Submitted by International Review on

Is capitalism a decadent mode of production and why? (I)

At the time of a major acceleration of the world economic crisis we have decided to return to the fundamental questions of the dynamic of capitalist society. Only by understanding them can we fight a system that is condemned to perish either by its own contradictions or by its overthrow and replacement by a new society. These questions have already been looked at in numerous publications of the ICC, so if we judge it necessary to raise them again it is to critique the vision developed in the book Dynamics, contradictions and crises of capitalism.1 This book explicitly defends, with quotations, the analyses of Marx concerning the characterisation of the contradictions and the dynamic of capitalism, notably the fact that the system, like other class societies that have preceded it, necessarily goes through an ascendant phase and a phase of decline. But the manner in which this framework of theoretical analysis is sometimes interpreted and applied to reality opens the door to the idea that reforms would be possible within capitalism which would permit the attenuation of the crisis. In opposition to this approach, the article that follows attempts an argued defence of the insurmountable character of the contradictions of capitalism.

In the first part of this article we examine whether capitalism has ceased to be a progressive system since the First World War, and if it has become, according to Marx's own words, “a barrier for the development of the productive powers of labour”.2 In other words, do the production relations of this system, after having been a formidable factor in the development of the productive forces, constitute, since 1914, a brake on the development of these same productive forces? In a second part we will analyse the origin of capitalism's insurmountable crises of overproduction, and unmask the reformist mystification of a possible attenuation of the crisis by 'social policies'.

Has capitalism been a brake on the growth of the productive forces since the First World War?

The blind forces of capitalism, unleashed by the First World War, destroyed far more productive forces than in all the economic crises of capitalism since its birth. They plunged the world, particularly Europe, into a barbarism threatening to engulf civilisation. This situation would provoke, in reaction, a world revolutionary wave aiming to finish with a system whose contradictions was now a threat to humanity. The position defended at the time by the vanguard of the world proletariat followed the vision of Marx for whom “The growing incompatibility between the productive development of society and its hitherto existing relations of production expresses itself in bitter contradictions, crises, spasms.”3 The Letter of Invitation (end of January 1919) to the Founding Congress of the Communist International declared: “the present period is that of the decomposition and collapse of the whole world capitalist system, it will be the collapse of European civilisation in general, if capitalism, with its insurmountable contradictions, is not defeated.”4 Its Platform underlined that: “A new epoch is born: the epoch of the dissolution of capitalism, of its inner collapse. The epoch of the communist revolution of the proletariat”.5

The author of the book, Marcel Roelandts, (MR) accepts this characteristic of the First World War and the international revolutionary wave that followed it, often in the same terms. His analysis partly restates the following elements in relation to the evolution of capitalism since 1914 and which, for us, has confirmed the diagnosis of the decadence of capitalism:

-

the First World War (20 million dead) lowered the production of the European powers involved in the conflict by more than a third, an unprecedented phenomenon in the whole history of capitalism;

-

it was followed by a phase of feeble economic growth leading to the crisis of 1929 and the depression of the 1930s. The latter caused a greater fall in production than that caused by the First World War;

-

the Second World War, even more destructive and barbaric than the first (more than 50 million dead) provoked a disaster to which the crisis of 1929 provides no possible comparison. The alternative posed by revolutionaries at the time of the First World War had been tragically confirmed: socialism or barbarism.

-

since the Second World War there hasn't been a single instant of peace in the world and instead hundreds of wars and tens of millions killed, without counting the resulting humanitarian catastrophes (famines). War, omnipresent in numerous regions of the world, had nevertheless spared Europe, the principle theatre of the two world wars, for a half century. But it made a bloody return there with the conflict in Yugoslavia that began in 1991;

-

during this period, except for the period of prosperity in the 50s and 60s, capitalism has not been able to avoid recessions that require the injection of more and more massive doses of credit. Growth has only been maintained by the fiction that these debts will be finally repaid;

-

after 2007-2008 the accumulation of colossal debt has become an insurmountable obstacle to the maintenance of even the weakest growth. Not only businesses and banks but also states have been fundamentally weakened or threatened with bankruptcy. A recession without end is now on the historical agenda.

We have limited ourselves here in this summary to the most salient elements of the crises and wars which have made the 20th century the most barbaric that humanity has even known. The dynamic of the economy is not necessarily the direct cause but it cannot be dissociated from the nature of this period.

With what method can we evaluate capitalist production and its growth?

For MR this picture of the life of society since the First World War is not sufficient to confirm the diagnosis of decadence.

For him, “if certain arguments of this analysis of capitalist obsolescence can still be defended, one is forced to recognise that there are others (since the end of the 1950s) which cannot.” He rests on Marx for whom capitalism can only be decadent if “the capitalist system becomes an obstacle for the expansion of the productive forces of labour”. So, according to MR, the quantitative data does not reasonably permit the idea “that the capitalist system is a brake on the productive forces” nor “that it has shown its obsolescence in the eyes of humanity”. Moreover, he says, “in comparison with the period of the strongest growth of capitalism before the First World War, development since then (1914-2008) is clearly superior.”6

The empirical data must necessarily be taken into account. But that is clearly not enough. A method is needed to analyse it. We cannot be content with an account sheet, but must go beneath the raw data to closely examine what production and growth are made of, in order to identify the actual existence of brakes on the development of the productive forces. This is not the point of view of MR for whom “those who maintain the diagnosis of obsolescence can only do so if they avoid confronting reality or use expedients to try and explain it: by credit, military expenses, unproductive expenses, the existence of a supposed colonial market, the so-called statistical manipulation or mysterious manipulations of the law of value, etc. Actually there are few marxists who have made a clear and coherent explanation of the growth of the Thirty Glorious Years7 and been able to discuss certain realities in flagrant contradiction with the diagnosis of the obsolescence of capitalism."8 We imagine that MR is of the opinion that he himself belongs to that rare category of marxists and therefore would quickly grasp the following question, to which no trace of response can be found in his book: in what way is the invocation of 'unproductive costs' an 'expedient' to explain the nature of growth in the phase of decadence?

In fact, understanding what capitalist production is made of corresponds completely to the needs of the marxist method in its critique of capitalism. It permits us to see how has this system, thanks to the social organisation of production, allowed humanity to make the enormous leap of developing the productive forces to a level where a society based on the free satisfaction of human needs becomes a possibility once capitalism is overturned. Can we say that the development of the productive forces since the First World War and the price paid for it by society and the planet, is a necessary condition for the victorious revolution? In other terms, has capitalism continued to be, since 1914, a progressive system, favouring the material conditions for the revolution and communism?

The quantitative data for growth

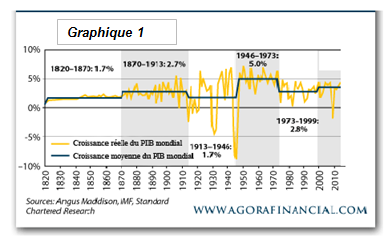

Graph 19 represents (in the horizontal lines) the average annual growth in different periods between 1820 and 1999. It also shows significant departures from the rates of growth, above and below the average figures.

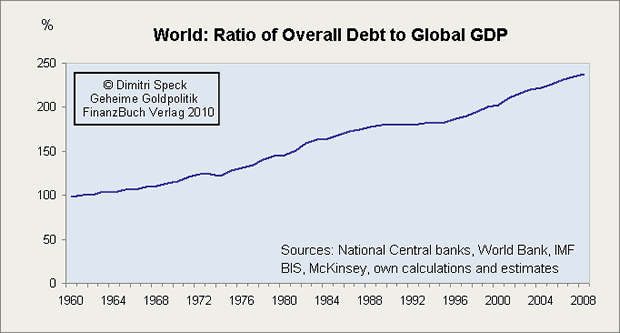

The average rate of growth in Graph 1 has been restated in Table 1 concerning the period 1820-1999. To complete this table, we have estimated the average annual rate of growth for the period 1999-2009 using a statistical series relative to this period 10 based on a negative world growth of 0.5% in 2009.11

From the figures presented here, a certain number of elementary conclusions can be drawn:

-

the four most important dips in economic activity have all occurred since 1914 and correspond to the two world wars, the crisis of 1929 and the recession of 2009;

-

the most splendid period in the life of capitalism before the First World War was between 1870-1913. It is the period that most represents a mode of production that has completely freed itself from the relations of production inherited from feudalism and possessing, following imperialist conquest of the colonies,12 a world market whose limits have not yet been reached. Moreover, as a consequence of this situation, the sale of an important mass of goods can compensate for the tendency for the rate of profit to fall, and free up a mass of profit sufficient for continued accumulation. It is also the period, which closes the phase of ascendance and opens up the phase of decadence marked by the outbreak of the First World War that occurs at the height of capitalist prosperity;

-

the period that follows the First World War and extends till the end of the 1940s fully confirms the diagnosis of decadence. In this sense we share the appreciation of MR for whom the characteristics of the period 1914-1945, and even beyond, up until the end of the 1940s, completely correspond to the description given by the revolutionary movement in 1919, in continuity with Marx, that the phase of the decadence of capitalism opens with the world war;

-

the period of the Thirty Glorious Years, between approximately 1946-1973, with far superior growth rates than those of 1870-1913, are in enormous contrast to the preceding period;

-

the following period, until 2009, shows a rate of growth slightly superior to the best phase of the ascendance of capitalism.

Do the Thirty Glorious Years put the analysis of decadence in question? Does the following period confirm that it has not been an exception?

The level of economic activity of each of these two periods is explained by the qualitative modifications of production since 1914, in particular the swelling of unproductive expenses, the way in which credit has been used since the 1950s, and by the creation of fictitious value through what is called the ‘financialisation’ of the economy.

Unproductive expenses: What are they?

We include in the category of unproductive expenses the costs of that part of production whose use value cannot be employed in any way in the simple or enlarged reproduction of capital. The clearest example is that of the production of armaments. Weapons may serve to make war but do not produce anything, not even other weapons. Luxury spending destined essentially to sweeten the life of the bourgeoisie also comes into this category. Marx speaks of it in pejorative terms: “A great part of the annual product is consumed as revenue and does not return to production as means of production: pernicious products (use values) which only assuage the most wretched whims and passions”.13

The reinforcement of the state machine

Another entry in this category are all the state expenses required to face up to the growing contradictions of capitalism on the economic, imperialist and social levels. Thus, beside arms spending one also finds the cost of the upkeep of the repressive and judicial apparatus, as well as that of the containment of the working class – the trade unions. It is difficult to estimate the part of the state expenses which is included in the category of unproductive expenses. A sector like education, which is necessary for the upkeep and development of the labour force and its productivity, also has an unproductive side of masking youth unemployment and making it tolerable. In a general way, as MR strongly argues, “The reinforcement of the state machine, as well as its growing intervention in society, is one of the most obvious manifestations of the phase of obsolescence of a mode of production (...) Fluctuating around 10% throughout the ascendant phase of capitalism, the share of the state in the OECD countries climbs progressively since the First World War to reach around 50% in 1995, varying between a low of about 35% for the US and Japan, and a high of 60-70% for the Nordic countries."14

Among these expenses, the cost of militarism is usually more than the 10% that the military budget reached in certain circumstances in some of the most industrialised countries, since the manufacture of armaments must be added to the cost of the different wars. The growing weight of militarism15 since the First World War is clearly not an independent phenomenon in the life of society but the expression of the high level of economic contradictions which constrain each power to increasingly engage in military preparations in order to survive in the world arena.

The weight of unproductive expenses in the economy

Unproductive costs, which certainly represent more than 20% of GDP, in reality only correspond to a sterilisation of a significant amount of accumulated wealth which therefore cannot be used for the creation of greater wealth, which is contrary to the fundamental essence of capitalism. We have here a clear manifestation of the braking effect on the development of the productive forces which has its origin in the relations of production themselves.

To these unproductive expenses may be added another type: that of illegal trafficking of all kinds, drugs in particular. This is an unproductive consumption but is however counted as part of GDP. Thus the laundering of the revenues of this activity represents several percentage points of world GDP: “Drug traffickers will have laundered around 1,600 billion dollars or 2.7% of world GDP in 2009 (...) according to a new report published on Tuesday by the United Nations Office against Drugs and Crime (UNODC) (...) The report of the UNODC indicates that all the benefits of this criminality, excluding tax evasion, will rise to about 2,100 billion dollars, or 3.6% of GDP in 2009”.16

To restore the truth about real growth, around 3.5% of the additional amount of GDP must be amputated because of money laundering for the different traffic.

The role of unproductive expenditure in the miracle of the Thirty Glorious Years

Keynesian measures, aimed at stimulating final demand and which thus helped to ensure that the problems of overproduction did not manifest themselves openly during any part of the period of the Thirty Glorious Years, were largely unproductive expenditures whose cost was supported by the state. Among them were wage increases, beyond what is socially necessary for the reproduction of labour power. The secret of the prosperity of the Thirty Glorious Years amounts to an enormous waste of surplus value that could then be supported by the economy due to the important productivity gains registered during this period.

The miracle of the Thirty Glorious Years, therefore, under favourable conditions, was enabled by a policy of the bourgeoisie which, educated by the 1929 crisis and the depression of the 1930s, took pains to delay the open return of the crisis of overproduction. In this sense, this episode in the life of capitalism fits well with what MR says: "The exceptional period of prosperity after the war appears in all points analogous with the periodic recoveries during the periods of ancient and feudal obsolescence. We therefore endorse our assumption that the Thirty Glorious Years only constitutes an interval in the course of a mode of production that has exhausted its historic mission." (Dyn p.65)

Would Keynesian measures be possible again? We cannot rule out scientific and technological advances that could again enable significant productivity gains and reduce the production costs of goods. Nevertheless this would continue to pose the question of a buyer for them since there are no more extra-capitalist markets and hardly any potential to increase demand through additional debt. Under these conditions the repetition of the boom of the Thirty Glorious Years appears totally unrealistic.

The financialisation of the economy

We reproduce here the most commonly accepted meaning of that term: "Financialization is strictly the use of funding and in particular to indebtedness on the part of economic agents. One can also call financialization of the economy the growing share of financial activities (banking, insurance and investments) in the GDP of developed countries in particular. It comes from an exponential multiplication of these types of financial activities and the development of the practice of financial operations, both by businesses and other institutions and by individuals. One can also speak of a rise of finance capital as distinguished from the narrower concept of capital focused on production equipment ".17 We distinguish ourselves completely from the anti-globalisation movement, and from the left the capital in general, for whom the financialisation of the economy is the cause of the current crisis in capitalism. We have widely developed in our press how it is exactly the opposite.18 Indeed, it is because the "real" economy has been plunged for decades in a deep slump that capital tends to shy away from this sphere which is less and less profitable. MR seems to share our view. That said, he does not seem interested in taking into account the significant implications of this phenomenon for the composition of GDP.

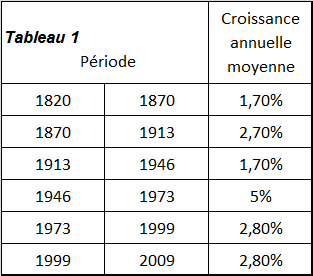

The U.S. is certainly the country where financial activity has been the most important development. In 2007, 40% of private sector profits in the U.S. were made by banks, which employ only 5% of employees.19 Table 2 shows, for the United States and Europe, the weight gained by financial activities20 (the parallel evolution of industrial production in the US over the same period has been given as a guide):

Unlike unproductive expenditures, we are not dealing here with a sterilisation of capital, but in the same sense as this, the development of finance leading to the artificial inflation of the estimate of the annual wealth of some countries ranging from 2% for the EU to 27% for the United States. Indeed, the creation of financial products is not accompanied by the creation of real wealth, so that, in all fairness, its contribution to national wealth is zero.

If we get rid of GDP activity corresponding to the financialisation of the economy, all major industrialised countries would see their GDP reduced by a percentage varying between 2% and 20%. An average of 10% seems acceptable in view of the respective weight of the EU and US.

The increasing recourse to debt from the 1950s

In our view, the failure to take into account the increase in debt which has accompanied capitalist development since the 1950s reveals the same prejudice that discards a qualitative analysis of growth.

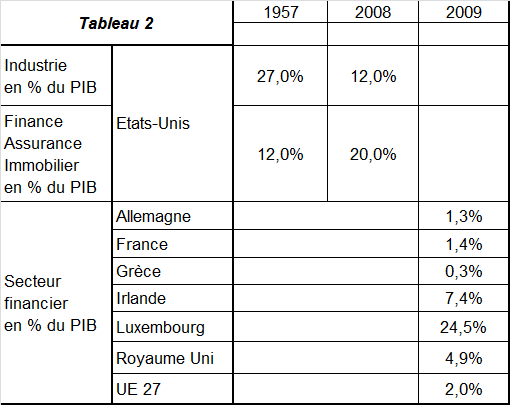

Can we deny that it is a fact? Graph 2 illustrates the evolution of world debt as a whole (relative to the growth of GDP) from the 1960s. Over this period debt increases faster than economic growth.

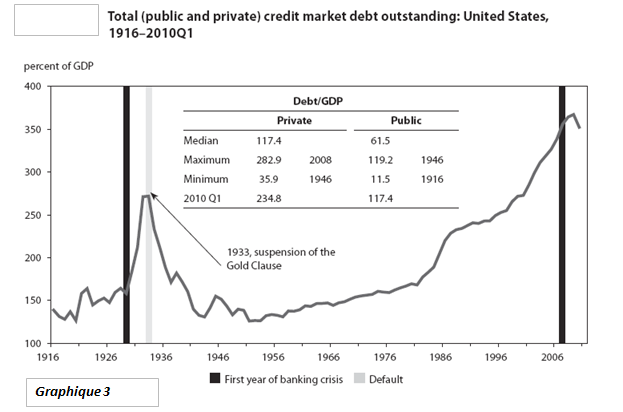

In the United States (Graph 321) debt starts to take off at the beginning of the 1950s. It goes from less than 1.5 times GDP at that time to reach a figure that is more than 3.5 times GDP today. Prior to 1950 it reached a peak in 1933 due to private debt but then decreased again.

It should be noted that the 1946 peak in public debt (at a moment when private debt was weak) was the result of growth in public spending to finance the New Deal. It was fairly low at first but increased dramatically from 1940 onwards in order to finance the war effort.

From the 1950s-60s, debt acted as "solvent demand" allowing the economy to grow. This was an ever-increasing debt that was basically destined never to be re-paid, as testified by the present situation of excessive debt on the part of all the economic players in every country. This situation risks leading to the bankruptcy of the main economic players, the nation states that is, and so heralds the end of growth by means of increasing debt. In other words, this means the end of growth all together, except for limited periods within a general course towards depression. It is vital that our analysis takes into account that reality is inflicting a dramatic lowering of the growth rate since the 1960s. This is the boomerang effect of this shameless cheating with the law of value. MR rejects the expression "cheating with the law of value" to describe this practice of international capitalism. Nevertheless it is essentially the same as the protectionist measures taken in the USSR in order to artificially keep alive an economy that was less efficient than that of the main countries of the western bloc. The collapse of the eastern bloc revealed the truth. Will it take the collapse of the world economy to convince MR of the consequences of a mass of existing debt that cannot be repaid?

In order to make an objective and rigorous assessment of real growth since the 1960s, we should deduct the amounting accumulation of debt from the official increase in GDP between 1960 and 2010. In fact, as Graph 2 shows, the increase in world GDP is less relevant than the increase in world debt in this period, to the point that not only did this important period of post war boom fail to generate wealth but it also helped to create a global deficit which reduces the miracle of the post war boom to nothing.

The evolution in the living conditions of the working class

During the ascendant period the working class was able to exact lasting economic reforms in terms of working hours and wage increases. This was because of the struggle for demands and also because the system was able to grant them, thanks in particular to a significant increase in production. This situation changes with capitalism's entry into decadence when, with the exception of the post-war boom, productivity increases are increasingly placed at the service of each national bourgeoisie's mobilisation against the contradictions that assail it at all levels (economic, military and social) and it leads, as we have seen, to the strengthening of the state apparatus.

Wage increases following the First World War generally serve only to compensate for the constant increase in prices. The increases granted in France in June 1936 (the Matignon agreement: 12% on average) were wiped out in six months as from September 1936 to January 1937 alone prices increased by about 11%. In the same way, we know what remained one year later of the increases obtained in May 1968 with the Grenelle agreement.

On this point, MR says this: "In the same way, the communist movement has defended the idea that after the First World War it is impossible to win real and lasting social reforms. However, if we look at the evolution of real wages and working hours in the course of the century, not only do we find nothing to back up this conclusion, but also the facts show that the opposite is the case. Whereas real wages in the developed countries doubled or tripled at most before 1914, they increased six or seven-fold after that date: that is, three or four times more during the "decadent" period of capitalism than when it was ascendant."22

It is rather difficult to discuss this analysis as the figures given are very approximate. We can understand that it is difficult to do better given the material available on this question but a minimum of scientific rigour demands that at least the sources be cited from which extrapolations are made. Moreover, assertions are made about wage increases in the ascendance and decadence of capitalism with no indication of the precise period referred to, It is easy to see that an increase over thirty years cannot be compared to an increase over 100 years (unless it is given in the form of the annual mean increase, which obviously is not the case). In addition, it is important to understand the period so that the comparison can integrate other aspects of social life, which are of primary importance to our mind in placing the wage increases in perspective. Of particular importance is the development of unemployment. An increase in wages accompanied by a rise in unemployment can very easily result in a lowering of workers' living standards.

Following the passage that we have just discussed, there is a graph in the book whose title indicates that it concerns real wage increases in Great Britain from 1750 to 1910 and a financial deal in France concerning the years from 1840 to 1974. However the figures relating to the French deal for the period between 1840 to 1900 are missing and those concerning the period 1950-1980 are illegible. We can make more use of the information on Great Britain. From 1860 to 1900 it would seem that real wages increased from 60 to 100, which corresponds to an annual increase of 1.29% over the period.

In examining wages in decadence we divide the period into two sub-periods:

-

from 1914 to 1950; we do not have a series of statistics for this period but rather scattered and heterogeneous figures, which nevertheless indicate that living standards were affected by the Second World War and the 1929 crisis;

-

the subsequent period, which goes up to the present day, for which we have more reliable and homogenous data.

1) 1914-1950 23

For the European countries the First World War is synonomous with inflation and the shortage of goods. Once it ended the two camps were confronted with the need to repay a colossal debt (three times the national income in the case of Germany) that had been incurred in order to finance the war effort. The bourgeoisie saw to it that the working class and the petty bourgeoisie paid for it through inflation which, while reducing the amount of debt, also drastically reduced income and sent savings up in smoke. In Germany in particular, from 1919 to 1923, workers saw a non-stop reduction in their income, with wages much lower than before the war. In was the same in France and in England too but to a lesser extent. But in the case of the latter the entire inter-war period was characterised by permanent unemployment that paralysed millions of workers, a phenomenon that was unknown up to then in the history of capitalism, either in England or internationally. In Germany from the end of the period of astronomic inflation, around 1924, up to the 1929 crisis the number of unemployed stayed generally above 1 million ( 2 million in 1926).

In 1929, unlike Germany, but like France, Great Britain had not returned to its 1913 position.

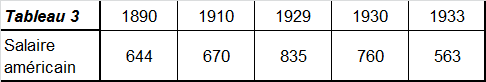

The trajectory of the United States was very different. Before the war, American industry developed faster than in Europe. This tendency strengthened from the end of the war up to the beginning of the world economic crisis. So the United States experienced prosperity throughout the First World War and the subsequent period until the open crisis of 1929. But this crisis reduced the real wage of American workers to a level inferior to that of 1890 (it was 87% of the latter). The development over this period is presented in Table 3:24

2) from 1951 to the present day (compared to 1880-1910)

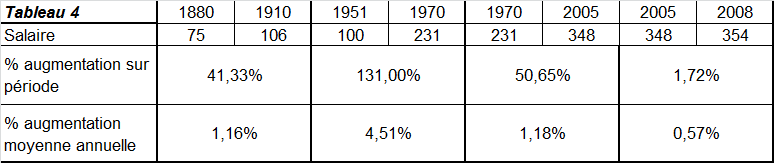

Table 4 contains statistics concerning the evolution of the wages of French workers:

-

expressed in Francs for the period 1880-1910;25

-

expressed in terms of a base of 100 for 1951 for the period 1951-2008.26

Table 4 demonstrates the following facts:

-

The period 1951-1970, at the heart of the post-war boom, experienced the highest rate of wage increases in the history of capitalism, which is consistent with the phase of economic growth to which it corresponds and its specificities, such as, among other things, Keynesian measures to sustain demand with a view to increasing wages.

There are also other factors, which are by no means secondary, to explain this growth in wages:

-

the standard of living in France in 1950 was very low, which is shown by the fact that it was only in 1949 that ration cards, introduced in 1941 to tackle the poverty of the war period , were abolished;

-

from the 1950s the cost of reproducing the work force includes a number of significant expenses which did not exist previously: the increased demand for technical knowledge for a large number of jobs means that the children of the working class must receive more years of schooling and so remain at the cost of their parents longer; "modern" working conditions in large cities also increase costs. Although the modern proletariat is surrounded by household goods which they did not have in the 19th century, this does not mean that their standard of living is higher, because their relative exploitation goes on increasing. Many of these "household goods" did not exist previously; in bourgeois houses the domestic servants did everything by hand. They have now become indispensable in workers' households in order to save time because often both the man and woman have to work to support the family. Likewise, when the car appeared on the scene it was a luxury of the rich. Now it has become indispensable for many proletarians to get to work without having to spend hours on public transport with its inadequate services. It is the rise in the productivity of labour which has made it possible to produce such things, which are no longer a luxury, at a price that is compatible with the level of workers' wages;

-

The subsequent period, 1970-2005, saw wage increases that were on a par with those in the ascendant period of capitalism (1.18% versus 1.16% - bearing in mind that in Great Britain there was a 1.29% increase in the period 1860-1900). Having said this, we should take into account a number of factors that show that the living conditions of the working class did not really improve to that extent and that they even got worse than in the previous period:

-

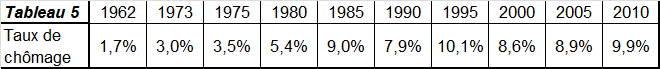

this period witnessed a dramatic increase in unemployment, which greatly affected the standard of living in working class households. We have figures for unemployment in France, which are presented in Table 5:27

-

from the 1980s legislation aiming to lower the official unemployment figures led to changes in the way the number of unemployed are counted (for example, by excluding partial employment) and also ended up excluding unemployed from the figures by means of increasingly strict criteria. This basically explains the lower rate of increase in unemployment afterwards;

-

the period after 1985 witnessed the development of precarious work with fixed term contracts and part-time work, which are really disguised unemployment;

-

the assessment of the real wage, adjusted to take account of the official estimate of the cost of living, is greatly over-estimated by the official figures, to the point that the INSEE (National Institute for Economic Statistics and Studies) in France have been forced to admit that there is a difference between official inflation and "perceived" inflation, the latter being based on a household view of price increases in basic, essential products (the expenses that one cannot cut down on), which is much higher than official inflation.28

-

The period 2005-2008, although shorter than the previous period, is more indicative in its official rate of wage increases as around 0.5% because it heralds the future. In fact this increase of only 0.5% corresponds to a much more significant deterioration, in that all the factors mentioned for the previous period must still be taken into account but in much larger proportions. In fact, it is the statistics on wages that lead us to give 2008 as the end of the period beginning in 2005. From 2008 onwards the situation of the working class deteriorated drastically as is attested by the evolution in the figures regarding poverty and we cannot ignore this fact when studying the period. In 2009 the percentage of poor people in French cities has not only increased but their degree of poverty has also increased. They now represent 13.5% of the population, that is 8.2 million people, 400,000 more than in 2008.

What can we conclude from nearly a century of capitalist development?

We have seen that the inclusion in GDP of all unproductive expenses, of activities that are merely financial or criminal, greatly contributes to an over-estimation of the wealth created annually.

We have also seen that the contradictions of capitalism itself wipe out a significant percentage of capitalist production (particularly through "unproductive" production). As for the living conditions of the working class, they are by no means as brilliant as the official statistics try to make us believe.

In addition, there is an aspect that we have not brought out in our examination of production or of working conditions, that is, the cost exacted by the domination of capitalist productive relations since the First World War, in terms of the destruction of the environment and the exhaustion of the world's resources of raw materials. This is difficult to quantify but absolutely crucial for the future of humanity. This is another reason, and by no means a minor one, to exclude decisively any idea that capitalism has been a progressive system as regards the future of the working class or of humanity for nearly a century now.

MR notes that capitalist development in this period has been accompanied by war, barbarism and environmental damage. On the other hand, and rather surprisingly, he concludes his defence plea, which aims to show that the relations of production after the 1950s have not acted increasingly as a brake on the development of the productive forces, by affirming that the system is well into its decadence: "In our opinion there is therefore no contradiction between recognising, on the one hand, the undeniable prosperity of the post-war period and all its consequences and in nevertheless maintaining, on the other hand, the diagnosis that capitalism has been historically obsolete since the beginning of the 20th century. It follows that the vast majority of the working population does not yet see capitalism as an out-dated tool that it must get rid of: it is always possible to hope that 'tomorrow will be better than yesterday'. Although this scenario is being reversed in the old industrial countries today, it is by no means the case for the emerging countries."29 If you reject the marxist criteria of a brake on the productive forces to characterise the decadence of a mode of production, what then is it based on? MR's reply: the "domination of wages on the scale of a now unified world market". He explains it in this way: "The end of colonial conquest at the beginning of the 20th century and the domination of wages on the scale of a now unified world market marked an historic turning point and inaugurated a new capitalist phase"30 And in what way does this characteristic of the new phase of capitalism explain the First World War and the revolutionary wave of 1917-23? What is its link with the resistance struggles that are so necessary for a proletariat faced with the manifestations of capitalism's contradictions? We have found no reply to these questions in the book.

We will return in part to these questions in the second part of this article, in which we will also examine how MR adapts the marxist theory and puts it at the service of reformism.

Silvio (December 2011)

1. Marcel Roelandts. Éditions Contradictions, Brussels, 2010.

2. Grundrisse: Foundations of the Critique of Political Economy. Chapter on Capital, Third Section, “Capital as fructiferous. Interest. Profit. (Production costs etc)”.

3. Ibid.

4. Letter of invitation to the Founding Congress of the Communist International. An English translation is published in Theses, Resolutions and Manifestos of the First Four Congresses of the Third International, Pluto Press, London, Second Edition 1983.

5. Ibid. The translation in the book cited differs from that we have given: “A new system has been born. Ours is the epoch of the breakdown of capital, its internal disintegration, the epoch of the Communist revolution of the proletariat.”

6. Roelandts, Dynamics, contradictions and crises of capitalism, pp.56, 57.

7. Usually known in English as 'the post-war boom'.

8. Roelandts, Op. Cit., p.63.

9. This is adapted from a graph reproduced here. We have deleted estimates for the period 2000-2030.

10. equity-analyst.com/world-gdp-us-in-absolute-term-from-1960-2008.html.

11. Consistent with IMF statistics: World Economic Outlook, April 2011 p2.

12. “From 1850 to 1914, world trade has multiplied by 7, that for Great Britain by 5 for imports and by 8 for exports. From 1875 to 1913, overall trade for Germany has multiplied by 3.5, for Britain by 2 and for the United States by 4.7. Finally, national income in Germany has multiplied by nearly 4 between 1871 and 1910, the U.S. by nearly 5.” (thucydide.over-blog.net/article-6729346.html).

13. Economic Manuscripts.

14. Roelandts, Op. Cit., pp.48-49.

15. On this subject see our two articles in the International Review ns 52 and 53, "War, militarism and imperialist blocs in the decadence of capitalism”.

16. Drogues Blog.

18 .See in particular "World economic crisis: The answer is not financial regulation but overthrowing capitalism", World Revolution no. 348, October 2011.

19. lexinter.net/JF/financiarisation_de_l'economie.htm

20. https://socio13.wordpress.com/2011/06/06/la-financiarisation-de-l’accumulation-par-john-bellamy-foster-version-complete/

21. A decade of debt, Carmen M. Reinhart and Kenneth S. Rogoff. Key words: Debt / GDP.

22. Roelandts, Op. Cit., p.57.

23. The information in the form of figures or a qualitative assessment contained in the study of this period, whose source is not explicitly cited, are taken from the book The conflict of the century by Fritz Sternberg, Seuil edition.

24. Stanley Lebergott, Journal of the American Statistical Association.

27. For 1962 and 1973 the source is "La rupture: les décennies 1960-1980, des Trente Glorieuses aux Tente Piteuses", Guy Caire.

For 1975 to 2005 the source is: INSEE. www.insee.fr/fr/themes/tableau.asp?reg_id=&ref_id=NATnon03337.

For 2010 the source is Google.

28. In fact official inflation is based on the variation in price of products that the consumer buys rarely or which are not essential.

29. Roelandts, Op. Cit., p.67.

30. Roelandts, Op.Cit.p.41.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace