Submitted by International Review on

The course of the economic crisis

In the report on the ‘Crisis and Inter-Imperialist Conflicts’ adopted at the Third Congress of the ICC in 1979, we pointed out that all the palliatives with which world capital had tried to bring about a recovery from the slump of 1974-75 (the third and sharpest downturn since the onset of the open crisis of overproduction in 1967) had failed. The excess industrial capacity and slackening rate of investment in new plant throughout the advanced countries of the American bloc, the virtual bankruptcy of the backward societies in the Western orbit, and the failure of the various Five-Year Plans to achieve their goals throughout the Russian bloc, led us to conclude that world capitalism stood on “...the brink of another decline in industrial production, investment and trade -- stronger than the downturns of 1971 and 1974 -- as the 1980s begin”. (International Review no.18, p. 8)

In the third volume of Capital, Karl Marx lays bare the link between the fall in the rate of profit and the saturation of the market[1]. The economic crisis of capitalism, whether in its cyclical form in the ascendant phase or in the form of an historic crisis (which poses the alternative, inter-imperialist world war or proletarian revolution) which characterizes the decadent phase, explodes in three inter-connected manifestations according to Marx: overproduction of commodities, overproduction of capital and overproduction of labor power. We can best gauge the extent to which our forecast of 1979 that capitalism “…stands poised on the brink of new and even more devastating economic cataclysms” (International Review no.18,p.3), has been confirmed by first tracing the course of the economic crisis on these three levels in the industrial behemoths of the West, which dominate the world economy.

The West

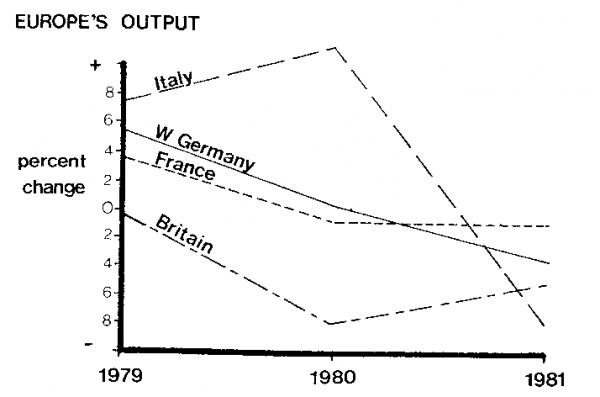

The slowdown in the growth of industrial production[2] which characterized the EEC, Japan and the US in 1979 has now given way to a sharp decline in industrial output in the EEC:

The catastrophic nature of this collapse of industrial production can best be seen in Britain where manufacturing output has fallen 15 percent since 1979 and now stands at its lowest level since 1967; the extent of overproduction in key industries can be found in the fact that under the EEC’s mandatory production controls for steel, production of that basic commodity will be 20 per cent lower by April 1981 than it was in 1979; while production of automobiles will fall 10 to 12 per cent this year, as Japanese companies compensate for the saturation of the world market by renewed dumping in Europe. In West Germany, the mighty engineering sector which was the key to that country’s trade surplus over the past several years has now followed the steel and auto producers along the path of falling output.

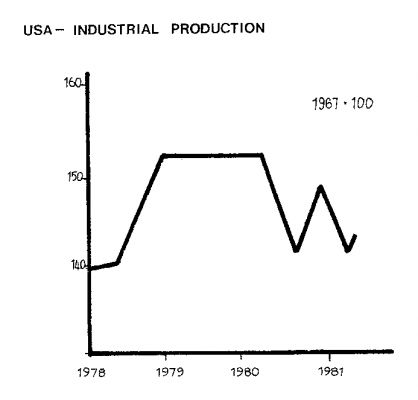

In the US, stagnation in industrial production during 1979 gave way to an abrupt drop in 1980; and the mild upturn at the end of last year was quickly transformed into a new downturn -- a “double-dip” recession, which presages the only kind of “recovery” that capitalism can generate today:

The magnitude of the decline in output in key industries in the US can be seen in the fact that in February 1981 the production of steel and lumber (the basis of the housing industry) was only at the same level as in 1967, while automobile production was even lower than it had been in 1967.

Japan alone among the industrial giants of the American bloc has so far escaped this slump in manufacturing output[3]. But Japan's industries are so completely dependent on exports that domestic demand is incapable of providing any significant compensation for the shocks which the looming protectionism of its major trading partners and/or a downturn in world trade will bring.

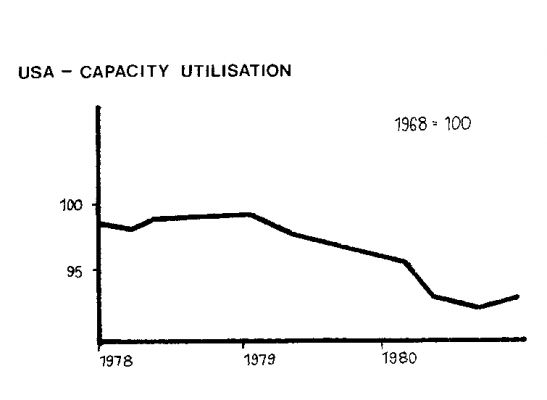

The enormous overproduction of commodities which has produced this downturn in industrial production has in its wake already brought about a strong fall in investment in capital goods and the beginnings of a collapse of manufacturing profits. In 1981 real spending on plant and equipment is expected to fall 2-3 per cent in West Germany, 7 per cent in Italy and10.25 per cent in Britain. In the US, as the utilization of manufacturing capacity has declined, investment in new plant has fallen below the level necessary to maintain America’s industrial base at competitive levels:

Meanwhile, the more than four billion dollars lost by American automakers in 1980 is certainly the most spectacular harbinger of the general collapse of profits which this overproduction of commodities must result in.

The barrier of a saturated world market, the lack of effective demand relative to the hyper-developed productive capacity of world capitalism means that at the level of global capital any effort to counteract the decline in the rate of profit by new investments to raise the productivity of labor can only exacerbate the difficulty of realizing the mass of surplus value by adding to the plethora of unsaleable commodities. Therefore, as industrial output falls, a growing mass of unemployed capital thirsting for profit is frantically hurled into the activity of speculation. It is possible that the overproduction of capital has already thrown one trillion dollars into speculation. It is this veritable flood of unemployed capital seeking a profitable short-term placement that has kept oil prices rising despite a 6 per cent fall in demand in the American bloc during 1980. The feverish excitement in the gold markets in the face of a decline in the demand for industrial gold has led specialists in precious metals to estimate that “50 percent of demand is now speculatively oriented” (New York Times, International Economic Survey, 8 February 1981). The fiasco of the Hunt brothers’ efforts to corner the silver market, the heavy trading in currency futures and foreign exchange by the world’s leading corporations and financial institutions, all attest to the frantic search for short-term profits on the part of idle capital. Indeed, today the very price of the world’s major currencies is increasingly determined by the rise and fall of interest rates -- the fluctuations ions of which can send billions of dollars scurrying from one country to another almost overnight. This vast overproduction of capital has spawned an enormous speculative bubble which threatens to burst with catastrophic consequences for world capital.

As industrial production slumped during 1980-81, unemployment rose at an accelerated rate throughout the industrialized countries of the American bloc:

Unemployment rates

| March 1979 | March 1980 | March 1981 |

France | 6.1% | 6.6% | 7.5% |

W. Germany | 4.1% | 3.5% | 4.6% |

Holland | 5.1% | 5.0% | 8.1% |

Italy | 8.0% | 8.2% | 8.6% |

Japan | 2.1% | 1.9% | 2.1% |

Sweden | 2.1% | 2.2% | 2.5% |

USA | 5.7% | 6.0% | 7.3% |

Britain | 5.6% | 5.7% | 9.6% |

The real dimensions of this “excess population” (Marx), which is one of the most vicious manifestations of the economic crisis of capitalism, can be seen in the OECD’s prediction that by mid 1981 there will be 23 million officially unemployed workers in the industrialized countries of the American bloc. In Holland, there is now more unemployment than at any time since the end of World War II. In Britain, there will be more than three million jobless workers by mid 1981 -- a higher figure than that reached even in the depths of the depression in the 1930s. In West Germany, economists at the Commerzbank not only predict a rise of unemployment for an official figure of 4.8 per cent, but also forecast that the number of short-time workers will rise from 130,000 to 520,000 this year. The racist attacks on immigrant workers in France (orchestrated by the government and the left in opposition alike), the plans of giant firms, like Italy’s FIAT (announced layoffs of 24,000 workers) and France’s Rhone-Poulenc (a projected 25 per cent cut in its workforce), to further slash their labor force, are so many signs of the grim fate that capital is planning for millions more workers in the 1980s.

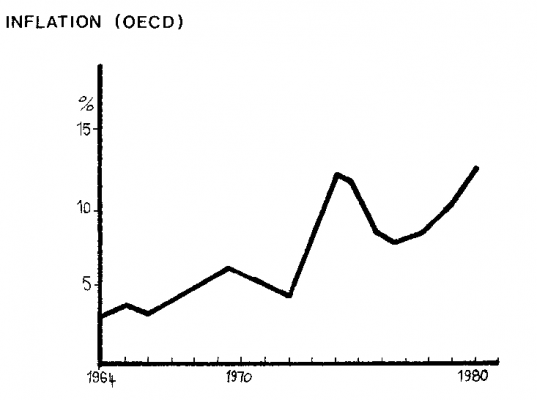

To these devastating manifestations of the open crisis of overproduction (overproduction of commodities, capital and labor-power) must be added another manifestation, no less ominous for capital: galloping inflation in the very midst of a collapse of production and profits. Capitalism, caught in the grip of a permanent crisis, has reacted by using the drug of inflation (creation of money and credit) in a desperate effort to compensate for the lack of effective demand brought about by the definitive saturation of the world market. This continuous and deliberate bloating of the money supply has now so swollen the costs of production that it has dragged down an already rapidly falling rate of profit and accelerated the very breakdown in production it was originally intended to prevent. Moreover, while in the other downturns in production since the onset of the open crisis -- 1967, 1971, 1974-1975 -- the rate of inflation fell, in the present downturn it has leaped ever higher.

The underdeveloped countries

In the backward Asian, African and Latin American countries which provide vital materials and necessary markets for the American bloc, the past two years have seen ranks of the impoverished peasantry and inhabitants of the miserable shanty towns swell. Today, according to the World Bank -- one of the institutions by which American three continents -- 800 million underfed human beings subsist in conditions of ‘absolute poverty’. Apart from a few oil-producing countries, the flow of dollars to whom provides a market for Western arms manufacturers or winds up on deposit in Western banks, the countries of the ‘third world’ have been reduced, by mounting trade and balance of payments deficits and a skyrocketing burden of foreign debt, to virtual bankruptcy. An absolute dependence on imported food -- the grim product of the chronic agricultural crisis capitalism has provoked -- has meant that these countries’ overall payments deficits have risen from $12 billion in 1973 to an anticipated $82 billion in 1981. Meanwhile, constant borrowing from Western private and public financial institutions, largely to cover these deficits, has resulted in an astronomical foreign debt of 290 billion dollars for these starving countries as a whole.

Over the past two years, a string of countries beginning with Zaire, Jamaica and Peru, continuing with Turkey, and most recently including Sudan and Bolivia, have tottered on the brink of bankruptcy and had to request a rescheduling of their debts from their imperialist creditors. In each of these cases, the only alternative to default and an immediate end to imports has been to accept some form of de facto control by the IMF -- the primary instrument of American imperialism’s domination of the backward countries of its bloc -- is a quid pro quo for the necessary debt rescheduling. This control has usually taken three complementary forms:

1. Devaluation of the debtor countries’ currency, which means that for the same amount of their own money its creditors can appropriate a much greater volume of raw materials.

2. Higher food prices in order to restrict imports, which means an even greater harvest of starvation in the “third world”.

3. Wage freezes so as to extract even more surplus value from the laboring population with which to pay back the interest and principal on the enormous debt.

With an inflation rate of 7per cent to 15 per cent and a budget deficit last year of $11 billion dollars, China too has followed the path of so many other backward countries of the American bloc to the IMF hot in hand. In her first year as a member of the IMF (which completed her economic integration into the American bloc) China has borrowed nearly $1.5 billion. Moreover, confirming our 1979 forecast that China would not fulfill the hopes of Western businessmen for a vast market in which to dispose of their overproduction, China has already this year cancelled or “deferred” capital investments contracted with western firms worth $3.5 billion. The 13 per cent cut in state spending announced in February indicates that the Peking regime has now officially embarked on the same path of draconian austerity as the rest of the capitalist world.

THE Russian bloc

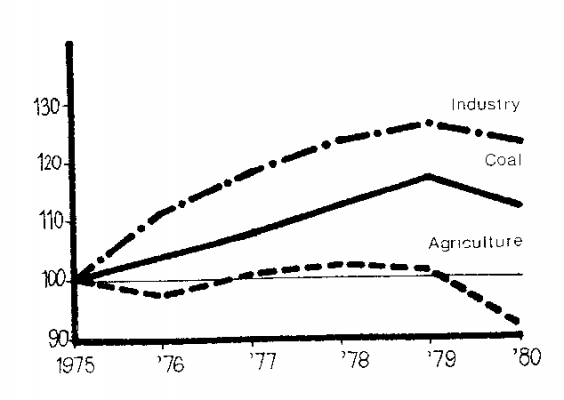

1n our 1979 report on the “Crisis and Inter-Imperialist Conflicts” we showed how one of the most important manifestations of the world economic crisis in the Russian bloc was a chronic scarcity of capital. During the 1970s, the Russian bloc prevented the downturn in production to which this scarcity of capital would have condemned it, by massive loans from Western banks and governments. This flow of money capital to the East (which financed the imports of Western capital goods and technology) allowed the economies of the Russian bloc to continue growing -- albeit at a much slower rate than before the onset of the open crisis of world overproduction. The example of Poland illustrates how economic activity was maintained in the face of a saturated world market and a scarcity of capital. In1971, Poland’s foreign debt was a miniscule $800 million; in 1980 (just before the outbreak of the mass strike in August) it had grown to a staggering $23.5 billion. However, by 1979, the greater part of the new loans were necessary just to assure the interest and repayment of principal on old loans, rather than to expand production. As a result, the Polish economy -- before the mass strike -- had begun to collapse:

Poland’s economic collapse differs only in its sharpness from the economic downturn in which the whole of the Russian bloc is now mired. Thus, in Russia agricultural production declined 3 per cent in 1980 and production in key industrial sectors like coal, steel, nuclear reactors and electric power fell far short of the goals set in the last Five-Year Plan.

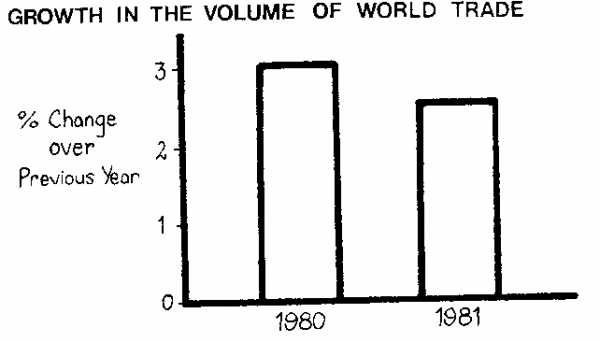

World trade

The economic slump which has now simultaneously hit all sectors of world capital ‑- both the advanced and backward countries of the American bloc and the whole of the Russian bloc -- has led to a continued and ever faster decline in the rate of growth of world trade:

A brief description of the ways in which world capital sought to ‘recover’ from slump of 1974-75 and the failure of that effort, is necessary to demonstrate why world trade is today virtually stagnant. Two basic economic stratagems were used to create a temporary pick-up in economic activity. First, the US became the ‘locomotive’ of the world economy by artificially providing a market for the rest of its bloc through enormous trade deficits. Between 1976-1980 the US bought commodities overseas to a value of 100 billion dollars more than it sold. Only the US -- because the dollar is the world’s reserve currency -- could run up such a trade deficit without the necessity for a massive devaluation of its currency. Second, the US flooded the world with dollars in an unprecedented credit expansion in the form of loans to the backward countries and to the Russian bloc (this latter largely by way of financial institutions based in Europe). This mass of paper values temporarily created an effective demand which allowed world trade to pick up. The virtual bankruptcy of the backward countries of the American bloc, which has driven country after country to avoid default by putting itself under the fiscal dictatorship of the IMF and submit itself to its austerity plans, has already removed one of the crutches which has propped up world trade over the past several years. A drastic reduction in imports by these countries -- necessary if a train of bankruptcies and a possibly mortal blow to the international monetary system is to be averted -- will have a catastrophic effect on the world’s industrial giants: 55% of the exports of the EEC (taken as one trading bloc), 46% of the exports of Japan and 46% of the US and Canada’s exports now find their market in the backward countries. This collapse of the backward countries as a market has put at risk half the exports of the industrialized countries! The growing economic and political risks of continued massive loans to the Russian bloc are now removing another crutch on which the growth of world trade has depended. Finally, the US has begun to take rigorous steps to reduce its own payments and trade deficits so as to prevent another and more devastating dollar crisis. Such a policy by Washington, however, means that the US can no longer play the role of locomotive of the world economy -- a role in which no other country can possibly replace it.

The resultant stagnation and impending decline in world trade will have a devastating effect on industrial production in the US, Japan and the EEC, where the domestic market is -- as we have seen -- already super-saturated. Japan and Europe have long been absolutely dependent on export markets in the US, the backward countries and - particularly in the case of Europe -- the Russian bloc to maintain their industrial activity. American capitalism, long protected from the vicissitudes of world trade by a huge domestic market, is today hardly less dependent on exports than the rest of its bloc: exports now account for an unprecedented 20% of domestic industrial production.

It is this reality of a deepening world slump that has lead even representatives of the bourgeoisie, such as the authors of France’s New Five Year economic plan to point to the certainty that “tomorrow will be worse than today”. Revolutionary Marxists (who alone can understand why the course of the economic crisis must lead capitalism to the abyss) who can see that this historic crisis has created the very preconditions for the destruction of capitalism by the proletariat, can only respond by a whole‑hearted “welcome the depression!”

Having traced the course of the economic crisis, we now want to briefly sketch the economic policies with which the capitalist class in both the American and Russian blocs will attempt to respond to the global depression.

The response of the bourgeoisie

State capitalism

In the American bloc, the economic crisis is greatly accelerating the tendency towards state capitalism[4]. State capitalism cannot simply be reduced to nationalization of the means of production -- which is but one particular manifestation that it can assume. One of the architects of state capitalism in the 1930’s, Hiram Schacht, Hitler’s first economic Czar, showed in reality what the basic principle of state capitalism is: “der Stadt am Stever der Wirtschaft” (the state as rudder of the economy). Within the framework of the anarchy of the world market, whose sole regulator is ultimately the capitalist law value, it is the state which charts the course for the economy of each national capital. This can be clearly seen in the case of France, under the centre-right government of Giscerd-Barre. The state has selected “strategic” industries, such as nuclear power, aerospace and telecommunications, in which it plans to invest or direct the investment of billions of dollars, while at the same time it has decided to wind down certain traditional industries such as steel, shipbuilding and textiles. Using a combination of nationalization, subsidies and state orders, indicative planning and political pressure, the French state is orchestrating mergers (the reorganization of the special steels industry, the centralization of truck making in the hands of state-owned Renault), creating new industrial groups (the formation of a telecommunications trust, beginning with Matra’s takeover of Hachette) and is maneuvering foreign capital out of key sectors ofthe economy (the takeover ofEmrain-Schreider by Paribus).

In completing the process of organizing each national capital into a single economic bloc, the capitalist state is faced with the dilemma of adopting a coherent fiscal and monetary policy with which to steer the economy in the midst of a simultaneous collapse of industrial production and galloping inflation. Today, no major western country is seriously contemplating a thoroughgoing reflationary policy; the specter of hyper-inflation and the definitive collapse of its currency precludes the massive public works programs which Hitler in Germany, the Popular Front in France or Roosevelt in the US could institute in the 1930’s, when the collapse of production had brought with it rapidly falling prices. However, the alternative of a deflationary policy, if it seems the only way to prevent hyper-inflation, will bring about a further disastrous plunge in industrial production, profits and investment (as well as a drastic rise in unemployment). In Britain where the Tory government of Margaret Thatcher has resorted to a deflationary of policy (albeit with inconsistencies), the results have been catastrophic for capital: industrial output down 15%; since 1979 leading British ‘multinationals’ like GKN and Lucas which had made profits even in the downturn of ‘67, ‘71, and ‘74-‘75 chalked up losses; bankruptcies rose 50% in 1980 while unemployment increased by 900,000 last year alone. This de-industrialization, which is turning Britain’s manufacturing heartland into a desert, has also provided the Treasury with a pyrrhic victory: the annual rate of inflation has come down from over 20% to a still ominous 13%. Small wonder that the Confederation of British Industry (the organ of industrial capital) has frantically called for a reversal of Thatcher’s deflation by way of a massive reflationary program of public investment (roads, pipelines, nuclear energy, transport and communications) to save them from the impending catastrophe.

‘Supply-side’ economics

The bankruptcy of both orthodox def lationary policies and classical reflationary policies in the face of the combined onslaught of overproduction and inflation has led to a frantic search for ‘new’ economic nostrums on the part of the bourgeoisie and its intellectual. hangers-on. The latest of these is supply-side economics, to which an important part of the Reagan administration is firmly committed. The basis of supply-side economics is the belief that far-reaching cuts in tax rates (primarily for business and the rich) will produce such an increase in investment and a concomitant rise in industrial output that government revenues will actually rise and a balanced budget be achieved. The fallaciousness of this ‘reasoning’ will be quickly revealed if Reagan’s $54 billion tax cut is implemented unmodified and without the drastic budget cuts that the deflationists who run the Treasury and Federal Reserve Board want: the billions cut from taxes will not flow into investment in new productive plant or businesses at a time when there is already a huge overproduction of capital; rather these billions will fuel speculative activity, bringing a dramatic collapse of paper values one step closer, or will generate a short-lived boom in unproductive consumption by the rich, which will fuel the inflation which is ravaging the economy. Moreover, behind the extreme right rhetoric of its partisans, supply-side economics turns out to be merely a variant of the Keynesianism which has dominated the world economy since the 1930s. The public works projects of traditional Keynesianism and the tax cuts of supply-side economics both vainly seek to compensate for a chronic lack of effective demand relative to the mass of commodities which a hyper-developed industrial apparatus spews forth. And in a world in the grip of galloping inflation, any such attempts to make up for the lack of demand by budget deficits risks pushing capitalism over the abyss.

Attack on workers living conditions

The more the devastating blows of the world crisis destroy the very possibility of coherent economic policy, the more the bourgeoisie is driven to rely on a direct assault on the living conditions of the proletariat as its primary reaction to an objective reality which has escaped all control. By attempting to drastically alter the ratio between wages and surplus value, the bourgeoisie cannot relieve the problem of global overproduction which bars an economic recovery whatever the rate of profit may be; however, such a policy - if it is successful - can increase the competitiveness of national capital at the expense of its rivals. This has brought about a two-pronged offensive by capital. First, against employment: drastic cuts in the workforce, with a consequent ‘rationalization’ and speed-up for the remaining workers is vital for the survival of each enterprise (though the growth of unemployment only exacerbates the difficulties of each national economy as a totality); in Britain, for example, GKN has shed 27% of its workforce over the past 15 months, while British Steel has laid-off 60,000 workers and announced that an additional 20,000 will be sacked. Second, against wages: in Belgium the unions and employers, under government prodding, signed a pact for a two-year wage deal in February, and the government has since proposed abandoning indexed wages (which rise under the impact of inflation) and a 10% cut in the wages of workers whose firms receive financial aid from the state. The economic stability of the countries of the American bloc is now absolutely dependent on the success of this offensive against the proletariat.

The Eastern bloc

The economic situation in the Russian bloc is, if anything, even more desperate than that faced by the industrialized countries of the American bloc. The cumulative effects of a chronic scarcity of capital, the growing obstacles to loans from the West with which to purchase the technology that the Russian bloc lacks, the ever shrinking market for its export industries, have combined to put an end to the ‘goulash socialism’ with which first Khrushchev and then Brezhnev sought to contain the explosive outburst of class struggle which the death of Stalin had unleashed throughout the bloc. Draconian austerity and a new direct assault on the miserable living and working conditions of the proletariat is the real basis of the new Five Year Plan unveiled at the 26th Congress of the Russian Communist Party this year. In his report to the Congress, Brezhnev said that Russia will “achieve more while using fewer resources in production” under the 1981-85 Plan. Here was the veiled admission of the scarcity of capital. The switch to more intensive methods of production was no longer, according to Brezhnev, “a choice but a necessity”. The effort to raise productivity by 17-20% over the next five years, with less capital investment than in the previous five, can only mean that not productivity (which is dependent on constant capital), but the intensity of labor must grow. Brezhnev’s report, therefore, announced that the Russian economy must henceforth depend to an ever-increasing extent on the extraction of absolute surplus value rather than relative surplus value -- precisely the same course that capital had embarked upon in the American bloc. In the East too, then, the very existence of the capitalist regime depends on the bureaucracy’s success in this attack on the working class.

Inter-imperialist antagonisms

As the curve of the economic crisis spirals upwards, it intensifies the inter-imperialist antagonisms to the breaking point. There is a direct and immediate link between the deepening world economic crisis and the clashes between the imperialist blocs. For capital, there is only one ‘solution’ to its historic crisis: inter-imperialist world war. The more quickly the various economic palliatives prove futile, the more deliberately each of the imperialist blocs must prepare for a violent redivision of the world market.

The Reagan Presidency corresponds to a new determination by the American bourgeoisie to assume an increasingly bellicose posture around the world. Underlying this heightened aggressiveness is the bourgeoisie’s growing recognition that war with Russia is its only real option -- a view not usually so openly expressed as it was by Richard Piper, the Russian specialist at the National Security Council, when he said in March that war was inevitable if the Russians did not abandon ‘communism’. The strategy that is emerging within the ruling circles of American imperialism is no longer based simply on the view that its Russian antagonist must be prevented from breaking out of its Eurasian heartland; today the conviction is growing in both the Pentagon and on Wall Street that having established its military hegemony up to the banks of the Elbe after two world wars, America must now finish the job and extend its domination beyond the Urals. This is the real meaning behind the Reagan Administration’s determination to increase military spending by 7% annually in real terms (so that it will account for more than a third of the Federal Budget). The 200,000 man Rapid Deployment Force, the string of bases in the Middle East (including the ultra-modern installations in the Sinai that America hopes to take-over when Israel withdraws next year), the new “strategic consensus” that Secretary of State Haig is forging in the area stretching from Palestine to Egypt (and significantly taking in Iraq), the project for a 600 ship navy by 1990 and the new manned bomber for the Air Force, constitute so many direct preparations for offensive war in the coming decades.

While the strategic balance between the Russian and American blocs has continued its onward shift in favor of Washington (the Russian army is bogged down in Afghanistan, an upsurge of the working class in Poland may yet force the Kremlin bureaucracy to attempt to crush the proletariat, which even if successful will tie down an immense army of occupation and disrupt the Warsaw Pact), this does not mean that Russian imperialism will now adapt a defensive strategy. As we pointed out in our report to the Third Congress of the ICC, the economically weaker Russian bloc can only hope to counteract America’s overwhelming industrial might by seizing the advanced industrial infrastructure of Europe and/or Japan. Russia’s strategy of seeking domination of the oil-rich Middle East has as its primary aim to make Europe and Japan as dependent on Moscow for the fuel to run their industry as they now are on the US, and thus detach them from the American bloc. The growing bellicosity of the US can only increase the desperation of the Kremlin bureaucracy to make its bid in the Middle East while there is still any chance of success. To this must be added another factor which is pushing Russian imperialism down the path of military adventure: the scarcity of capital with which to develop her Siberian oil reserves means that both her war industries and her capacity to control her bloc by providing so vital a resource will soon be at risk -- all of which will only intensify the pressure to grab the Arabian oil fields in the coming years.

The pursuit of these warlike strategies by Russian and American imperialism is dependent on the further consolidation and strengthening of their respective blocs. However, the very deepening of the economic crisis which is pushing American imperialism to more directly plan for war is also creating stresses and strains within the Western Alliance. Japan’s massive export offensive, which produced an EEC trade deficit with Tokyo of $11.5 billion and an American trade deficit with Japan of $12.2 billion in 1980, has provoked a growing protectionist sentiment on the part of powerful factions of the bourgeoisie in both Europe and America. While the US has moved quickly to assert the cohesiveness of its bloc through pressure on Japan to ‘voluntarily’ limit its exports and to remove its own barriers to imports and foreign investment, the clamor for protectionism (and even autarky) by bourgeois factions in Europe is a growing danger to which Washington must respond.

While France and Britain have resolutely backed the US in its increasingly aggressive posture towards the Russians, America’s pressure on Europe to reduce its trade links with the Russian bloc and to have second thoughts about its participation in the projected natural gas pipeline from Siberia, has run into growing resistance -- particularly from West Germany. Eastern Europe and Russia are one of the few markets where German (and more generally European) capital does not face stiff competition from the US and/or Japan. The limitation of trade and economic links with Russia, which America’s strategy entails, will considerably reduce the small degree of autonomy which German capital has acquired since the last war. To these economic considerations must be added the fact that important segments of the European bourgeoisie still hesitate to accept all of the consequences of the strategy Washington wants to impose (the basing of Pershing II missiles in Europe) because a war would immediately turn Europe into a bloody battlefield. Nonetheless, to the degree that these hesitations are not just a facade to divert the proletariat from its own class terrain or a cloak behind which stand pro-Moscow factions of the bourgeoisie, they will ultimately give way to the impervious necessity to strengthen the bloc as it prepares for war.

As Russian imperialism moves to strengthen its bloc, it is encountering resistance on the part of certain of the bureaucracies of Eastern Europe. The Romanian and Hungarian bureaucracies in particular are loathe to put their own complex trade and economic links with Western Europe at risk, as it is only through these links that they have achieved any autonomy vis-a-vis Moscow. Nevertheless, the growing dependence on Russian loans (as these countries reach the limits of their creditworthiness in the West), reliance on Moscow for raw materials, and the ominous Brezhnev Doctrine, will ultimately prevail over the hesitations of the little Stalins.

****************************

If the upward curve of the economic crisis inexorably drives the bourgeoisie towards inter-imperialist war, the outcome of the historic crisis is not determined by the course of the economic crisis alone. It is the intersection of the curve of the economic crisis and the curve of the class struggle that determines whether the historic crisis will end in inter-imperialist world war or proletarian revolution.

If the upward curve of the economic crisis intersects with a downward curve of the class struggle (as in the 1930s) imperialist war is inevitable. If, however, the wave of the economic crisis intersects with an ascendant curve of class struggle, then the road to war is barred and an historic course towards class war between the bourgeoisie and the proletariat is on the agenda. The present ascendant course of class struggle is today the real key to the international situation. The menace of the proletariat increasingly determines the actions of the capitalist class everywhere. The vast arrays of weapons with which the capitalist classes of both blocs have armed themselves to fight an inter-imperialist war are now being prepared for use in a class war. The strengthening of the blocs, which is a pre-requisite for war against the rival bloc, is now a direct and immediate preparation to confront the proletariat wherever it challenges the role of capital.

[1] The fact that Marx did not live to write the projected volumes on ‘foreign trade’ and the ‘world market’ of his vast analysis of ‘the system of bourgeois economy’ meant that his treatment of this link is somewhat one-sided, with the axis on the over-accumulation of capital due to the fall in the rate of profit. Based on Marx’s own analysis in Capital and Theories of Surplus Value, it is the task of revolutionary Marxism to more clearly reveal the complex inter-action between overproduction of capital and over-production of commodities which a correct understanding of the immanent tendency of capitalism to saturate the world market then makes possible.

[2] While official and semi-official statistics in every country grossly distort the real state of the economy, the figures for industrial production correspond better to the real level of economic activity than the figures for GNP in which – among other things – the distinction between productive and unproductive labor (which is vital for determining the real conditions of a capitalist economy is completely denied.

[3] A 2.6 percent drop in industrial production during the third quarter of 1980 was quickly followed by a massive dumping on foreign markets (particularly the EEC and the US) which has yet to run its course.

[4] In the Russian bloc, in part as a result of the expropriation of private capitalists by the victorious proletariat in 1917-18, in part as a result of economic backwardness which made the nationalization of the means of production an absolute necessity if capitalism was to survive and an imperialist policy pursued, “private” capital has been virtually eliminated.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace