bourgeoisie has been announcing a recovery which it has been forced to put off at every quarter. For more than 2.5 years economic performance has fallen systematically below forecasts, forcing the ruling class to revise these downwards. The present recession, beginning in the second half of the year 2000, is already one of the longest since the end of the 1960s. And, although there are some signs of recovery in the United States, this is still far from being the case in Europe or Japan. Moreover, any improvement in United States is essentially the product of some of the most vigorous state intervention in 40 years, and an unprecedented increase in debt, leading to fears that the new speculative bubble in the housing market is about to burst.

As regards state intervention aimed at maintaining economic activity, it should be noted that the American government has allowed an unrestrained increase in the budget deficit. From a positive balance of $130 billion in 2001, by 2003 the budget had fallen into deficit to the tune of $300 billion (3.6% of GNP). Today, the American business and political classes are increasingly alarmed by the size of the deficit and by the increases forecast as a result of the conflict in Iraqi and a reduction in tax returns as a result of the fall in income tax.

With regard to the debt, the Federal Reserve's drastic reduction in interest rates was intended above all to maintain household consumption thanks to the renegotiation of their mortgage loans. Reducing the load of housing loan repayments made it possible for the banks to grant new loans and so increase household debt. American households' mortgage debt has thus grown by $700 billion (more than twice the budget deficit!). The United States' ability to recover more rapidly than other countries is due to the triple growth of American debt: state, households, and foreign debt. However, this recovery will only last if sustained economic activity continues into the medium-term. Otherwise America runs the risk of finding itself in the same situation as Japan more than ten years ago, faced with the bursting of a speculative property bubble and an enormous increase in bad debt.

Europe can scarcely afford such luxury, since its deficits were already impressive when the recession began again, and the continued recession has only served to increase these deficits. Thus Germany and France, which represent the economic heart of Europe, but today are revealed as the worst students in the class, with budget deficits of the 3.8% and 4% respectively. These are already well beyond the 3% ceiling fixed by the Maastricht treaty, and, as a result France and Germany are both under threat of punishment by the European commission and the enormous fines provided for by the treaty. This reduces still further Europe's ability to undertake a serious policy of recovery. Moreover, any European recovery will have to carry the weight of the fall in the dollar against the Euro organised by the US to reduce its trade deficit: Europe will have more and more difficulty in maintaining its export surplus. It is hardly surprising that countries at the heart of Europe like Germany, France, Holland and Italy are in recession and that the others are not far behind.

Those who believed the bourgeoisie's talk about a new era of prosperity thanks to the opening of East European markets after the collapse of the Berlin Wall are having to think again. Far from providing a springboard for "German domination", reunification is still proving to be a heavy burden for Germany. Once the locomotive of Europe, Germany now has difficulty in keeping up with the train. Inflation is down almost to the point of deflation, high real interest rates are a dampener on economic activity, and the existence of the Euro makes it impossible to undertake a policy of competitive devaluation of the national currency. Unemployment, wage restrictions, and recession have all led to a stagnation of the domestic market never seen during previous downturns. The future integration of Eastern countries into the European Union will weigh still more heavily on the economic situation.

The obsolescence of capitalist relations of production finds rxpression in the crisis

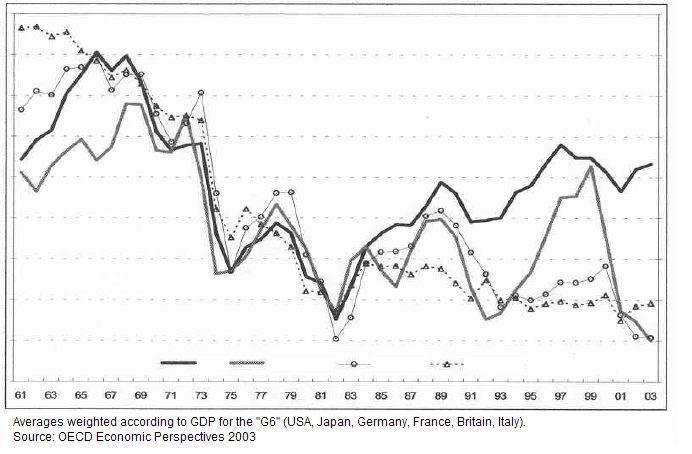

The uninterrupted decline in growth rates since the end of the 1960s (see our article "The reality of 'economic prosperity' laid bare by the crisis" in International Review n°114, and the graph below), reveals the immense bluff that the bourgeoisie has maintained throughout the 1990s about capitalism's supposed renewed economic prosperity thanks to the 'new' economy, globalisation, and the recipes of neo-liberalism. This is hardly surprising, since the crisis has nothing to do with economic policy: the exhaustion of the Keynesian policies of the 1950s and 60s, followed by the neo-Keynesian policies of the 1970s, and the inability of the neo-liberal recipes of the 1980s and 1990s to offer any kind of solution, are due to the fact that the world wide crisis is not the result of "bad economic management", but of the fundamental contradictions that pervade the whole mechanism of the capitalist economy. And if the crisis has nothing to do with economic policy, it has still less to do with the government of the day. Whether they be on the right or on the left, governments have gone the rounds of all the recipes available. We thus have the British and American governments applying the most neo-Keynesian policies imaginable, with run-away budget deficits, despite being at opposite ends of the political spectrum. Similarly, the austerity programmes of the Schröder government in Germany (social-democrat and ecologist), and of the Raffarin government in France (liberal right), are as alike as two peas in a pod.

One of the main responsibilities of revolutionaries, confronted with this 35-year uninterrupted spiral of crisis and austerity, is to demonstrate that its roots are to be found in the historical obsolescence of the wage labour that lies at the heart of capitalist relations of production.[1] Wage labour concentrates within itself all the social, economic, and political limitations of the production of capitalist profit, and its very mechanisms set a barrier in the way of the latter's complete realisation.[2] The generalisation of wage labour lay at the heart of capitalism's expansion in the 19th century, and, since World War I, has lain at the heart of the inadequacy of the solvent market relative to the needs of the process of accumulation.

Against all the false explanations for the crisis, it is up to revolutionaries to demonstrate that while capitalism was once a necessary and progressive mode of production, it is now historically redundant and is dragging humanity to its doom. As in the decadence of previous modes of production (feudalism, slavery, etc.), this historical obsolescence lies in the fact that the social relations of production have become too narrow to contain and encourage the development of the productive forces as they once did.[3]In today's society, it is wage labour that is holding back the full satisfaction of human needs. Humanity will only be able to free itself from these contradictions by overthrowing this social relationship and creating communism.

Since the collapse of the Berlin Wall, the bourgeoisie has mounted endless campaigns on the "absurdity of communism", the "utopia of revolution", and the "dilution of the working class" in a formless mass of citizens whose only legitimate activity is supposedly the "democratic" reform of a capitalism presented henceforth as humanity's only horizon. Within this monstrous ideological swindle, the anti-globalisation movement has been accorded a monopoly on anti-establishment protest. The ruling class takes endless trouble to put them at the forefront of the criticism of its own system: their analyses and activity are widely reported in the media, their most eminent representatives are occasionally invited to summit meetings, etc. And with good reason, the stock in trade of the anti-globalisation movement perfectly complements the bourgeoisie's ideological campaign on the "utopia of communism", since both are grounded in the same hypothesis: that capitalism is the only possible system, and its reform the only alternative. According to this movement, with the organisation ATTAC and its council of "economic experts" at its head, capitalism could be humanised if only a "good regulated capitalism" could expel "bad financial capitalism". The crisis is supposedly the result of neo-liberal deregulation and the dictatorship of finance capital imposing its demand of 15% return on investment from industrial capital - all supposedly decided at an obscure 1979 meeting called "the Washington consensus". Austerity, financial instability, recession - all this is nothing but the result of a new balance of forces within the bourgeoisie itself, to the benefit of usurious capital. Whence the ideas of "regulating finance", "pushing it back", and "redirecting investment towards the productive sphere", etc.

In this atmosphere of general confusion as to the causes of the crisis, revolutionaries must establish a clear understanding of what are its origins, and above all demonstrate that it is the product of capitalism's historical bankruptcy. In other words, they must re-establish the validity of marxism in this domain. Sadly, when we look at the analyses of the crisis proposed by the groups of the proletarian political milieu (eg the PCInt - Programme Communiste, or the IBRP), we can only say that they have great difficulty in marking a clear separation with the ambient ideology of anti-globalisation, and of mounting a clear defence of marxism. Both groups are undoubtedly part of the proletarian camp, and set themselves fundamentally apart from the anti-globalisation crowd by the denunciation of reformist illusions and their defence of a revolutionary communist perspective. However, their own analysis of the crisis is to a large extent borrowed from the anti-globalists' defrocked leftism.

Some choice selections: "The profits gained from speculation are so great that they are attractive not only to 'classical' businesses but also for many others such as insurance companies or pension funds, of which Enron is an excellent example (...) Speculation is a complementary, not to say the principal, means whereby the bourgeoisie appropriates surplus-value (...) A rule has been imposed, fixing the minimum return on invested capital at 15%. To achieve or to outdo this rate of growth in share value, the bourgeoisie has had to increase the conditions of exploitation of the working class: the rhythm of labour has intensified, real wages have fallen. Collective redundancies have affected hundreds of thousands of workers" (Bilan et Perspectives n°4, p.6, our translation). We can start by pointing out that this is a strange way to pose the problem on the part of a group that proclaims itself "materialist" in contrast to the ICC's "idealism". "A rule has been imposed", says the IBRP. But how? By itself? We will not insult the IBRP by suggesting that they imagine any such thing. This new rule must have been imposed by a class, a government, a given human organisation, but why? Because certain powerful individuals have suddenly become greedier and nastier than usual? Because the "bad guys" have won out over the "good guys" (or the "less bad guys")? Or simply, as marxism would have it, because the objective conditions of the world economy have obliged the ruling class to intensify their exploitation of the workers. Unfortunately, the passage we have quoted does not pose the problem like this.

Worse still, we could read the same analysis in any anti-globalist pamphlet: financial speculation has become the main source of capitalist profit (!), financial speculation imposes its 15% rule on business, financial speculation is responsible for the increase in exploitation, massive lay-offs and falling wages, and it is even financial speculation that is the source of a process of de-industrialisation and of poverty all over the planet: "The accumulation of speculative and financial profit feeds a process of de-industrialisation that brings in its wake unemployment and poverty all over the planet" (idem, p.7).

The PCInt - Programme Communiste is scarcely any better, even if it does refer to the authority of Lenin, and couch its analysis in more general terms: "Thanks to the development of finance capital, the banks have become the real actors of capital's centralisation, increasing the power of gigantic monopolies. In capitalism's imperialist phase, it is finance capital that dominates the market, companies, indeed the whole of society, and this domination itself leads to further financial concentration to the point where 'Finance capital, concentrated in a few hands and exercising a virtual monopoly, exacts enormous and ever-increasing profits from the floating of companies, issue of stock, state loans, etc., strengthens the domination of the financial oligarchy and levies tribute upon the whole of society for the benefit of monopolists' (Lenin, in Imperialism, the highest stage of capitalism[4]). Capitalism was born from minuscule usurious capital, and ends its evolution in the form of gigantic usurious capital" (Programme Communiste, n°98, p1, our translation). This vigorous denunciation of parasitic finance capital could satisfy the most radical anti-globalist.[5]

One would search in vain through these few extracts for any kind of demonstration that it is capitalism as a mode of production which is outmoded, that it is capitalism as a whole which is responsible for the world's crises, wars, and poverty. One would search in vain for any denunciation of the anti-globalists' central idea: that crises are caused by finance capital, when in fact it is the capitalist system as a whole which lies at the heart of the problem. By adopting whole segments of the anti-globalist argument, these two groups of the Communist Left leave the door wide open to a theoretical opportunism towards leftist analyses. These present the crisis as the consequence of a change in the balance of forces within the bourgeoisie, between the financial oligarchy and industrial capital. The moment when the financial oligopoly got the upper hand over business capital, is supposedly linked to the decision taken in Washington to suddenly raise interest rates.

There has not in reality been any "triumph of finance over industry", it is the whole bourgeoisie which has changed gear in its offensive against the working class.

Is "financial profit" the basis for a usurious capitalism?

The denunciation of the theme of finance capital is today a theme common to all the so-called "critical" economists. It is the fashion among the "critics of capitalism" to claim that the rate of profit has increased but that it has been confiscated by the financial oligarchy, and that as a result the industrial rate of profit has not significantly recovered. This is supposed to explain the failure of growth to recover (see the graph in this article, below). It is true that, since the decision to raise interest rates in 1979, a large part of extracted surplus value has not been accumulated via company self-financing, but has been distributed in the form of financial revenue. The typical response to this observation is to present the growth in finance capital as a drain on global profit, which thus hinders productive investment. The weakness of economic growth is thus explained by the parasitism of the financial sphere, by the hypertrophy of "usurious capital", whence the pseudo-marxist "explanations" based on Lenin's mistakes (such as the passage cited above from Programme Communiste) according to which financial profit is supposedly a "drain" on company profit (the famous 15% return on investment).

This analysis is a return to the vulgar economics of a capital choosing between productive or financial investment depending on the relation between the return on industrial investment and the return on finance capital. On a more theoretical level, these approaches to finance as a parasitic element demand a return to two theories of value and profit.

According to marxist theory, value exists prior to its redistribution and is produced solely in the production process through the exploitation of labour power. In Book III of Capital, Marx clearly states that interest is "The part of the profit paid to the owner is called interest, which is just another name, or special term, for a part of the profit given up by capital in the process of functioning to the owner of the capital, instead of putting it into its own pocket" (Capital, Vol III, Part V, Chapter 21, "Interest-Bearing Capital").[6] In saying this, Marx radically sets himself apart from bourgeois economics, which presents profit as the sum of different factors of profit (revenue from the factor of labour, revenue from the factor of capital, revenue from the factor of rent, etc.). Exploitation disappears, since each factor is remunerated according to its own contribution to production: "For vulgar political economy, which seeks to represent capital as an independent source of value, of value creation, this form is naturally a veritable find, a form in which the source of profit is no longer discernible, and in which the result of the capitalist process of production - divorced from the process - acquires an independent existence" (Capital, Vol III, Part V, Chapter 24, "Externalisation of the relations of capital in the form of interest-bearing capital"). The fetishism of finance consists in the illusion that holding a part of capital (a share, a treasury bond, a debenture) will, in the true sense of the term, "produce" interest. Buying a share means buying the right to receive a fraction of the value created, but that does not in itself create value. It is labour, and only labour, that gives value to what is produced. Capital, property, shares, a savings account, or a stock of machines, produce nothing whatsoever by themselves. It is human beings who produce.[7] Capital has a "return" in the same sense that the hunting hound "returns" with the game. It creates nothing, but it gives its owner the right to a share of what has been produced by whoever set the capital in motion. In this sense, capital is less an object than a social relation: a share of the fruit of the labour of the workers ends up in the hands of the owner of capital. The ideology of anti-globalisation turns things upside down by mixing up the extraction of surplus value with its distribution. The source of capitalist profit lies solely in the exploitation of labour, there is no such thing as speculative profits for the bourgeoisie as a whole (although this or that sector of the bourgeoisie may gain from speculation); the stock market does not create value.

The other theory, flirting with vulgar economy, conceives global profit as the sum of industrial profit on the one hand, and financial profit on the other. The rate of accumulation is supposedly low because finance profit is higher than industrial profit. This vision is directly inherited from the late and unlamented Stalinist parties, which spread a "popular" criticism of capitalism seen as the confiscation of "legitimate" profit by a parasitic oligarchy (the "200 families" in France, etc.). Here the idea is the same: it is based on a veritable fetishism of finance, which sees the stock market as a means of creating value in the same way as the exploitation of labour. This is the basis for the whole anti-globalist mystification of the Tobin tax, the regulation and humanisation of capital. Any theory which transforms a contradiction as effect (the increasing role of finance capital) into a contradiction as cause carries with it the risk of falling into a typically leftist vision: that there is a distinction between a "good" capitalism that invests and a "bad" capitalism that speculates. This leads to a vision of finance capital as a sort of parasitic growth on an otherwise healthy capitalist body. The crisis will not disappear, even after the abolition of the "gigantic usurious capital" so dear to Programme Communiste. In a sense, the idea of capitalism dominated by finance capital leads to an under-estimation of the depth of the crisis, since it implies that the crisis is the result of the parasitic role of finance capital demanding extravagant interest rates from companies, and therefore preventing them from undertaking productive investment. If this were indeed the root of the crisis, then its resolution would merely be a matter of "euthanasia for the rentiers" as Keynes put it.

This sliding into leftism at the analytical level leads to the presentation of various economic data with the aim of demonstrating this absolute domination by finance capital, and its enormous drain on the economy: "the major companies saw their investments oriented towards the supposedly more 'profitable' financial markets (...) This phenomenal market developed faster than production (...) As far as currency speculation is concerned, of the $1,300 billion that moved daily from one currency to another in 1996, at most 5-8% corresponded to payment for goods or services sold between countries (to which we should add non-speculative currency exchange operations). Of these $1,300 billion, 85% thus corresponded to purely speculative daily operations! These figures would need to be brought up to date, but we can bet that the figure has gone beyond 85%" (IBRP, Bilan et Perspectives, n°4, p.6). The figure is indeed higher now, and the sums exchanged are now in the region of $1,500 billion, or in other words almost the entire debt of the Third World... but these figures only frighten the ignorant for they are meaningless! In reality, this money is merely going round in circles and the faster it turns the higher the figures. We need only imagine a speculator converting 100 currency units every ½ hour; after 24 hours, the total transactions will amount to 4,800 units, and if he speculated every ¼ hour, then the total sum counted would double... but this sum is purely virtual since the speculator only actually possess the original 100 +5 or -10, depending on his talents as a speculator. This media presentation of the facts, adopted by the IBRP, unfortunately gives credit to the interpretation of the crisis as a product of the parasitic action of finance.

In reality, the growth in the financial sphere is to be explained by the increase in non-accumulated surplus-value. It is the crisis of over-production - and therefore the scarcity of fields for profitable accumulation - which engenders the payment of surplus-value in the form of finance revenue, rather than finance capital which opposes or substitutes itself for productive investment. The increasing role of finance capital corresponds to a growing proportion of surplus-value, which can no longer be profitably re-invested.[8]The distribution of financial revenue is not automatically incompatible with accumulation based on company self-financing. When there is attractive profit to be drawn from economic activity, finance revenue is re-invested and participates in companies' accumulation. What needs explaining, is not that profit goes out in the form of the distribution of finance revenue, but that it doesn't come back to be productively reinvested in the economic cycle. If a significant part of these sums were reinvested, then this would be expressed in a rise in the rate of accumulation. And if this is not happening, it is because there is a crisis of over-production, and therefore a scarcity of possibilities for profitable accumulation.

Financial parasitism is a symptom of capitalism's difficulties, not a cause. The financial sphere is the crisis' showcase, for this is where stock market bubbles, currency collapses, and banking upheavals make their appearance. But these upheavals are the product of contradictions whose origins lie in the productive sphere.

Wage labour at the heart of the crisis of over-production

What has happened over the last twenty years? Austerity and falling wages[9] have allowed companies to re-establish their rate of profit, but these increased profits have not led to an increase in the rate of accumulated investment. Growth has therefore remained depressed (see the graph in this article). In short, the brake placed on wage costs has restricted markets, and fed financial revenue rather than the reinvestment of profit. But why is the level of reinvestment so low despite the fact that companies have re-established their profits? Why has accumulation not started up again despite a twenty-year increase in the rate of profit? Marx, followed by Rosa Luxemburg, have shown that the conditions of production (the extraction of surplus-value) are one thing, while the conditions for the realisation of this surplus labour crystallised in manufactured commodities are another. The surplus labour crystallised in production only becomes surplus-value in the form of liquidities that can serve for accumulation if the commodities produced have been sold on the market. It is this fundamental difference between the conditions of production and the conditions of realisation that allows us to understand why there is no automatic link between the rate of profit and growth.

The graph summarises very well capitalism's evolution since World War II. The exceptional phase of prosperity during the period of reconstruction saw all the basic variables of profit, accumulation, growth, and labour productivity either increase or fluctuate at high levels until the re-appearance of the open crisis at the turn of the 1960s-70s. The exhaustion of gains in productivity that began in the 1960s dragged all the other variables down together until the beginning of the 1980s. Since then, capitalism has been in an altogether unprecedented situation on the economic level, combining a high rate of profit with mediocre labour productivity, rates of accumulation, and therefore of growth. This separation, for more than 20 years, between the evolution of the rate of profit and that of the other variables, can only be explained in the framework of capitalism's decadence. The IBRP does not believe this, and considers that the concept of decadence should be confined to the dustbins of history: "What role then does the concept of decadence play on the terrain of the militant critique of political economy, in other words of a profound critique of the phenomena and dynamics of capitalism in the period in which we are living? None. (...) We will not be able to explain the mechanisms of the crisis, nor denounce the relationship between the crisis and the increasing influence of finance capital, or the relationship between the latter and the policies of the super-powers in their struggle for control of financial income and its sources, using the concept of decadence".[10] The IBRP thus prefers to abandon the key concept of decadence on which its own positions are based[11] and to replace them with concepts in vogue in the anti-globalist milieu, such as "financiarisation" (which we have translated as the "increasing influence of finance capital") and the "rent of finance capital" in order to "understand the crisis and the policies of the super-powers". They even end up declaring that "these concepts [decadence in particular] are foreign to the method and the arsenal of the critique of political economy" (idem).

Why is the framework of decadence so vital for understanding the crisis today? Because the uninterrupted decline in growth rates in the OECD countries since the end of the 1960s (respectively 5.2%, 3.5%, 2.8%, 2.6%, and 2.2% for the 1960s, 70s, 80s, 90s, and the years 2000-02) confirm capitalism's return to the historic tendency that began with World War I. The parenthesis of the exceptional period of growth (1950-75) is definitively closed.[12] Like a broken spring returning to its position of rest after one last rebound, capitalism is inexorably returning to the growth rates of the period from 1914 to 1950. Contrary to the vociferous claims of our critics, the theory of the decadence of capitalism is not in the least a specific product of the period of stagnation in the 1930s.[13] It lies at the very heart of historical materialism, the secret at last discovered of the succession in history of modes of production. As such, it gives us the framework for analysing the evolution of capitalism, and above all of the period since World War I. Its bearing is general, and valid for a whole historical era. It is absolutely not dependent on a particular period or economic conjuncture. Moreover, even if we include the exceptional phase of growth between 1950 and 1975, the two world wars, the depression of the 1930s, and more than 35 years of austerity and crisis until the present day, condemn capitalism out of hand: barely 35 years of "prosperity" (if we count large) against 55-60 years of war and/or economic crisis (and the worst is still to come!). The historical tendency for capitalism's obsolete relations of production to hold back the growth of the productive forces is the rule, the framework that allows us to understand the evolution of capitalism, including its exceptional phase of prosperity after World War II (we will return to this point in future articles). By contrast, it is the abandonment of the theory of decadence which is a pure product of the years of "prosperity", analogous to the way in which the reformists of the Second International allowed themselves to be deceived by capitalism's performance during the Belle Époque that preceded 1914.

Moreover, the graph demonstrates clearly that the mechanism at the basis of the increase in the rate of profit is neither an increase in labour productivity, nor a reduction in capital. It also allows us definitively to wring the neck of all the nonsense about the "new technical revolution". There are some university professors who are dazzled by computers to the point where they fall for the bourgeoisie's campaigns about the "new economy", and confuse the frequency of their computer's CPU with the productivity of labour: it is not because the Pentium 4 is 200 times faster than the first-generation processors that the office worker types 200 times faster on his keyboard, or increases his productivity by the same amount. The graph shows clearly enough that labour productivity has declined since the 1960s. And despite the restoration of profits, the rates of accumulation (investments which underpin possible gains in productivity) have not taken off. The "technological revolution" only exists in the campaigns of the ruling class and in the heads of those who swallow them. More seriously, the empirical observation that the increase in productivity (progress in technology and the organisation of labour) has been constantly slowing down since the 1960s, contradicts the media image of increasing technical change, a new industrial revolution supposedly borne on a wave of computing, telecommunications, the Internet, and multimedia. How are we to explain the strength of this mystification, which turns reality upside down in the heads of every one of us?

Firstly, we should remember that the increases in productivity were much more spectacular immediately following World War II than those which are presented today as a "new economy". The organisation of labour in three eight-hour shifts, the generalisation of production lines throughout industry, rapid progress in the development and extension of all kinds of transport (trucks, trains, aircraft, cars, ships), the replacement of coal by cheaper oil, the invention of plastics and their use to replace more expensive materials, the industrialisation of agriculture, the universal supply of electricity, natural gas, running water, radio and the telephone, the mechanisation of home life thanks to the development of household appliances, etc... all these are far more remarkable in terms of an increase in productivity than the recent developments in computing and telecommunications. And since the "Golden 60s", the increase in productivity has fallen continuously.

Furthermore, there is a constantly encouraged confusion between the appearance of new commodities for consumption and the progress of productivity. The tide of innovation, and the proliferation of the most extraordinary new consumer products (DVD, GSM phones, the Internet, etc.) is not the same thing as an increase in productivity. An increase in productivity means the ability to reduce the resources needed to produce a commodity or a service. The term "technical progress" should always be understood as progress in the "techniques of production and/or organisation", strictly from the standpoint of the ability to economise the resources used in the production of a commodity or the supply of a service. No matter how extraordinary, the progress of digital technology is not expressed in significant increases in productivity within the productive process. This is the bluff of the "new economy".

Finally - and despite the assertions of our critics, who deny the reality of capitalism's decadence and the validity of Rosa Luxemburg's theoretical work, and who make the fall in the rate of profit the alpha and omega of capitalism's evolution - the history of the economy since the beginning of the 1980s shows us clearly that it is not because profit rates increase that growth starts up again. Certainly, there is a link between the rate of profit and the rate of accumulation, but it is neither mechanical nor unambiguous: the two variables are partially independent. This contradicts those who make the crisis of overproduction dependent on the fall in the rate of profit, and the return to growth on its renewed rise: "This contradiction between the production of surplus value and its realisation appears as an overproduction of commodities and therefore as a cause of the saturation of the market, which in turn holds back the process of accumulation, which makes the system as a whole unable to counter-balance the fall in the rate of profit. In reality, the process is the opposite (...) It is the economic cycle and the process of valorisation which makes the market 'solvent' or 'insolvent'. It is on the basis of the contradictory laws which control the process of accumulation that we can explain the 'crisis' of the market" (Battaglia Comunista's presentation to the first conference of groups of the Communist Left, May 1977, our translation). Today, we can see clearly that the rate of profit has been rising for some twenty years despite the fact that growth remains depressed and the bourgeoisie has never spoken of deflation as much as it does today. It is not because capitalism can produce profitably that it is also able to create automatically, by the same mechanism, the solvent market where it will be possible to transform the surplus labour crystallised in commodities, into hard cash which alone allows the profit to be reinvested. The extent of the market does not depend automatically on the evolution of the rate of profit; like the other variables that condition capitalism's evolution, it is partially independent. Understanding this fundamental difference, between the conditions of production and those of realisation, already highlighted by the theoretical work of Marx as it was continued by Rosa Luxemburg, allows us to understand why there is no automatic relationship between growth and the rate of profit.

Decadence and the orientation of the workers' resistance

Because they reject decadence as the framework for understanding the present period and the crisis, point to financial speculation as the cause of the world's misfortunes and under-estimate the development of state capitalism on every level, the two most important groups of the communist left apart from the ICC - the PCInt - Programme Communiste and the IBRP - can offer no coherent orientation for the resistance struggles of the working class. We need only read their analyses of the bourgeoisie?s austerity policies and the conclusions they draw from their analysis of the crisis to see this: "During the 1950s, the capitalist economies returned to growth and the bourgeoisie at last saw profits flourish durably. This expansion, which continued during the decade that followed, was thus based on a growth in credit and was possible thanks to the support of the state. It undeniably found expression in an improvement in the workers' living conditions (social security, collective bargaining, rising wages...). These concessions by the bourgeoisie, under pressure from the working class, were expressed in a fall in the rate of profit, which is itself an inevitable phenomenon linked to the internal dynamic of capital (...) While at the beginning of the imperialist stage, the profits gained thanks to the exploitation of the colonies and of their peoples allowed the dominant bourgeoisies to guarantee a certain social peace by allowing the working class to benefit from a fraction of the extorted surplus value, the same is no longer true today, since the logic of speculation implies a calling into question of all the social gains won by the workers of the 'central countries' during the previous decades from their bourgeoisie" (IBRP, Bilan et Perspectives, n°4, our translation).

Here again, we can see that abandoning the framework of decadence opens wide the door to concessions to leftist analyses. The IBRP prefers to copy the leftists' fairy-tales about the social gains of "social security, collective bargaining, rising wages" which were supposedly "concessions by the bourgeoisie, under pressure from the working class", and which today are called into question by the "logic of speculation", rather than basing itself on the theoretical contributions inherited from the groups of the international communist left (Bilan, Communisme, etc.), who analysed these measures as the means whereby the bourgeoisie made the working class dependent on, and attached it to, the state.

During capitalism's ascendant phase, the development of the productive forces and of the proletariat was not adequate to threaten the bourgeoisie and to make a victorious international revolution a possibility. This is why, even though the bourgeoisie did everything it could to sabotage the proletariat's organisation, the workers were nonetheless able, in bitter struggle, to combine in a "class for itself" within capitalism, through their own organisations: the working class' political parties, and the trades unions. The unification of the proletariat was achieved through struggles to wrest reforms from capital in the form of improvements in working class living conditions: reforms on both the economic and the political terrain. As a class, the proletariat won the right to a political life within society, or to use Marx's terms in The poverty of philosophy: the working class won the right to exist and to assert itself in social life as a 'class for itself', in other words as an organised class with its own meeting places, its own ideas, and its own social programme, its traditions and even its songs.

With capitalism's entry into its decadent phase in 1914, the working class demonstrated its ability to overthrow the bourgeoisie's domination by forcing the latter to bring the war to an end and by developing and international wave of revolutionary struggle. Ever since, the proletariat has been a permanent potential threat for the bourgeoisie. This is why the bourgeoisie can no longer tolerate its class enemy being able to organise permanently on its own class terrain, being able to live and grow within its own organisations. The state extends its totalitarian domination over every aspect of social life. Everything is in the grip of its omnipresent tentacles. Everything that lives in society must either submit unconditionally to the state, or confront it in a fight to the death. The time when capital could tolerate the existence of permanent organisations of the proletariat is over. In the same way, "Since World War I, in parallel with the role of the state in the economy, the laws that regulate the relationship between capital and labour have proliferated, creating a strict framework of 'legality' within which the proletarian struggle is circumscribed and reduced to impotence" (ICC pamphlet The unions against the working class). This state capitalism on the social level means the transformation of all class life into an ersatz on bourgeois terrain. Whether through the trades unions in some countries, or directly in others, the state has laid hands on all the different strike funds or funds for mutual assistance in case of sickness or unemployment, created by the working class during the 19th century. The bourgeoisie has deprived the proletariat of its political solidarity, to transform it into economic solidarity in the hands of the state. By dividing wages into a part paid directly by the employer, and another part paid indirectly by the state, the bourgeoisie has greatly reinforced the mystification that the state is an organ standing above classes, a guarantee of the common interest and of the working class' social security. The bourgeoisie has succeeded in tying the working class materially and ideologically to the state. This was how the Italian and Belgian Fractions of the international communist left analysed the unemployment and mutual aid funds set up by the state during the 1930s.[14]

What has the IBRP to say to the working class? First and foremost, that the "logic of speculation" is responsible for "calling into question of all the social gains"... and here we are back again to the absolute evil of "financiarisation"! In passing, the IBRP forgets that the crisis and the attacks on the working class did not wait for the appearance of the "logic of speculation" to rain down on the proletariat. Does the IBRP really believe, as its prose suggests, that all will be rosy for the working class if only the "logic of speculation" were eradicated? On the contrary, this leftist mystification that the struggle against austerity depends on the struggle against the "logic of speculation" should be fought as vigorously as possible!

Worse still, it is a gross mystification to lead the proletariat to the belief that social security, collective bargaining, or even the automatic sliding scale of wages indexed to inflation, are "gains won by the workers" in struggle. Certainly, the reduction of the working day, the outlawing of child labour, or of night work for women, were really concessions won by the workers' struggles during capitalism's ascendant phase. By contrast, the so-called "social gains" like social security, or the collective bargaining enshrined in the "Social Pacts for Reconstruction" have nothing to do with the struggle of the working class. It was not the working class exhausted by war, drunk with nationalism, in the euphoria of the Liberation, which won these "gains" thanks to its "struggle". The "Social Pacts for Reconstruction" were worked out by the governments in exile as they prepared to set up measures of state capitalism. It was the bourgeoisie which took the initiative, during 1943-45 and in the midst of the war, of bringing together all the "live forces of the nation" and the "social partners", through tripartite meetings of representatives of the employers, of the government, and of the different parties and trades unions, in other words in the perfect national harmony of the resistance, to plan the reconstruction of its devastated economies, and to negotiate the socially difficult phase of reconstruction. There were no "concessions by the bourgeoisie, under pressure from the working class", in the sense of a bourgeoisie forced to accept a compromise faced with a working class mobilised on its own terrain and developing a strategy that broke with capitalism; these were the means adopted by the collusion of all the different components of the bourgeoisie (employers, trades unions, government) to ensure the social control over the working class during the reconstruction period.[15] We should also remember that after the war, it was the bourgeoisie itself that created from nothing trades unions like the CFTC in France or the CSC in Belgium.

Obviously, revolutionaries denounce any reduction in either direct or indirect wages. Obviously, they denounce the attacks on living conditions when the bourgeoisie reduces the coverage of social security. But they will never defend the principle of the mechanism that the bourgeoisie has set up to tie the working class to the state.[16] On the contrary, revolutionaries must denounce all the ideological and material logic that underpins these mechanisms, such as the supposed "neutrality" of the state, or of the social security organised by the state.

There is much at stake in the general aggravation of the contradictions of the capitalist mode of production, and in the difficulties that the working class has in rising to the situation. It is up to revolutionaries to respond adequately to the new questions that history poses, and they need to deepen their analyses to do so. But this deeper analysis cannot be founded on the adulterated garbage produced by the extreme left fractions of the bourgeoisie's political apparatus. Only by taking their stand on marxism, and on the gains of the communist left, especially on the analysis of the decadence of capitalism, will revolutionaries be able to live up to their responsibilities.

C. Mcl

1 Since as Marx says, "Capital therefore presupposes wage-labour; wage-labour presupposes capital. They condition each other; each brings the other into existence" (Wage labour and capital).

2 We cannot, in the framework of this article, go back over what Marx and marxist theoreticians have had to say about the contradictions engendered by capitalist society, in other words by the transformation of labour power into a commodity. For more detail on what marxists have had to say on the subject, we refer our readers to our pamphlet The decadence of capitalism and to our articles in the International Review.

3 "At a certain stage of their development, the material productive forces of society come in conflict with the existing relations of production, or - what is but a legal expression for the same thing - with the property relations within which they have been at work hitherto. From forms of development of the productive forces these relations turn into their fetters" (Preface to Introduction to the critique of political economy).

5 Unfortunately, Lenin is not much help here since his study on imperialism, however decisive it may be on certain aspects of capitalism?s evolution and the stakes at play for imperialism at the turn of the 19th and 20th centuries, accords far to much importance to the role of finance capital and ignores the far more fundamental process of the development of state capitalism (see the International Review n°19 "On imperialism" and Révolution Internationale n°3 and 4 "Capitalisme d'Etat et loi de la valeur"). Contrary to the analyses of Lenin and Hilferding, state capitalism drastically restricted the power of finance capital after the crisis of 1929, before restoring a certain freedom to it during and after the 1980s. The decisive point here is that it is the nation states which ordered the movement and not some international phantom of financial oligarchy imposing its diktat one evening in Washington in 1979.

6 "Interest, as we have seen in the two preceding chapters, appears originally, is originally, and remains in fact merely a portion of the profit, i.e., of the surplus-value, which the functioning capitalist, industrialist or merchant has to pay to the owner and lender of money-capital whenever he uses loaned capital instead of his own" (Capital, Vol III, Part V, Chapter 23, "Interest and Profit of Enterprise").

7 To grasp this point, we need only imagine two "catastrophic" scenarios: in one all the machines are destroyed and only human beings remain, in the other the human beings are destroyed and only machines remain!

8 Moreover, the fact that rates of company refinancing have been higher than 100% for some time destroys this thesis, since it means that companies do not need finance capital to finance their investments.

9 In Europe, wages as a share of added value have fallen from 76% to 68% between 1980 and 1998, and since wage inequalities have grown considerably during the same period, this means that the reduction in workers? average wage is still greater than at first sight appears from this statistic.

10 IBRP, "Eléments de réflexion sur les crises du CCI", our translation.

11Let us just quote, from the text presented by Battaglia Comunista to the first conference of the groups of the Communist Left in 1977, this paragraph entitled "Crisis and decadence": "When this begins to appear, the capitalist system has ceased to be a progressive system, in other words necessary to the development of the productive forces, to enter into a phase of decadence characterised by attempts to resolve its own insoluble contradictions, adopting new organisational forms from the productive point of view (...) In fact, the state's increasing intervention in the economy should be considered as the sign of the impossibility of resolving the contradictions that are accumulating within the relations of production and is therefore the sign of capitalism's decadence".

12 We refer the reader to the report on the economic crisis of our 15th International Congress, published in the previous issue of this Review. Without in the least calling into question the exceptional nature of the period 1950-75, this report demystifies the calculation of growth rates during the period of decadence in general, and especially since World War II which have been substantially over-estimated.

13 A few quotes:

- "...the theory of decadence, as it springs from the conceptions of Trotsky, of Bilan, of the GCF and of the ICC, is no longer adapted today to an understanding of capitalism's real development during the 20th century, notably since 1945 (...) As far as the communists of the first half of the 20th century are concerned, this is readily understandable: the events during the three decades between 1914 and 1945 were such (...) that they seemed to give credence to the theses of capitalism's historic decline, and to confirm their forecasts; it was logical for them to see in capitalism nothing but an exhausted, putrefying, and decadent system" (Cercle de Paris, "Que ne pas faire?").

- "The concept of the decadence of capitalism first arose within the Third International, where it was developed by Trotsky in particular (...) Trotsky soon fine tuned his conception by assimilating the decadence of capitalism to a pure and simple halt in the growth of the productive forces of society (...) That vision seemed to correspond well enough to the reality of the first half of the 20th century (...) Trotsky's vision was basically taken up by the Italian communist left around the magazine Bilan before World War II, then by the Gauche Communiste de France (GCF) after it" (Internationalist Perspectives, "Towards a new theory of the decadence of capitalism").

- "The hypothesis of an 'irreversible brake' on the productive forces is no more than a deduction, on the theoretical level, of a general impression inherited from the inter-war period, when capitalist accumulation, conjuncturally, had difficulty getting under way again" (Communisme ou Civilisation, "Dialectique des forces productives et des rapports de production dans la théorie communiste").

- "After the Second World War both the Trotskyists and Left-communists emerged committed to the view that capitalism was decadent and on the edge of collapse. Looking at the period that had just passed the theory was did not appear too unrealistic - the 1929 crash had been followed by depression through most of the thirties and then by another catastrophic war (...) Now, while we might say the left and council communists upheld some important truths of the experience of 1917-21 against the Leninist version upheld by the Trots, the objectivist economics and mechanical theory of crisis and collapse which they shared with the Leninists made them incapable of responding to the new situation characterised as it was by the long boom (...) After the Second World war capitalism entered one of its most sustained periods of expansion with growth rates not only greater than the interwar period but even greater than those of the great boom of classical capitalism" (Aufheben, "The theory of decline or the decline of theory?").

14 See "Une autre victoire du capitalisme: l'assurance chômage obligatoire" in Communisme n°15, June 1938, also "Les syndicats ouvriers et l'Etat" in n°5 of the same review.

15 There were indeed social struggles during the war, and even more during the immediate post-war period in view of the appalling living conditions of the time. But, apart from a few notable exceptions such as in Italy or in the Ruhr valley, they presented no real threat to capitalism. These struggles were all thoroughly controlled, and often broken, by the left parties and the trades unions, in the name of the national concord necessary for reconstruction.

16 It is absolutely incredible that the IBRP should include in the category of "social gains" the "collective bargaining agreements" which are - it is blindingly obvious - the codification and the imposition of social peace in the workplace by the bourgeoisie.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace