Submitted by International Review on

The recession deepens

The American economy's plunge into recession continues, dragging the rest of the world down in its wake. The US leaders' official optimism of spring 1991 has died with the summer. Since September, the figures have made it impossible to maintain the illusion. There is no longer any room for confidence in a constantly rejuvenated capitalism, rising like a phoenix from its own ashes after each passing recession and continuing down in its pathless of endless growth[1]. Barely two years ago, the ruling classes triumphantly hailed liberal capitalism as humanity's only means of survival after its victory over the collapsing Stalinist "model" of state capitalism. Today, they are eating their words.

The dive into recession

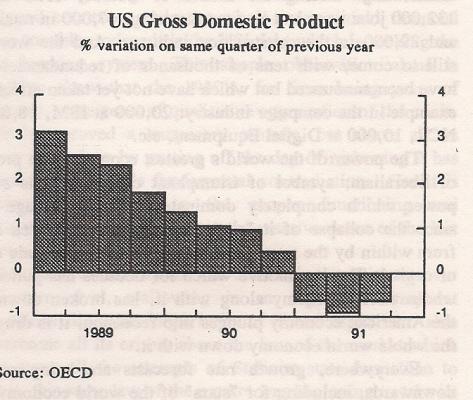

For two years, the US economy has been marking time, unable to find a way out of the quagmire. The GNP's average annual "growth" rate during the Bush presidency has been 0.3%.

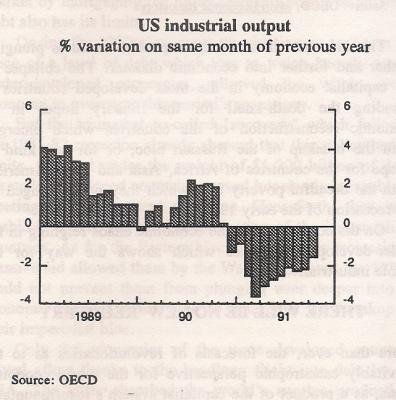

After three successive quarters of officially falling GNP, the 3rd quarter's improvement (2.4% growth) was hardly reassuring for the capitalists. Those responsible for the economy were expecting a much better result, between 3 and 3.5%. The simultaneous publication of September's monthly growth rate for industrial production (0.1%, in decline ever since June) only served to deepen the prevailing gloom in the bourgeoisie's leading circles.

The American economy is faced with the prospect of a still deeper plunge into recession. And the whole world capitalist economy is being rocked to its foundations.

Quite apart from all the different figures which are published regularly throughout the world, more bad news comes with every passing day.

For business, the "optimistic" figure of 2.4% growth for the 3rd quarter 1991 is not even an improvement. On the contrary, competition is getting sharper, price wars are endemic, and profit margins shrinking. The result is not merely a fall in profits, but a plethora of enormous losses. Every branch of industry is affected. Some of the most spectacular examples - but far from the only ones - come from the heavyweights of American industry.

These disastrous financial results have led to a series "restructuring" or "recovery" plans, which boil down to factory closures, ie redundancies, and attacks on wages. The weakest companies go bankrupt, and their redundant employees swell the ever-greater ranks of the poor and unemployed.

Only a short time ago, Reagan claimed to have beaten unemployment for good. In reality, this was achieved above all thanks to a proliferation of badly paid and insecure service industry jobs, and to outrageous cheating with statistics. Notwithstanding, unemployment has grown relentlessly from 5.3% of the working population at the end of 1988, to 6.8% in October 1991. It should not be forgotten that an apparently insignificant 0.1 percentage point increase means about 130,000 extra unemployed. All this of course is according to government statistics, which are well-known to under-estimate the real situation. Moreover, the tendency is accelerating. During the month of October 1991 alone, 132,000 jobs were lost in manufacturing, 47,000 in retailing, and 29,000 in the construction industry. And the worse is still to come, with tens of thousands of redundancies that have been announced but which have not yet taken effect, for example in the computer industry: 20,000 at IBM, 18,000 at NCR, 10,000 at Digital Equipment, etc.

The power of the world's greatest economy, the prophet of liberalism, symbol of triumphant capitalism, the super-power which completely dominates the world stage ever since the collapse of it "soviet" rival, is being eaten away from within by the ravages of the worldwide economic crisis of capital. The locomotive which for decades has pulled the whole world economy along with it, has broken down. As the American economy plunges into recession, it is dragging the whole world economy down with it.

Everywhere, growth rate forecasts are being revised downwards, including for "stars" of the world economy like Germany and Japan. For those already in the recession, such as Canada and Great Britain, the illusions in a renewal of growth are melting with those of the USA.

On every level, the USA sets the tone for the world economy, and just as in the USA, so in Europe and Japan the recession is accompanied by a string of bankruptcy, factory closures, and of course mass lay-offs.

The industrial heart of the capitalist world is plunging further and further into economic disaster. The collapse of the capitalist economy in the most developed countries is sounding the death-knell for the illusory hopes in an economic reconstruction of the countries which emerged from the breakup of the Russian bloc, or for any kind of escape for the countries of Africa, Asia and Latin America, from the dreadful poverty into which they were plunged by the recession of the early 1980's.

On the contrary, it is the economic chaos reigning in the under-developed countries which shows the way for the whole industrial world.

There will be no new “recovery”

More than ever, the forecasts of revolutionaries as to the inevitably catastrophic perspective for the world economic crisis, as a product of the capitalist system's insurmountable contradictions, are being confirmed.

Obviously, the ruling class cannot recognize the irredeemable bankruptcy of the capitalist economy, since this means its own defeat. This is why all the fine talk about a future "recovery" is not just a matter of propaganda aimed at an anxious population, it is also an attempt by the bourgeoisie to reassure itself. It is also true that capitalism's past ability to hide, and to alleviate the most brutal effects of the crisis, cannot but strengthen this allusion.

The measures taken to “kick-start” the economy are worn out,

and only make the situation worse

Since the end of the 60's and the return of the open crisis, at the end of the years of reconstruction and growth which followed World War II, the American, and therefore the world, economy has suffered several recessions: in 1967, 1969-70, 1974-75, and 1981-82. Each time, the capitalists thought that they had succeeded in laying the spectre of falling production to rest for ever, and that they had at last discovered the miracle remedy which would consign to the dustbin of history the forecasts of genuine marxism. And each time, the crisis reappeared, its effects more widespread, more powerful and more profound than ever.

All the remedies presented as decisive innovations (not so long ago, the economists were still pompously talking about Reagan's decisive "contributions" to economic science under the name of "Reaganomics") were in fact nothing other than the measures theorized and advocated by Keynes, and applied since the 1930's. This policy was one of state capitalism, characterized by: lowering of the central bank's lending rates, budget deficits, an increasingly massive and forceful intervention by the state in every branch of the economy, along with a universal reinforcement of the war economy, which owes as much to Hitler's state capitalism as it does to Keynes' theories. All these economic devices rely essentially on the growing development of credit and debt.

Capitalism's economic crisis is in reality a generalized crisis of over-production, brought on by the lack of solvent outlets capable of absorbing production. The development of credit is the means par excellence of artificially enlarging the market by mortgaging the future. But this policy of universal debt also has its limits.

During the 1970's, recovery thanks to easy credit, at the price of a level of debt which was to weigh heavily on the under-developed economies, allowed the whole world economy to overcome this period's recessions.

But the triumphal so-called "recovery" which followed the 1981-82 recession already showed that this policy had its limits. Crushed under the weight of $1,200 billion of debt, the under-developed countries proved hopelessly incapable of meeting their repayment deadlines. Henceforth, they were unable to absorb the surplus production of the industrialized countries. As for the Eastern bloc countries, the increasingly massive aid allowed them by the West throughout the 1980's could not prevent them from plunging ever deeper into an economic disaster which was to determine the breakup of their imperialist bloc.

Only the economies of the more developed countries stayed afloat thanks to the headlong flight into debt by the USA. The latter absorbed the world's surplus production, which could no longer be sold in the "Third World" by accepting ever more enormous trade deficits, and maintained their own economy's "growth" thanks to gigantic budget deficits which for the most part went to finance armaments production. Frantic property and stock market speculation allowed the US to attract capital from all over the world. But above all, it artificially swelled company balance-sheets and created the dangerous illusion of intense economic activity.

At the end of the 1980's, the USA was swimming in a fantastic ocean of debt. These debts are all the more difficult to quantify, in that the dollar has become a world currency and it is therefore hard to distinguish between domestic and foreign debt. While estimates place the US foreign debt at the all-time record figure of some $900 billion, its domestic debt has reached the astronomical sum of $10,000 billion, almost twice the annual GNP of the United States. In other words, all the workers in America would have to work for two years without wages to pay it off!

But not only has the USA's headlong flight into debt failed to relaunch the world economy as a whole during the 1980's, above all it has not prevented the return, little by little, of open crisis and more and more vigorous recession at the end of the decade. The repeated slumps in stock exchange speculation since 1987, and the collapse of the property boom since 1988 have provoked a series of bank failures. They are the signs of the fall in production which determined the open recession, officially recognized at the end of 1990.

Threadbare credit

Under such conditions, the new plunge into recession which began with this decade expresses not only capitalism's fundamental inability to find solvent outlets for its production, but also the exhaustion of all the economic mechanisms which have been used to soothe this insurmountable contradiction. The various "recoveries" of the last 20 years have brought capitalism to a credit crisis. At the heart of this crisis is the world's greatest economic power: the USA.

At the beginning of the 1980's, the debt of the under-developed countries made the whole international financial system tremble: today, it is the US' debt which is rocking the world banking system. This simple observation alone is enough to show that the 1980's, far from being years of prosperity, were years of qualitative aggravation of the crisis. Credit has proved a temporary remedy, but above all an illusory one, since by putting off the day of reckoning it has deepened the system's fundamental contradictions. Credit is traditionally necessary to the proper functioning and development of capital. Used in the massive doses of the last 20 years, it is a violent poison.

Just as Western capital was celebrating its victory over its Eastern rival, wallowing in an orgy of triumphant declarations about the "superiority of liberal capitalism" able to overcome all its crises, about the law of the market which swept away all the attempts of Stalinist state capitalism to cheat it, this same law of the market was beginning to take its spectacular revenge on all the lies pouring out in the West. Despite 19 consecutive falls in the US Federal Bank's interest rates (a classic state capitalist measure if ever there was one), the real economy failed to respond to the stimulus. Not only was the offer of new credit insufficient to relaunch domestic investment and consumption, and therefore production: the banks themselves are less and less eager to lend, since they know very well that they will never be repaid, which is after all logical enough under the law of the capitalist market.

After the stock market slumps of 1987 and 1989, on 5th November Wall Street underwent the fifth worst fall in its history. This happened despite a whole series of draconian controls set up after 1989, and reflects the fundamental contradiction between the frantic speculation which returned undaunted after the 1989 slump, and the reality of an economy which is going deeper and deeper into the red.

The particular event which sparked off the new slump in US stock market values is also significant. It was the banks' resistance to the government's desire to force them to lower interest rates on their credit cards. At them same time as the banks are faced with a growing tide of bad debts, and obliged to set aside increasing sums to cover them, the high cost of consumer credit (19%) remains their only way to re-balance their accounts. The bankers' fury forced Bush to back down, in order to reassure the market, just as he had been forced to give way a few days earlier when Congress refused to accept his proposed banking reform, which would have led to a series of bankruptcies among the weaker banks. The whole US credit system is suffocating, just as the US needs more money to finance a recovery. New, spectacular bankruptcies loom on the horizon. Congress has tried to confront these by voting $70 billion of new credits to the FDIC (Federal Deposit Insurance Corporation) which guarantees the banking system. This apparently enormous sum is likely to be hopelessly inadequate to deal with the losses to come. We need only remember the colossal losses caused by the bankruptcies of hundreds of Savings and Loans companies (buildin societies) following the collapse of the property market since 1989: $1000 billion!

The state's rescue of insolvent banks in fact resolves nothing at all. On the contrary, it only carries the problem to a higher level. These new demands on the budget can only increase the Federal budget deficit and increase its expenses at a time when its income is diminishing as the economy slows down. Some estimates now put the 1991 budget deficit at a record $400 billion. To fill in this ever-deepening pit, the American state has to call on capital throughout the world through the sale of Treasury bonds.

There are no more "locomotives" for the world economy

The American state's flight into debt is beginning to reach its limits. The world's investors are increasingly suspicious of the US economy. Not only does the enormous level of debt raise questions about the ability of the US to repay the credits already raised, the present recession makes the future look even bleaker. To try to "kick-start" the recovery, Treasury bonds are offered at low rates of interest, which reduces their attractiveness, the entire planet is confronted with a "credit crunch".

The major investors of the previous decade are no longer available: Germany needs capital to finance the integration with the ex-GDR, and Japan is weakening, with bad debts all over the world. The collapse of local property speculation and the slump in the Tokyo stock exchange has put the Japanese banks in a delicate situation. The crisis of confidence in America can be seen concretely in the 70% drop in foreign investment in the US during the first half of 1991, relative to the same period of the previous year. Japanese investment, which was the biggest during the 1980's, fell during the same period from $12.3 to $0.8 billion. All over the world, the demand for new credit is growing, while the offer is shrinking. The USSR, its days numbered, is begging for new loans simply to avoid famine during the winter; Kuwait needs capital for its reconstruction; the under-developed countries need new credits to go on repaying the old ones; and so on. As the world economy plunges irresistibly into recession, every country is frantically looking for new supplies of the drug to which they have become addicted, and which for years lulled them in a beautiful dream of an end to the crisis. A major financial crisis is in the offing, with the dollar, the world's main currency, at its heart.

The world's capitalists are anxiously awaiting the crunch, the moment when the US government can no longer place its Treasury bonds on the world market: a moment which is inevitable, and which will shake the entire international banking, monetary and financial system to its core, hurling the economy into a still deeper recession.

Whatever the immediate fluctuations of the US economy, the downward dynamic is already there. A brief upsurge of growth in these conditions[2] will only maintain the fiction of the patient's health for a few months longer. It will solve nothing. Faced with this situation, economists the world over are looking desperately for a solution. very measure they consider comes up against the stubborn reality of facts. They are either illusory, or their results would inevitably be catastrophic. At all events, they will be incapable of stopping the crisis.

Inevitable recession and the return of inflation

A rise in interest rates, which was the method Reagan put into practice on his arrival in office, and which provoked the 1981 world recession, would only accelerate, immediately and dramatically, the recession which is already here. It would violently destabilize the entire world economy, opening a veritable "Pandora's box" of uncontrollable chaos of the kind we are seeing today in the ex-USSR but on a world scale.

Moreover, we should remember that Reagan himself very quickly brought his high-risk policy of "rigor" to an end, in favor of its exact opposite, which allowed US capitalism to maintain a relative stability in the industrialized countries, and so to defend its own imperialist interests.

It is this second element of "Reaganomics" - the "recovery" - which is today at the end of its tether. As the budget deficit plumbs the depths, it is less and less possible to launch a consumer-based recovery by lowering taxes. As for a recovery through credit, as we have seen, the world supply of credit has already been dried up by the American state's repeated borrowing over the years.

There is only one source of supply for the fresh money that America needs to fuel its economy, and which it can no longer find on the world market: the printing press. This would result in a return to high inflation. This "less awful" "solution" would probably hold up downward slide, if only briefly.

Apart from the fact that such a policy would put an end to the dogma of the "struggle against inflation", which has been the ruling class' hobby horse for years to justify the sacrifices it imposed on the workers, it would also create a growing chaos in the capitalist economy, especially in the international monetary system.

The Bush administration is following a typically inflationist policy, which is expressed in the fall of the dollar. So far, inflation has been contained, in the USA and the developed countries, essentially by sharpening competition in a shrinking world market which has brought about the collapse of raw material prices, and forced companies to reduce their profit margins, as well as to attack the living conditions of the working class, so reducing the "cost of labor power".

These typically deflationary effects will also reach their limits. The conditions are ripening for a new upsurge of inflation. Nor should we forget that outside the most industrialized countries, inflation has never gone away, and is today ravaging the "under-developed" economies, as well as developing in the ex-Eastern bloc.

Never in its history has the economic outlook for capitalism been so bad. The economists' cold and abstract statistics herald a worldwide disaster.

The heart of world capital, in the most developed countries where the world proletariat is most concentrated and most experienced, are now at the eye of the storm. The great cloud of poverty and wretchedness which has covered the exploited of the "Third World" and Eastern Europe for years is about to cast the workers of the "rich" countries into shadow.

The working class, and the exploited all over the world, are about to suffer a brutal and dramatic decline in their living conditions. They must learn the truth about the utter dead-end into which capitalism is leading humanity, and against this tragedy, the vital necessity to put a truly communist perspective on the agenda, for all humanity's sake.

JJ, 28/11/91

[1] The ICC has constantly denounced this lie of the capitalist economy's prosperity. The open recession, in every characteristic, therefore comes not as a surprise but as the striking confirmation of the catastrophic and inevitable nature of the capitalist economy's crisis, which has been demonstrated by marxists for generations, and which the ICC has endeavored to demonstrate throughout its history. We need only mention the titles of the articles published during the last few years in the International Review, and which we recommended to interested readers:

“The perspective of recession has not disappeared”: no. 54, 2nd Quarter 1988

“Credit is not an eternal solution”: no. 56, 1st Quarter 1989

“The barbaric death-agony of capitalism”: no. 57, 2nd Quarter 1989

“After the East, the West”: no. 60, 1st Quarter 1990

“The crisis of state capitalism – the world economy sinks into chaos”: no. 61, 2nd Quarter 1990

“The world economy on the edge of the abyss”: no. 64, 1st Quarter 1991

“The recovery of the collapse of the world economy”: no. 66, 3rd Quarter 1991

[2] Given that the American ruling class is in the midst of its electoral circus, it will probably use whatever means it can to keep the economy afloat in order to maintain the illusion of its health, even if these means falsifying the statistics still further. Even if this gives them a few months breathing space, this situation is clearly temporary.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace