Submitted by International Review on

In quick succession over the last few months we have seen a number of important events bearing witness to the gravity of the world economic situation: Greece’s inability to deal with its debts; similar threats to Italy and Spain; warnings to France of its extreme vulnerability in the event of a cessation of payment by Greece or Italy; the paralysis of the US House of Representatives over the issue of raising the debt-ceiling; the USA’s loss of its “Triple A” status – the guarantee of its ability to repay its debts; more and more persistent rumours about the danger of certain banks collapsing, with denials to the contrary fooling nobody given that the same banks have often already imposed massive job-cuts; the first confirmation of the rumours with the failure of the Franco-Belgian bank Dexia. Each time, the leaders of this world have been running after events, but each time the holes they seem to have filled in seem to open up again a few weeks or even days later. Their inability to hold back the escalation of the crisis is less the result of their incompetence and their short-term view than of the current dynamic of capitalism towards catastrophes which cannot be avoided: the bankruptcy of financial establishments, the bankruptcy of entire states, a plunge into deep global recession.

Dramatic consequences for the working class

The austerity measures pushed through in 2010 were implacable, placing a growing part of the working class – and of the rest of the population – in a situation where their most basic needs can no longer be met. To enumerate all the austerity measures which have been introduced in the euro zone, or which are about to be introduced, would make a very long list. It is however necessary to mention a certain number of those that are becoming widespread and which are a significant indication of the lot of millions of the exploited. In Greece, while taxes on consumer goods were increased, the retirement age was raised to 67 and public sector wages were brutally reduced. In September 2011 it was decided that 30,000 public sector workers should be put on technical unemployment with a 40% reduction in wages, while pensions over €1,200 were cut by 20%; the same measure was applied to incomes over €5,000 a year.[1] In nearly all countries taxes have been raised and thousands of public sector jobs axed. This has created many problems in the operation of public services, including the most vital ones: thus, in a city like Barcelona, operating theatres, emergency services and hospital beds have been greatly reduced;[2] in Madrid, 5,000 uncontracted teachers lost their jobs[3] and this was made up for by the contracted teachers having to take on an extra two hours teaching a week.

The unemployment figures are more and more alarming: 7.9% in Britain at the end of August; 10% in the euro zone (20% in Spain) at the end of September[4] and 9.1% in the US over the same period. Throughout the summer, redundancy plans and job-cuts came one after the other: 6,500 at Cisco, 6,000 at Lockhead Martin, 10,000 at HSBC, 3,000 at the Bank of America: the list goes on. The earnings of the exploited have been falling: according to official figures, real wages were going down at an annual rate of 10% by the beginning of 2011, by over 4% in Spain, and to a lesser extent in Italy and Portugal. In the US, 45.7 million people, a 12% increase in a year,[5] only survive thanks to the weekly $30 food stamps handed out by the state.

And despite all this, the worst is yet to come.

All this demonstrates the necessity to overthrow the capitalist system before it leads humanity to ruin. The protest movements against the attacks which have been taking place in a whole number of countries since the spring of 2011, whatever their insufficiencies and weaknesses, nevertheless represent the first steps of a broader proletarian response to the crisis of capitalism (see the article “From indignation to the preparation of class battles” in this issue of the Review).

Since 2008, the bourgeoisie has not been able to block the tendency towards recession

At the beginning of 2010, it was possible to have the illusion that states had succeeded in sheltering capitalism from the continuation of the recession that began in 2008 and early 2009, taking the form of a dizzying fall in production. All the big central banks of the world had injected massive amounts of money into the economy. This was when Ben Bernanke, the director of the FED and architect of major recovery plans was nicknamed “Helicopter Ben” since he seemed to be inundating the US with dollars from a helicopter. Between 2009 and 2010, according to official figures, which we know are always overestimated, the growth rate in the US went from -2.6% to +2.9%, and from -4.1% to +1.7% in the euro zone. In the “emerging” countries, the rates of growth, which had fallen, seemed in 2010 to return to their levels before the financial crisis: 10.4% in China, 9% in India. All states and their media began singing about the recovery, when in reality production in all the developed countries never succeeded in going back to 2007 levels. In other words, rather than a recovery, it would be more accurate to talk about a pause in a downward movement of production. And this pause only lasted a few quarters:

· In the developed countries, rates of growth began to fall again in mid-2010. Predicted growth in the US in 2011 is 0.8%. Ben Bernanke has announced that the American recovery is more or less “marking time”. At the same time, growth in the main European countries (Germany, France, Britain) is near to zero and while the governments of southern Europe (Spain, 0.6% in 2011 after -0.1% in 2010;[6] Italy 0.7% in 2011)[7] have been repeating non-stop that their countries “are not in recession”, in reality, given the austerity plans that they are and will be going through, the perspective opening in front of them is not very different from what Greece is currently experiencing: in 2011, production there has fallen by over 5%.

· In the “emerging” countries the situation is far from brilliant. While they saw important growth rates in 2010, 2011 is looking much gloomier. The IMF has predicted that their growth rate for 2011 will be 8.4%,[8] but certain indices show that activity in China is about to slow down.[9] Growth in Brazil is predicted to go from 7.5% in 2020 to 3.7% in 2011.[10] Finally, capital is starting to flee Russia.[11] In brief, contrary to what we have been sold by the economists and numerous politicians for years, the emerging countries are not going to act as locomotives pulling world growth. On the contrary, they are going to be the first victims of the situation in the developed countries and will see a fall in their exports, which up till now have been the main factor behind their growth.

The IMF has just revised its predictions which had assumed a 4% growth in the world economy in 2010 and 2011: having previously noted that growth had “considerably weakened”, they have now said that we “cannot exclude” a recession in 2012.[12] In other words, the bourgeoisie is becoming aware of the degree to which economic activity is contracting. In the light of all this, the following question is posed: why have the central banks not carried on showering the world in money as they did at the end of 2008 and in 2009, thus considerably increasing the monetary mass (it was multiplied by 3 in the US and 2 in the euro zone)? The reason is that pouring “funny money” into the economy doesn’t resolve the contradictions of capitalism. It results not so much in a recovery of production, but a recovery of inflation. The latter stands at nearly 3% in the euro zone, a bit more in the US, 4.5% in the UK and between 6 and 9% in the emerging countries.

The production of paper or electronic money allows new loans to be agreed... thereby increasing global debt. The scenario is not new. This is how the world’s big economic actors have become mired in debts to the point where they can no longer pay them back. In other words, they are now insolvent, and this includes none other than the European states, America, and the entire banking system.

The cancer of public debt

The euro zone

The states of Europe are finding it increasingly difficult to honour the interest on their debts.

The reason that the euro zone has been the first to see certain states in default of payment is that, unlike the US, Britain and Japan, they don’t control the printing of their own money and so don’t have the opportunity to pay towards their debts in fictional money. Printing euros is the responsibility of the European Central Bank (ECB) which is basically controlled by the big European states and in particular Germany. And, as everyone knows, multiplying the mass of currency by two or three times at a time when production is stagnating only leads to inflation. It’s in order to avoid this that the ECB has become more and more reluctant to finance states that need it; otherwise it risks being in default of payment itself.

This is one of the central reasons why the countries of the euro zone have for the last year and a half been living under the threat of Greece defaulting on its payments. In fact, the problem facing the euro zone has no solution since its failure to finance Greece’s debt will result in a cessation of payment by Greece and its exit from the euro zone. Greece’s creditors, which include other European states and major European banks, would then find it very hard to honour their commitments and would themselves face bankruptcy. The very existence of the euro zone is being put into question, even though its existence is essential for the exporting countries in the north of the zone, especially Germany.

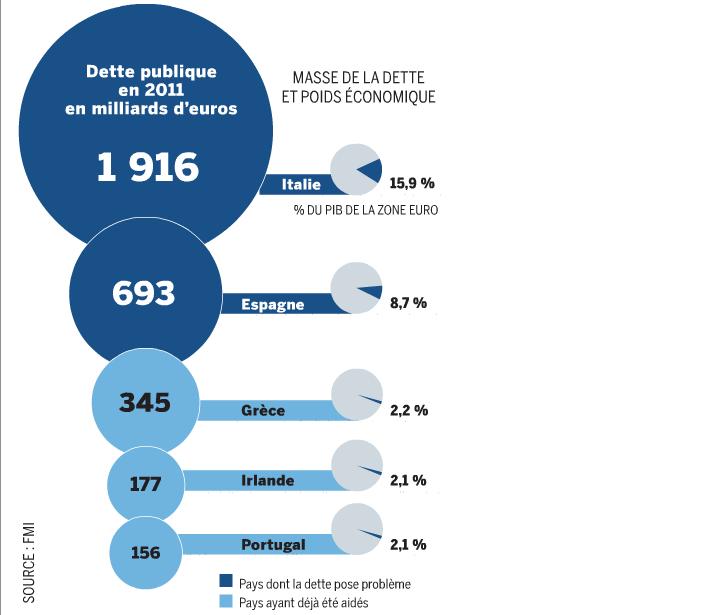

For the last year and a half the issue of defaulting on payments has been focussed mainly on Greece. But countries like Spain and Italy are going to find themselves in a similar situation since they have never found a fiscal recipe for amortising part of their debt (see graph[13]). A glance at the breadth of Italy’s debt, which is very likely to default in the near future, shows that the euro zone would not be able to support these countries to ensure that they could honour their commitments. Already investors believe less and less in their capacity to repay, which is why they are only prepared to lend them money at very high rates of interest. The situation facing Spain is also very close to the one that Greece is now in.

The positions adopted by governments and other euro zone institutions, especially the German government, express their inability to deal with the situation created by the threat of certain countries going bust. The major part of the bourgeoisie of the euro zone is aware of the fact that the problem is not knowing whether or not Greece is in default: the announcement that the banks are going to take part in salvaging 21% of Greece’s debts is already a recognition of this situation, which was confirmed at the Merkel-Sarkozy summit on 9 October which admitted that Greece would default on repaying 60% of its debt. From this point the problem posed to the bourgeoisie is to find a way of making sure that this default will lead to the minimum of convulsions in the euro zone. This is a particularly delicate exercise that has provoked hesitation and divisions within it. Thus, the political parties in Germany are very divided over the issue of how, if they are going to aid Greece financially, they will then be able to help the other states that are rapidly heading towards the same position of default as Greece. As an illustration, it is remarkable that the plan drawn up on 21st July by the authorities of the euro zone to “save” Greece, which envisages a strengthening of the capacity of the European Financial Stability Facility from 220 to 440 billion euros (with the obvious corollary of an increased contribution from the different states), was contested for weeks by an important section of the ruling parties in Germany. After a turn-around in the situation, it was finally voted for by a large majority in the Bundestag on 29th September. Similarly, up till the beginning of August, the German government were opposed to the ECB buying up the titles of Italy and Spain’s sovereign debt. Given the degradation of these countries’ economic situation, the German state finally agreed that from August 7th the ECB could buy up such obligations.[14] So much so that between August 7th and 22nd the ECB bought up 22 billion euros of these two countries’ sovereign debt![15] In fact, these contradictions, these coming and goings, show that a bourgeoisie as internationally important as the German bourgeoisie doesn’t know what policies to carry out. In general, Europe, pushed by Germany, has opted for austerity. But this doesn’t rule out a minimal financing of states and banks via the European Financial Stability Facility (which thus presupposes increasing the financial resources available to this organism) or authorising the ECB to create enough money to come to the aid of a state which can no longer pay its debts and so avoid an immediate default.

Certainly this is not just a problem for the German bourgeoisie but for the entire ruling class, because the whole bourgeoisie has been getting into debt since the 1960s to avoid overproduction, to the point where it is now very difficult not only to pay back the debts but even to pay back the interest on those debts. Hence the economies it is now trying to make via draconian austerity polices, draining incomes everywhere, and at the same time causing a reduction in demand, aggravating overproduction and accelerating the slide into depression.

The USA

The USA was faced with the same kind of problem in the summer of 2011.

The debt ceiling, which in 2008 was fixed at $14,294bn, was reached by May 2011. It had to be raised in order for the US, like the countries in the euro zone, to be able to keep up the payments, including internal ones: the functioning of the state was at stake. Even if the unbelievable stupidity and backwardness of the Tea Party was an element aggravating the crisis, they were not at the root of the problem facing the President and Congress. The real problem was the necessity to choose between two alternatives:

· either carry on with the policy of increasing Federal state debt, as the Democrats argued, which basically meant asking the FED to print money, with the risk of an uncontrolled fall in the value of the dollar;

· or push through a drastic austerity programme, as the Republicans demanded, through the reduction over the next ten years of public expenditure by something between $4,000bn and $8000bn. By way of comparison, the Gross Domestic Product of the US in 2010 was $14,624bn, which gives an idea of the scale of the budget cuts, and thus the slashing of public sector jobs, implied by this plan.

To sum up, the alternative posed this summer to the US was the following: either take the risk of opening the door to galloping inflation, or carry through an austerity programme which could only strongly restrict demand and provoke a fall or even a disappearance of profits: in the long run, a chain reaction of closures and a dramatic fall in production. From the standpoint of the national interest, both the Democrats and the Republicans are putting forward legitimate answers. Pulled hither and thither by the contradictions assailing the national economy, the US authorities have been reduced to contradictory and incoherent half measures. Congress will still be faced with the need both to make massive economic cuts and to get the economy moving.

The outcome of the conflict between Democrats and Republicans shows that, contrary to Europe, the USA has opted more for the aggravation of debt because the Federal debt ceiling was raised by 2100 billion up till 2013, with a corresponding reduction in budgetary expenses of around 2500 billion in the next ten years.

But, as for Europe, this decision shows that the American state does not know what policies to adopt in the face of the debt crisis.

The lowering of America’s credit rating by the rating agency Standard and Poor, and the reactions that followed, are an illustration of the fact that the bourgeoisie knows quite well that it has reached a dead-end and that it can’t see a way out of it. Unlike many other decisions taken by the ratings agencies since the beginning of the sub-prime crisis, Standard and Poor’s decision this summer looked coherent: the agency is showing that there is no recipe to compensate for the increase in debt agreed by Congress and that, as a result, the USA’s capacity to reimburse its debts has lost credibility. In other words, for this institution, the compromise, which avoided a grave political crisis in the US by aggravating the country’s debt, is going to deepen the insolvency of the US state itself. The loss of confidence in the dollar by the world’s financiers, which will be an inevitable result of Standard and Poor’s judgement, will lead to a fall in its value. At the same time, while the vote on increasing the Federal debt ceiling made it possible to avoid a paralysis in the Federal administration, the different states and municipalities are already faced with exactly that problem. Since July 4, the State of Minnesota has been in default and it had to ask 22,000 state employees to stay at home.[16] A number of US cities, such as Central Falls and Harrisburg, the capital of Pennsylvania, are in the same situation, while it looks like the State of California and others will soon be in the same boat

Faced with the deepening of the crisis since 2007, the economic policies of both the US and the euro zone have meant the state taking charge of debts that were originally contracted in the private sector. These new debts can’t fail to increase the overall public debt, which has itself been growing ceaselessly for decades. States are facing a deadline on debt that they can never pay back. In the US as in the euro zone, this will mean massive lay-offs in the public sector, endless wage-cuts and ever-rising taxes.

The threat of a grave banking crisis

In 2008-9, after the collapse of certain banks such as Bear Stearns and Northern Rock and the utter downfall of Lehman Brothers, states ran to the aid of many other banks, pumping in capital to avoid the same fate. What is the state of health of the banks today? It is once again very bad. First of all, a whole series of irrecoverable loans have not been removed from their balances. In addition, many banks themselves hold part of the debts of states that are now struggling to make their repayments. The problem for the banks is that the value of the debts they have taken on has now considerably diminished.

The recent declaration by the IMF, based on a recognition of the current difficulties of the European Banks and stipulating that they must increase their own funds by 200 billion euros, has provoked a number of sharp reactions and declarations from these institutions, claiming that everything was fine with them. And this at a moment when everything was showing the contrary:

American banks no longer want to refinance in dollars the American affiliates of the European banks and have been repatriating fund which they had previously placed in Europe;

European banks are lending less and less to each other because they are less and less sure of being repaid. They prefer to put their liquidities in the ECB, despite very high bank rates; a consequence of this growing lack of confidence is that the rate of interest on inter-bank loans has been climbing continually, even if it has not yet reached the levels of the end of 2008.[17]

The high point was reached a few weeks after the banks proclaimed their wonderful state of health, when we saw the collapse and liquidation of the Franco-Belgian bank Dexia, without any other bank being willing to come to the rescue.

We can add that the American banks are poorly placed to keep the machine going on behalf of their European consorts: because of the difficulties they are facing, the Bank of America has just cut 10% of its workforce and Goldman Sachs, the bank which has become the symbol of global speculation, has just laid off 1,000 people. And they too prefer depositing their liquidities in the FED rather than loaning to other American banks.

The health of the banks is essential for capitalism because it can’t function without a banking system that supplies it with currency. But the tendency we are seeing today is towards another “Credit Crunch”, i.e. a situation where the banks no longer want to loan as soon as there is the least risk of not being repaid. What this means in the long run is a blockage in the circulation of capital, which amounts to the blockage of the economy. From this perspective we can better understand why the problem of shoring up the banks’ own funds has become the first item on the agenda of the various international summit meetings that have taken place, even ahead of the situation in Greece, which has certainly not been resolved. At root, the problem of the banks reveals the extreme gravity of the economic situation and illustrates the inextricable difficulties facing capitalism.

When the US lost its triple A status, the headline of the French economic daily Les Echos of 8th August read: “America downgraded, the world enters the unknown”. When the main economic media of the French bourgeoisie expresses its disorientation like this, when it shows its anxiety about the future, it merely expresses the disorientation of the entire bourgeoisie. Since 1945, western capitalism (and world capitalism after the collapse of the USSR) has been based on the fact that the strength of American capital was the final guarantor of the dollars that ensured the circulation of commodities and thus of capital around the world. But now the immense accumulation of debts contracted by the American bourgeoisie to deal with the return of the open crisis of capitalism since the end of the 1960s has ended up becoming a factor aggravating and accelerating the crisis. All those holding parts of the American debt, starting with the American state itself, are holding an asset which is worth less and less. The currency on which the debt is based can now only weaken the American state.

The base of the pyramid on which the world has been built since 1945 is breaking up. In 2007, when the financial crisis broke, the financial system was saved by the central banks, i.e. by the states. Now the states themselves are on the verge of bankruptcy and it is out of the question that the banks can come along and save them. Whichever way the capitalists turn, there’s nothing that can make a real recovery possible. Even a very feeble rate of growth would require the development of fresh debts in order to create the demand needed to absorb commodities; but even the interest on the debts already taken out is no longer repayable and this is dragging banks and states towards bankruptcy.

As we have seen, decisions that once seemed irrevocable are being put into question in the space of a few days and certainties about the health of the economy are being disproved just as quickly. In this context, states are more and more obliged to navigate from one day to the next. It is probable, but not certain because the bourgeoisie is so disoriented by a situation it has never been in before, that to deal with immediate issues it will continue to sustain capital, whether financial, commercial or industrial, with newly-printed money, even if this gives a new impetus to the inflation that is already on the march and is going to become more and more uncontrollable. This will not stop the continuation of lay-offs, wage-cuts and tax increases; but inflation will more and more make the poverty of the great majority of the exploited even worse. The very day that Les Echoes wrote “America downgraded, the world enters the unknown”, another French economic daily, La Tribune led with “left behind”, describing the planet’s big decision-makers whose photos appeared on the front page. Yes indeed: those who once promised us marvels and mountains, and then tried to console us when it became obvious that the marvel was actually a nightmare, now admit that they have been left behind. And they have been left behind because their system, capitalism is definitively obsolete and is in the process of pulling the vast majority of the world’s population into the most terrible poverty.

Vitaz 10/10/11.

[1]. lefigaro.fr, 9.22.11, “La colère gronde de plus en plus en Grèce”.

[2]. news.fr.msn.com; “Espagne, les enseignants manifestent à Madrid contre les coupes budgetaires”.

[4]. Statistique Eurostat.

[5]. Le Monde, 7-8.8.11.

[6]. finance-economie.com, 10.10 11, “Chiffres clés Espagne”.

[7]. globalix.fr “La dynamique de la dette italienne”.

[8]. IMF, World Economic Outlook Update, July 2010.

[9]. Le Figaro, 3.10.11.

[10]. Les Echos, 9.8.11.

[11]. lecourrierderussie.com, 10.12.11: “Putin, la crise existe”.

[12]. lefigaro.fr, 5.10.11: “FMI, recession mondiale pas exclue”.

[13]. Adapted from Le Monde 5.8.11.

[14]. Les Echos, August 2011.

[15]. Les Echos, 16 August 2011.

[16]. rfi.fr, 2.7.11,”Faillite: le gouvernment de Minnesota cesse activities”

[17]. gecodia.fr “Le stress interbancaire en Europe approche du pic post Lehman”

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace