Submitted by International Review on

World debt has reached astronomical proportions, no longer making it possible to go on "re-launching" the economy through a new spiral of debt without threatening the financial credibility of states and the value of their currencies. Faced with this situation, revolutionaries have a responsibility to make an in-depth analysis of the ways in which capitalism has up till now kept its system artificially alive by "cheating" its own laws. This is the only method that can result in a pertinent evaluation of the impasse which the world bourgeoisie now faces.

Studying the period known as the "Thirty Glorious Years", so lauded and so regretted by the bourgeoisie, is no exception to this and revolutionaries obviously need to refute the interpretations offered by the defenders of capitalism, in particular when they want to convince us that capitalism can be reformed.[1] while at the same time engaging in a fraternal confrontation with the different points of view that exist on this subject within the proletarian camp. This is the aim of the debate to which our organisation has opened the columns of the International Review for two years now.[2]

The view developed in our pamphlet The Decadence of Capitalism, according to which the destruction that took place during the Second World War, by creating a reconstruction market, were the source of the boom of the 1950s and 1960s, has been subjected to a critique in the ICC, particularly from the position of the thesis we defend, referred to as "extra-capitalist markets and debt". As its name indicates, this thesis considers that it was selling to extra-capitalist markets and selling on credit that was the motor for capitalist accumulation during the 1950s and 60s, and not Keynesian measures, as defended in the other thesis, referred to as the Keynesian-Fordist thesis.[3] In International Review n° 138 there was a contribution signed by Salome and Ferdinand, defending the latter point of view and which, by putting forward a number of arguments that have not yet been publicly discussed, has reanimated the debate. While responding to the arguments of these two comrades, this article has the following objectives: to recall the foundations of the thesis of extra-capitalist markets and debt; to present some statistical elements which, in our opinion, illustrate its validity and to examine its implications for the ICC's global framework of analysis of the period of capitalist decadence.[4]

The main theoretical arguments

The analysis defended in The Decadence of Capitalism sees a certain economic rationality in war (war as having positive economic consequences). In this sense, it is in contradiction with older texts of our organisation which argue that "what characterises all these wars, like the two world wars, is that unlike those of the previous century, at no time have they permitted any progress in the development of the productive forces, having had no other result than massive destructions which have bled dry the countries in which they have taken place (not to mention the horrible massacres they have provoked)".[5]

In our opinion the mistake in our pamphlet is the result of a hasty and erroneous application of the following passage from the Communist Manifesto: "And how does the bourgeoisie get over these crises? On the one hand by enforced destruction of a mass of productive forces; on the other, by the conquest of new markets, and by the more thorough exploitation of the old ones". In fact, these lines do not attribute the destruction of the means of production with the virtue of opening a new solvent market capable of getting the economic machine back in motion. In conformity with all the economic writings of Marx, it's necessary to interpret the effects of the destruction of capital (or rather the devaluing of capital) as helping to disgorge the existing market and counter the tendency towards the falling rate of profit.[6]

The thesis referred to as Keynesian-Fordist state capitalism offers an interpretation of the years of "prosperity" in the 1950s and 1960 different both from the one put forward in The Decadence of Capitalism and the extra-capitalist markets and debt thesis. "The guaranteed growth in profits, state spending and the rise in real wages, were able to guarantee the final demand so vital if capital were to continue its accumulation."[7] Two arguments have been put forward in response to this idea:

Increasing wages above what is necessary for the reproduction of labour power constitutes, from the capitalist point of view, a pure and simple waste of surplus value which can in no way contribute to the process of accumulation. Furthermore, while it's true that increasing workers' consumption (through raising wages) and augmenting state spending create an outlet for a growth in production, the overall consequence of this is a sterilisation of wealth which cannot usefully serve the valorisation of capital.[8]

Among the sales made by capitalism, the part which can be devoted to the accumulation of capital, and which thus participates in its real enrichment, correspond to sales realised through trade with extra-capitalist markets (internal or external). This is effectively the only way of permitting capitalism to avoid finding itself in a situation where "capitalists are exchanging among themselves and consuming their own production", which, as Marx said "does not at all permit the valorisation of capital".[9]

In their article in International Review n° 138, comrades Salome and Ferdinand come back to this subject. Here they make a precision, a perfectly appropriate one in our view, regarding what they see as the framework of this debate: "One might reply that such an increase in the size of the market is not enough to realise the whole of the surplus value necessary for accumulation. This is true in general and in the long term. Those of us who defend the ‘Keynesian-Fordist' thesis do not think that we have discovered a solution to capitalism's inherent contradictions, which could be endlessly repeated".

They then illustrate via a schema (based on those used by Marx in the second volume of Capital to present the problem of enlarged reproduction) how accumulation can continue despite the fact that a part of the surplus value is deliberately returned to the workers in the form of wage increases. From their point of view, the same underlying logic explains why an extra-capitalist market is not indispensible to the development of capitalism: "if the conditions are such as those assumed in the schemas, and if we accept the consequences (conditions and consequences which can be analysed separately), then a government which controls the entire economy can theoretically organise it in such a way that accumulation functions according to the schema"

For the comrades, the balance sheet of this redistribution of surplus value, even if it slows accumulation down, is nevertheless positive, since it makes it possible to enlarge the internal market: "If this profit is high enough, then the capitalists can increase wages without losing all the increase in extracted surplus value...The only ‘damaging' effect of this ‘waste of surplus value' is that the increase in capital's organic composition is less frenetic than it would otherwise have been".

We agree with the observation the comrades make regarding the effects of the "waste of surplus value". But on this subject they also say: "we cannot assert that this ‘waste of surplus value' plays no part in the process of accumulation. On the contrary this distribution of profit obtained through the increase in productivity plays a complete part in accumulation". It is clear, as the comrades themselves recognise, that the waste in question does not participate in the process of accumulation through the injection of capital into the process of production. Indeed it diverts capital which could have been accumulated away from the capitalist goal of accumulation. There is no doubt a momentary usefulness in this for the bourgeoisie, since it allows it to artificially maintain, or even increase, a certain level of economic activity. It thus postpones the problem of the lack of sufficient markets for capitalist production. This is the function of Keynesian measures; but, once again, this does not participate in the process of accumulation. Rather it participates in the process of production in the conditions of the decadence of capitalism, when this system, more and more unable to function "normally", has to multiply unproductive expenses in order to keep economic activity going. This waste is added on to the already enormous amount of waste made up of military spending or the cost of keeping society under control. Motivated by the necessity to create an artificial internal market, it is an expense equally as irrational and unproductive as the last two.

While Keynesian measures did allow for a very important growth in GNP in the main industrial countries during the 50s and 60s, thus giving the illusion of a lasting return to the prosperity of the ascendant phase of capitalism, the wealth really created during this period grew at a rhythm that was necessarily much more modest since a significant part of the growth of GNP was made up of unproductive expenses.[10]

To finish this part, we will examine another implication of the comrades' reasoning, which holds that "at this level there is no necessity for extra-capitalist markets". Contrary to what the comrades announce, we have not found here the least new argument putting into question the necessity for a buyer outside capitalist relations of production. The schema that they put forward of is that of a "government which controls the entire economy (and so) can theoretically organise it" in such a way as to allow the enlargement of production (through the increase in the means of production and of the means of consumption), without having recourse to an external buyer and by paying the workers more than is necessary for the social cost of reproducing their labour power. Very good, but this does not represent enlarged accumulation as capitalism practises it. More precisely, enlarged accumulation could not be practised in this way under capitalism whatever the level of state control over society, and this is true whether or not the workers receive extra wages.

The explanation given by Rosa Luxemburg for why this is impossible, in her description of the infinite merry-go-round implied in the enlarged reproduction schemas (elaborated by Marx in Volume Two of Capital), refers to the concrete conditions of capitalist production. "According to Mark's diagram, Department I has the initiative: the process starts with the production of producer goods. And who requires these additional means of production? The diagram answers that Department II needs them in order to produce means of consumption in increased quantities. Well then, who requires these additional consumer goods? Department I, of course - replies the diagram - because it now employs a greater number of workers. We are plainly running in circles. From the capitalist point of view it is absurd to produce more consumer goods merely in order to maintain more workers, and to, turn out more means of production merely to keep this surplus of workers occupied."[11]

At this stage in our reflection it would be opportune to examine a remark made by the comrades: "If there were no credit, and if it were necessary to realise the whole of each year's production in money form then yes, an outside purchaser would be necessary for capitalist production. But this is not the case".

We agree with the comrades that it is not necessary for an external buyer to intervene in each cycle of production, as long as credit exists. This said, it doesn't eliminate the problem but simply extends it in time, ensuring that it is posed less often but at each step in a more significant way.[12] Once an external buyer is present, for example after 10 cycles of accumulation involving the cooperation of sectors one and two, and he buys the means of production or consumption needed to reimburse the debts contracted during those ten cycle of accumulation, then all goes well for capitalism. But if in the final instance there is no external buyer, the debts accumulated can never be reimbursed, or only at the price of new loans. Debt then swells inevitably and immeasurably until the outbreak of a new crisis which merely has the effect of increasing the spiral of debt. It is exactly this process that we have been seeing with our own eyes, in an increasingly serious manner, since the end of the 1960s.

Redistributing part of the extracted surplus value in the form of wage increases only, in the end, increases the cost of labour power. But this in no way eliminates the problem of the endless merry-go-round pointed out by Rosa Luxemburg. In a world made up only of capitalists and workers, there is no answer to the question which Marx kept posing in Volume Two of Capital "but what is the source of the money needed to pay for the increase both in means of production and means of consumption?" In another passage in The Accumulation of Capital, Rosa Luxemburg takes up this problem and poses it in a very simple way: "Part of the surplus value is consumed by the capitalist class itself in form of consumer goods, the money exchanged for these being retained in the capitalists' pockets. But who can buy the products incorporating the other, the capitalised part of the surplus value? Partly the capitalists themselves - the diagram answers - who need new means of production for the purpose of expanding production, and partly the new workers who will be needed to work these new means of production. But that implies a previous capitalist incentive to enlarge production; if new workers are set to work with new means of production, there must have been a new demand for the products which are to be turned out... Where does the money for realising the surplus value come from if there is accumulation, i.e. not consumption but capitalisation of part of the surplus value?"[13] In fact, Marx himself provided a response to this question by pointing to "foreign markets".[14]

According to Luxemburg, bringing in a buyer who is outside capitalist relations of production resolves the problem of the possibility of accumulation. This also resolves the other contradiction in Marx's schemas that results from the difference in rhythm in the evolution of the organic composition of capital in the two sections (means of production and means of consumption).[15] In their text the two comrades come back to this contradiction noted by Rosa Luxemburg: "this distribution of profit obtained through the increase in productivity plays a complete part in accumulation. Not only that, it attenuates the problem identified by Luxemburg in Chapter 25 of The Accumulation of Capital, where she insists that with a tendency towards an ever-increasing organic composition of capital, the exchange between the two main sectors of capitalist production (production of the means of production on the one hand, and of the means of consumption on the other) becomes impossible in the long term". In this regard the comrades make the following comment: "Sternberg considers this point of made by Luxemburg is the most important ‘of all those that have been carefully avoided by those who criticise Luxemburg'. (Sternberg, El imperialismo)." Here again we don't share the position of the comrades, nor that of Sternberg, which doesn't really correspond to the way Rosa Luxemburg posed the problem.

For Luxemburg, this "contradiction" is resolved in society by placing "ever increasing portions of the surplus value earmarked for accumulation in Department I rather than in Department II. Both departments being only branches of the same social production - supplementary enterprises, if you like, of the "aggregate capitalist" - such a progressive transfer, for technical reasons, from one department to the other of a part of the accumulated surplus value would be wholly feasible, especially as it corresponds to the actual practice of capital. Yet this assumption is possible only so long as we envisage the surplus value earmarked for capitalisation purely in terms of value."[16] This presupposes the existence of "external buyers" regularly intervening in the successive cycles of accumulation.

In fact, while such a "contradiction" contains the risk of making exchange between the two sectors of production impossible, it is essentially in the abstract world of the schemas of enlarged reproduction, as soon as an "external buyer" is taken out of the equation:

"The adjustments we have tried out on Marx's diagram are merely meant to illustrate that technical progress, as he himself admits, must be accompanied by a relative growth of constant as against variable capital. Hence the necessity for a continuous revision of the ratio in which capitalised surplus value should be allotted to c and v respectively. In Marx's diagram, however, the capitalists are in no position to make these allocations at will, since the material form of their surplus value predetermines the forms of capitalisation. Since, according to Marx's assumption, all expansion of production proceeds exclusively by means of its own, capitalistically produced means of production."[17]

In fact we think that the comrades have never been convinced by Rosa Luxemburg's demonstration of the necessity of an outside buyer to permit capital to accumulate (or, if not, a resort to credit which is however non-reimbursable). On the other hand, we have not identified the way in which the objections they put forward, based on the arguments of Sternberg (who we also have good reasons to think did not really assimilate the essentials of Luxemburg's theory of accumulation[18]) actually put into the question the cardinal positions of this theory.

As we have already underlined in previous contributions, the fact that extra wages given to the workers do not serve to augment either constant capital or variable capital is already enough to conclude that, from the standpoint of capitalist rationality, these expenses are a total waste. From the strictly economic point of view, the same effects would be produced by increasing the personal expenditure of the capitalists. But to arrive at this conclusion it is not necessary to look to Rosa Luxemburg.[19] This said, if we have judged it necessary to reply to the comrades' objections to the theory of accumulation defended by Rosa Luxemburg, it is because we consider that the debate on this question helps to provide us with a more solid basis for understanding not only the phenomenon of the Thirty Glorious Years but also the problem of overproduction, which is hard to deny lies at the heart of the current difficulties of capitalism.

The part played by extra-capitalist markets and debt in accumulation during the 1950s and 60s

Two factors are at the origin of the increase in GNP during this period:

- an augmentation of society's real wealth through the process of capital accumulation;

- a whole series of unproductive expenditure, which grew as a consequence of the development of state capitalism and in particular the Keynesian measures that were put in place.

In this section we are interested in the way that accumulation took place. It was the opening of the accelerated exploitation of extra-capitalist markets which was at the origin of the phase of very powerful expansion of capitalism during the second half of the 19th century, a phase brought to a halt by the First World War. The period of capitalist decadence was globally characterised by the relative insufficiency of these markets in relation to the ever-growing need for outlets for commodities. But should we conclude from this that extra-capitalist markets no longer played anything but a marginal role in accumulation in the period of capitalism's life opened by the war of 1914? If that was the case, then these markets could not explain, even partially, the accumulation carried out in the 1950s and 60s. This is the reply given by the comrades in their contribution: "For us, the mystery of the Reconstruction boom cannot be explained by the remaining extra-capitalist markets, since these have been insufficient for the requirements of expanded capital accumulation ever since World War I". For our part, we think on the contrary that these extra-capitalist markets played an important role in accumulation, especially at the beginning of the 1950s, progressively decreasing until the end of the 1960s. The more insufficient they became, the more debt took over the role of external buyer for the capitalists; but obviously this was debt of a "new quality", having no prospect of being reduced. In fact, we have to look back to this period to find the origin of the phenomenon of the explosion of world debt that we are seeing today, even if the value contribution of debt in the 1950s and 1960s, compared to today's debts, is rather derisory.

Extra-capitalist markets

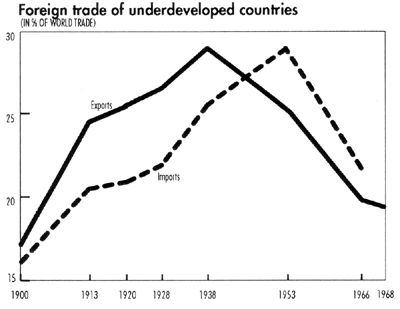

Statistically, it was in 1953 that we saw the high point in the portion of exports from the developed countries towards the colonial countries, evaluated as a percentage of world exports (see figure 1, where the curve of imports from colonial countries is supposed to be the same as those of exports from developed countries towards the colonial countries.). The rate of 29% attained at that point was thus an indication of the importance of exports towards the extra-capitalist markets in the colonial countries since, in this period, the colonial markets were still to a large extent extra-capitalist. After that, this percentage diminished to around 22% of exports in 1966. In reality, the shrinking of this percentage, relative to GNP and not exports, was much more rapid than this since during this period GNP grew more rapidly than exports.

Figure 1 Imports from colonial markets as a percentage of world imports (tables taken from the BNP Guide Statistique 1972. Source: P Bairoch, op cit, OECD Communiqué, November 1970)

To the exports in the direction of the extra-capitalist markets of the colonies, we should add the sales achieved in capitalist countries like France, Japan, Spain, etc to sectors like agriculture which were as yet only partly integrated into capitalist relations of production. Similarly, in Eastern Europe there was still an extra-capitalist market, since the outcome of the First World War had condemned capitalist expansion in these countries to stagnation.[20]

Thus if we take into account all the sales carried out by regions dominated by capitalist relations of production towards those still producing under pre-capitalist relations, whether these were external or internal markets, we can see that they were able to support an important part of the real growth that took place during the Thirty Glorious Years, at least at the beginning of that period. In the final part of this article we will come back to the appreciation of the level of saturation of markets at the time capitalism entered into its period of decadence, in order to characterise this more precisely.

Debt

Right at the beginning of our internal debate, those who put forward the Keynesian-Fordist thesis opposed our hypothesis that debt played a major role in supporting demand during the 1950s and 60s, arguing that "total debt practically did not increase during the period 1945-1980. It was only in response to the crisis that it exploded. Debt can therefore not explain the vigorous post-war growth" The whole question is to know what lies behind this "practically did not" and whether, despite everything, this was enough to complete the process of accumulation alongside the extra-capitalist markets.

It is quite difficult to find statistical data for the evolution of world debt during the 1950s and 60s for most countries, except for the US.

We do have figures for the evolution of the total debt and of the American GNP, year by year, between 1950 and 1969. Studying this data (figure 2) should enable us to reply to the following question: is it possible that, each year, the growth of debt was sufficient to cope with the part of the augmentation of GNP which did not correspond to sales directed towards extra-capitalist markets? As we have already said, as soon as these markets are no longer available, it's debt that plays the role of buyer outside the capitalist relations of production.[21]

|

Year |

49 |

50 |

51 |

52 |

53 |

54 |

55 |

56 |

57 |

58 |

59 |

60 |

61 |

62 |

63 |

64 |

65 |

66 |

67 |

68 |

69 |

||

|

GNP |

257 |

285 |

328 |

346 |

365 |

365 |

398 |

419 |

441 |

447 |

484 |

504 |

520 |

560 |

591 |

632 |

685 |

750 |

794 |

866 |

932 |

||

|

Debt |

446 |

486 |

519 |

550 |

582 |

606 |

666 |

698 |

728 |

770 |

833 |

874 |

930 |

996 |

1071 |

1152 |

1244 |

1341 |

1435 |

1567 |

1699 |

||

|

%annual Debt/GNP |

|

171 |

158 |

159 |

160 |

166 |

167 |

167 |

165 |

172 |

172 |

174 |

179 |

178 |

181 |

182 |

182 |

179 |

181 |

181 |

182 |

||

|

%over the period Δ Debt /ΔGNP |

185% |

||||||||||||||||||||||

|

Δ annual GNP |

|

28 |

44 |

17 |

19 |

0 |

33 |

21 |

22 |

6 |

36 |

20 |

16 |

40 |

30 |

42 |

53 |

65 |

44 |

72 |

67 |

||

|

Δ annual Debt |

|

40 |

33 |

31 |

31 |

24 |

60 |

33 |

30 |

41 |

63 |

41 |

56 |

66 |

75 |

81 |

93 |

97 |

94 |

132 |

132 |

||

|

(Δ annual Debt- Δ annual GNP) |

|

12 |

-11 |

14 |

12 |

24 |

27 |

11 |

8 |

35 |

27 |

21 |

40 |

26 |

45 |

39 |

40 |

32 |

50 |

60 |

65 |

||

Figure 2 Comparative evolution of US GNP and debt between 1950 and 1960[22] (Source (of GNP and debt): Federal Reserve Archival System for Economic Research, https://fraser.stlouisfed.org/publications/scb/page/6870 https://fraser.stlouisfed.org/publications/scb/page/6870/1615/download/6870.pdf

|

Year |

50 |

55 |

60 |

65 |

70 |

|

%annual Debt/GNP |

22 |

39 |

47 |

67 |

75 |

Figure 3 Evolution of debt in West Germany between 1950 and 1970. Source: Survey of Current Business (07/1975) - Monthly Review (vol 22, no.4, 09/190, p 6)

The increase in the value of debt as a percentage of the increase in the value of GNP is, for the period in question, 18%. In other words, the increase in the value of debt is almost double the increase in GNP over 20 years. In fact, this result shows that the evolution of debt in the USA was such that, overall during this period, it could on its own have ensured the growth in GNP in the US (and even play a part in the growth of other countries) without the need to have recourse to sales on extra-capitalist markets. Furthermore, we can see that each year, with the exception of 1951, the increase in debt is superior to that of GNP (it was only in 1951 that the difference between the increase in debt and the growth in GNP was negative). This means that, for all of these years except one, it is debt which took charge of the augmentation of GNP. This was more than was necessary given the contribution that extra-capitalist markets could still make at the time.

The conclusion from this regarding the US is the following: the theoretical analysis which holds that the resort to credit took over from sales to extra-capitalist markets in order to allow accumulation to take place is not refuted by the real evolution of debt in these countries. And while such a conclusion cannot be automatically generalised to all the industrial countries, the fact that it concerns the world's biggest economic power does confer a certain universality on it, and this is confirmed by the case of West Germany. With regard to the latter, we do dispose of statistics on the evolution of debt in relation to GNP (figure 3) which illustrate the same tendency.

What are the implications for our analysis of decadence?

What was the level of the saturation of markets in 1914?

The First World War broke out in the midst of a phase of prosperity for the world capitalist economy. It was not preceded by any open economic crisis; but still, it was the growing imbalance between the development of the productive forces and the relations of production which lay at the origin of the world conflict and, along with it, the entry of capitalism into its phase of decadence, The development of this system had been conditioned by the conquest of extra-capitalist markets, and the end of the colonial and economic conquest of the world by the great capitalist metropolises led the latter into a confrontation over their respective markets.

Contrary to the interpretation by comrades Salome and Ferdinand, such a situation does not imply that "the extra-capitalist markets ...have since the First World War been insufficient with regard to the necessities of enlarged accumulation reached by capitalism" If that had been the case, the crisis would have manifested itself at a purely economic level before 1914.

It was these characteristics of the period (imperialist rivalries around the remaining non-capitalist territories) which were expressed very precisely in the following passage from Luxemburg: "Imperialism is the political expression of the accumulation of capital in its competitive struggle for what remains still open of the non-capitalist environment. Still the largest part of the world in terms of geography...."[23] On several occasions Luxemburg came back to the state of the world during this period: "alongside the old capitalist countries there are still those even in Europe where peasant and artisan production is still strongly predominant, like Russia, the Balkans, Scandinavia and Spain. And finally, there are huge continents besides capitalist Europe and North America, where capitalist production has only scattered roots, and apart from that the people of these continents have all sorts of economic systems, from the primitive communist to the feudal, peasantry and artisan."[24]

In fact, "The world war, while ultimately a product of the system's economic contradictions, had broken out before these contradictions could reach their full import at a 'purely' economic level. The crisis of 1929 was thus the first global economic crisis of the decadent period."[25]

If 1929 was the first significant manifestation, during the period of decadence, of the insufficiency of extra-capitalist markets, does this mean that after that date it was no longer possible for them to play any significant role in capitalist prosperity?

In the ten years that preceded 1929, it had not been possible to "dry up" the vast pre-capitalist zones which existed around the world in 1914: this was a period which was not marked by intensive economic activity on a world scale. Similarly, during the 1930s and a good part of the 1940s, the economy had slowed down. This is why the crisis of 1929, while revealing the limits of the extra-capitalist markets which had been opened up at this point, did not mark the end of any possibility of them playing a role in the accumulation of capital.

The exploitation of a virgin extra-capitalist market, or the better exploitation of an old one, depends to a large extent on factors such as the productivity of labour in the capitalist heartlands, which determines the competitiveness of the commodities they produce, and the means of transport available to capital to ensure the circulation of commodities. These factors constitute the motor of the expansion of capitalism around the world, as was already pointed out in The Communist Manifesto.[26] Furthermore, the process of decolonisation, by relieving trade of the burden of maintaining an apparatus of colonial domination, made certain extra-capitalist markets much more profitable.

The cycle "crisis-war-reconstruction-new crisis" is put into question

Some time ago the ICC corrected the false interpretation that the First World War was the consequence of an open economic crisis. As we have seen, the cause and effect relationship between crisis and war has to be considered by seeing the term crisis in broad terms, as a crisis of the relations of production.

As for the sequence "war-reconstruction-new crisis", we have also seen that it was not able to take account of the prosperity of the 1950s and 60s, which cannot be attributed to the post Second World War reconstruction. It's the same regarding the revival that took place after the First World War, when capitalism re-connected with the pre-war dynamic based on the exploitation of extra-capitalist markets, but on a much smaller scale given the effects of the destruction brought about by the war. There is indeed a process of reconstruction after war, but far from facilitating accumulation, it is part of the faux frais needed to get the economy going again.

And since 1967, when capitalism once again entered into a period of economic turbulence, crises have come one after the other and capitalism has ravaged the planet by multiplying imperialist conflicts without at all creating the conditions for a reconstruction that is synonymous with a return to prosperity, even in a limited and momentary sense.

As the ICC has shown, the entry into decadence did not mean the end of accumulation as the continuation of growth between 1914 and today has shown, although overall it has taken place at a rhythm inferior to the most rapid phases of the ascendant period (most of the second half of the19th century until 1914). This continued accumulation was based on the exploitation of extra-capitalist markets until the point where they were exhausted. It was then non-reimbursable debt which took up the baton, while at the same time piling up increasingly insurmountable contradictions.

Thus, and contrary to what's implied by the formula "crisis-war-reconstruction-new crisis", the mechanism of destruction/reconstruction was not what enabled the bourgeoisie to prolong capitalism's life, neither after the First World War nor the Second. The main instruments of such an enterprise, Keynesianism and above all debt, while having an immediate effect by postponing the impact of overproduction, are by no means a miraculous answer. The most striking proof of this is the abandonment of Keynesian measures in the 1980s and the present impasse of generalised, bottomless debt.

Silvio, 1st Quarter, 2010.

[1]. Faced with the crisis, there is no lack of voices on the "left" (and even for a good part of the right these days) calling for a return to Keynesian measures, as can be seen from the following passage taken from a working document by Jacques Gouverneur, a teacher at the Catholic University of Louvin in Belgium. As the reader can see, the solution he puts forward involves making use of increases in productivity to install Keynesian measures and alternative policies...rather like the ones that were advocated by the left of capital in response to the aggravation of the economic situation at the end of the 1960s, with the aim of mystifying the working class about the possibility of reforming the system. "To get out of the crisis and solve the problem of unemployment, should we reduce - or, on the contrary should we increase - wages, social security benefits (unemployment pay, pensions, health benefits, family allowances) public spending (education, culture, public works...)? In other words: should we carry on with restrictive policies inspired by neo-liberalism (as we have done since the beginning of the 1980s) or should we on the contrary advocate a return to the expansive policies, inspired by Keynesianism, and applied during the period of growth between 1945 and 1975? In other words: can enterprises simultaneously increase their profits and their outlets? For this two conditions are necessary. The first resides in a general increase in productivity, in the sense that with the same number of workers (or inhabitants) the economy produces a greater volume of goods and services. To use an image, an increase in productivity over a given period...enlarges the size of the "cake" produced, increases the number of slices to be given out. In a period when productivity increases, the establishment of Keynesian measures is the second condition for enterprises to have at their disposal bigger profits and wider outlets...The perpetuation of neo-liberal policies will multiply social dramas and will lead into a major economic contradiction: it accentuates the divorce between the global growth of profits and the global growth of outlets. But it does favour enterprises and the dominant groups: the latter will continue to exert effective pressure on the public authorities (national or supranational) in order to prolong these pernicious policies. The return to Keynesian policies presupposes a change in the current balance of forces: it will not however be enough to resolve the economic and social problems highlighted by the structural crisis of the capitalist system. The solution to these problems demands alternative policies: an increase in public taxes (essentially on profits) in order to finance socially useful production, reduction of working time in order to develop levels of employment and free time, a sliding composition of wages in order to promote solidarity" https://www.capitalisme-et-crise.info/telechargements/pdf/FR_JG_Quelles_... (our emphasis).

[2]. The presentation of this debate and of the three main positions involved can be found in the article "ICC internal debate: The causes of the post-war economic boom" in IR n° 133; we then published the following articles: "The origins, dynamics, and limits of Keynesian-Fordist state capitalism" in IR n° 135; "The bases of capitalist accumulation" and "War economy and state capitalism" in IR n° 136; "In defence of the "Keynesian-Fordist state capitalism" thesis (reply to Silvio and Jens)" in IR n° 138.

[3]. "In defence of the "Keynesian-Fordist state capitalism" thesis (reply to Silvio and Jens)" in IR n° 138.

[4]. If the present contribution doesn't look into Salome and Ferdinand's response to the war economy and state capitalism thesis, this is because we see the discussion raised by the latter as being less of a priority, though still necessary to come back to. This is because this thesis is not first and foremost determined by a particular conception of the process of accumulation but more by the geopolitical conditions in which accumulation takes place.

[5]. "War, militarism and imperialist blocs in the decadence of capitalism", International Review n° 52, cited in the article which opened up this debate in IR n° 133. '

[6]. See "The decadence of capitalism: the mortal contradictions of bourgeois society" in IR n° 139

[7]. "Origins, dynamic and limits of Keynesian-Fordist state capitalism", IR n° 135

[8]. See "The bases of capitalist accumulation" in IR n° 136

[9]. See the section on the extra-capitalist markets and debt thesis in "The causes of the post-1945 economic boom" in IR n° 133. The references in Marx are from Capital Vol. 3, part III, "The law of the tendency of the rate of profit to fall", chapter XV, "Exposition of the internal contradictions of the law", 3, "Excess capital and excess population".

[10]. On this point see the section on extra-capitalist markets and debt in the article in IR n° 133.

[11]. The Accumulation of Capital, chapter 7, "Analysis of Marx's diagram of enlarged reproduction".

[12]. It is undeniable that credit plays a regulating role and makes it possible to attenuate the need for extra-capitalist markets during each cycle. But it does not at all do away with the basic problem, which can be looked at, as Rosa Luxemburg puts it, through the study of an abstract cycle resulting from the elementary cycles of various capitals: "The characteristic feature of enlarged reproduction of the aggregate social capital - just as in our previous assumption of simple reproduction - is the reproduction of individual capitals, since production as a whole, whether regarded as simple or as enlarged production, can in fact only occur in the form of innumerable independent movements of reproduction performed by private individual capitals" Accumulation of Capital, chapter 6. Similarly, it is obvious that only in certain of these cycles does an external buyer intervene

[13]. These two passages are from chapters 7 and 9.

[14]. This response can be found, among other places, in volume 3 of Capital: "How could there otherwise be a shortage of demand for the very commodities which the mass of the people lack, and how would it be possible for this demand to be sought abroad, in foreign markets, to pay the labourers at home the average amount of necessities of life? This is possible only because in this specific capitalist interrelation the surplus-product assumes a form in which its owner cannot offer it for consumption, unless it first reconverts itself into capital for him. If it is finally said that the capitalists have only to exchange and consume their commodities among themselves, then the entire nature of the capitalist mode of production is lost sight of; and also forgotten is the fact that it is a matter of expanding the value of the capital, not consuming it". (Part III, "The law of the tendency of the rate of profit to fall", chapter XV, "Exposition of the internal contradictions of the law", 3, "Excess capital and excess population").

[15]. The rising organic composition of capital (i.e. the greater growth of constant capital in relation to variable capital) in the means of production sector is on average faster than in the means of consumption sector, given the technological characteristics of these two sectors.

[16]. Accumulation of Capital, "Contradictions within the diagram of enlarged reproduction".

[17]. Ibid

[18]. Despite the excellent illustrations and interpretations of the development of world capitalism which he produced, drawing from the theory of Rosa Luxemburg, in particular in The Conflict of the Century, we can nevertheless ask whether he really assimilated this theory in depth. Thus, in this same book, Sternberg analyses the crisis of the 1930s as a result of capitalism's inability during this period to synchronise the increase in production with that of consumption: "the attempt to synchronise, on the basis of the capitalist profit economy and without any major external expansion, on the one hand the growth in production and productivity, and on the other hand the increase in consumption, ended in failure. The crisis was the result of this failure" (p 344). This leads us to understand that such synchronisation is possible under capitalism and this is the beginning of an abandonment of the rigour and coherence of Rosa Luxemburg's theory. This is confirmed in Sternberg's study of the post- Second World War period, where he develops the idea that it is possible to transform society through nationalisations and to improve workers' living conditions. The following passage gives us a glimpse of this: "...the integral realisation of the Labour programme of 1945 was a great step towards the complete socialisation of the British economy, making it possible for further steps in the same direction to be taken more easily...During the first years after the war, the Labour government sought to carry out the mandate conferred on it by the people. Keeping strictly to the methods and means of traditional democracy, it brought in radical changes to the capitalist state, society and economy" (chapter headed "The world today", p 629). The aim here is not to make a radical critique of Sternberg's reformism. It is simply a question of showing that his reformist approach necessarily involved a considerable underestimation of the economic contradictions that assail capitalist society, an under-estimation that is hardly compatible with Rosa Luxemburg's theory as developed in The Accumulation of Capital

[19]. As illustrated in our text "The bases of capitalist accumulation", which is based on the writings of Paul Mattick. For the latter, unlike Rosa Luxemburg, for accumulation to be possible, the intervention of buyers outside capitalist relations of production is not necessary.

[20]. The Conflict of the Century, III, "The stagnation of capitalism; the halt in capitalist expansion; the halt in the external expansion of capitalism".

[21]. We should not however forget that the function of debt is not only to create an artificial market.

[22]. % annual Debt/GNP = (Debt/GNP)*100; % over the period Δ Debt/ΔGNP = ((Debt in 1969 - Debt in 1949) / (GNP in 1969 - GNP in 1949))*100 ; Δ annual GNP = GNP in (n) - GNP in (n-1) ; Δ annual Debt for the year (n) = Debt for the year n - Debt for the year (n-1)

[23]. The Accumulation of Capital, "Protective tariffs and accumulation", our emphases.

[24]. The Accumulation of Capital, an Anticritique, our emphases.

[25]. "Resolution on the international situation" 16th ICC Congress, International Review n° 122.

[26]. "The bourgeoisie, by the rapid improvement of all instruments of production, by the immensely facilitated means of communication, draws all, even the most barbarian, nations into civilisation. The cheap prices of commodities are the heavy artillery with which it batters down all Chinese walls, with which it forces the barbarians' intensely obstinate hatred of foreigners to capitulate" (our emphasis).

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace