Submitted by ICConline on

Just over a year ago, the bourgeois class launched an ideological campaign around the Panama Papers. Loud publicity was given to a blacklist of fiscal havens. It was billed as the discovery of a series of murky networks and geographical areas, outside any legal controls, where enormous amounts of capital are being stashed. As it happens this is a song we have been hearing a lot since the phase of acute economic crisis opened up in 2008-9.

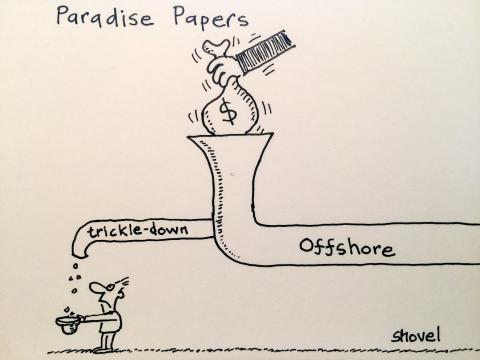

But now it’s all starting again! A new ideological campaign has been launched and all the bourgeois media are involved. This time they are talking about the Paradise Papers. All kinds of personalities are involved: politicians, businessmen, sports and entertainment stars. Queen Elizabeth the Second herself has not escaped the scandal. The bourgeois media and a good number of states are apparently being infected by a new virus which is obliging them to seek for truth, morality and fairness.

An ideological campaign against the proletariat

The state and the media cry about injustice: certain rich people don’t want to pay the taxes they owe to the national collective, to the state! Even some of the biggest global companies are evading their taxes! This is theft pure and simple! And in contrast to this, most of us, even when our wages hardly allow us to survive, are paying our taxes in full…

The left of capital has a particular role to play in all this. In France, it’s Mélenchon’s party, La France Insoumise, which shouts the loudest and proclaims that it is scandalised. Their slogan is simple: “make the rich pay, not the poor!”. All the leftist parties are on the same wavelength: The NPA (New Anti-Capitalist Party) and Lutte Ouvrière also join in the refrain. If the state was doing its job, none of this would be going on. There would be more money for hospitals, schools and all the other public services. In fact these arguments are not very different from what the government itself is saying. It’s the same story in all the developed countries.

A basic law we’ve learned from the history of capitalism is that you should never take the declarations of the ruling class and its media at face value. So what is being hidden behind this deafening chorus, this demand that the cheats and thieves be caught and punished? That the rich should pay what they owe and that that no one should escape from “equality before the Tax”? What’s the reality behind all this, and what do these fiscal “paradises”, these tax havens, really represent?

Tax havens: a world-wide reality linked to state capitalism

A tax haven is a country, a part of a country, or an organism where, usually quite legally, money can be stashed with impunity. Little or no tax is paid and no questions are asked about where the invested capital comes from. There are thousands of such tax havens around the world. And they are not only to be found in more or less exotic places like the Virgin Islands or Bermuda. Nor are they limited to the small states we hear about so much in the media, such as Luxemburg, Malta or Ireland. In fact the leading tax haven in the world is the City of London. London’s financial district is the centre of a spider’s web connected to any number of offshore tax havens. In other words, the capital amassing in the parallel circuits of the tax havens comes here to be invested. The biggest banks in the world, such as the HSBC and their shadowy agencies (the “back banks”), the most powerful investment funds and the world’s leading companies use these networks to circulate a large part of their capital. Money from drugs, prostitution, arms sales, floods all these networks. Reality is very far from the picture painted by the media, who focus on this or that celebrity hiding their dough in Swiss banks. This is a whole system, managed by the states themselves. One of the essential features of decadent capitalism is the concentration of capital in the hands of the nation state, which has become the entity around which the national capital organises its struggle, both against the proletariat and against other national capitals. States are not the dupes of multinational companies who escape the rules laid down for the operation of the world market. On the contrary, they are the main protagonists on these markets and in the final instance they are in control of the banks and the companies. Despite appearances, above even the most powerful banks and multinationals, the public authority of the state takes precedence. Multinational firms like Exxon, General Motors or Apple are always closely tied to the state, whether through public investments, the nomination of directors and so on. “Contrary to an opinion often expressed, by acting as the impetus for truly innovative projects, the public organisms (public investment banks and others) don’t push out the banks or private firms. They do what the latter don’t do or can’t do. Far from being victims of exclusion, the private enterprises could not develop if the state didn’t prepare the ground for them by making investments, notably in key research, which they could not do either financially or ‘strategically’”[1]. For a state, the big multinationals which are linked to it often represent a strategic sector of the national economy. This doesn’t mean that the private interests of these enterprises or banks always coincide exactly with those of the state. The quest for “tax optimisation” or the hunt for tax fraud are very current illustrations of this. But in the world’s financial markets and stock exchanges, the authority of the state remains a preponderant one. For example, the Euronext fusion of the stock exchanges of Paris, Bruxelles and Amsterdam openly depends on public financial authorities such as the Autorité des Marches Financiers in France or the Autorité Européene des Valeurs Mobilières. These state organs survey, control and can even sanction private enterprises. Here again, the interests of private operators can often come up against those of the state, but they can’t completely escape its control.

Despite the efforts at regulation, states have permitted an exponential development of what’s called the “little by little” market[2], which paradoxically makes activities and operators more opaque. This parallel market is mainly reserved for the very big investors (precisely the ones most closely linked to the state), those whose exchanges are measured in billions. More than 50% of these transactions, a good part of them highly dubious, take place at financial centres like the City or Wall Street. And the actors are not exactly unknowns: JP Morgan Chase, Goldman Sachs, Barclays Capital, etc. We should also add that central banks like the European Central Bank or the FED are key players as well.

While the finger is most often pointed at the more exotic tax havens, the World Bank stresses that “the financial systems of developing countries have less depth and a more limited access than those of the developed countries”. In short, the essential job of tax evasion or “optimisation” by the grand conglomerates, acting behind a myriad of screening companies, gets done in the “domicile”. All states encourage the formation of “offshore” resources under their aegis. The tax havens are largely dependent on the big countries, who use them to attract foreign investment as well as to avoid too great a flight towards tax havens controlled by other states, or which remain more or less out of their own control. Thus, France’s favoured tax haven is the Principality of Monaco. Britain has the Channel Islands, the USA has the Bahamas or the state of Delaware, Austria and Germany have Liechtenstein. The list goes on. But more than this, states have their own investment funds destined for these parallel circuits. On 11 November 2017, the Belgian Finances Minister Johan Owerdeveldt declared that he would endeavour to make sure in the future that the state would not support investments in tax havens via the Belgian investment society which is 64% owned by the state. All this is sheer hypocrisy, theatrical speeches that have been going on for years while nothing really changes. And for good reason. Since the 1980s, the proliferation of tax havens has become a very widespread phenomenon. They would not have been able to play such a key role in the world economy if, under the guidance of the major states, there had not been so much deregulation of finance. Since then finance capital has assumed gigantic proportions across the entire planet. It is this form of capital which has become so necessary for the state itself to maintain capitalist accumulation. The search for ever-growing investment and profit has brought about an evolution in state capitalist policy on a global scale. It is this process which lies at the roots of the possibility and necessity to develop this network of tax havens to drain off a large part of liquidity. Thus Business Bourse on 18 November 2017 wrote: “the evil given the name of tax havens function like the brothels of capitalism. You do dirty business which can’t be publicly recognised but is indispensable to the functioning of the system. Like houses of ill repute in traditional society”. The Paradise Papers, like the Panama Papers, were uncovered and made public by investigative journalists who belong to 96 of the most important newspapers in the world. The leading papers in the western world are all included. In Britain, it’s The Guardian. In France, it’s Le Monde. The bourgeois press seems to be on the trail of the tax evaders. But here again the orchestra is being conducted by the capitalist state. All this investigative journalism is tied to the interests of the national economy and the states which present themselves as the guarantors of social justice and as the victims of “financial gangsters” and “greedy bankers”.

Tax havens: cogs of the capitalist economy in crisis

Tax havens have taken on a powerful weight in the reality of world commerce. Two thirds of Hedge Funds, speculative investment funds, are domiciled in tax havens and play a key role in investments in production and the financial sector. More than 40% of profits from the big global companies and banks end up in tax havens. Already in 2008, just after the appearance of the open crisis, 35% of financial flows were passing through these offshore locations. But even more significant is the fact that 55% of international trade depended directly on these flows of capital. And this tendency has increased exponentially since then.

A better control over the tax havens: a necessity for all capitalist states

A question is posed: why are the capitalist states now orchestrating this huge media campaign? It is well known that capitalist nations and their states are weighed down by global debt. True, not all of them to the same degree. Germany, for example, is a relative exception. But the USA, Japan, the other countries of Europe, all are experiencing dizzying levels of debt. And China has become a leading model in this trend. The capitalist economy has an imperious need for tax havens today, but capitalist states are desperate for funds. The finances of the central banks are not sufficient to bear the weight of state debts, so that governments have a real need for tax revenue at a time when a large part of such revenue is escaping them thanks to the tax havens. In July 2012 the “independent” foundation Réseau pour la Justice Fiscal published a study on tax havens and estimated that tax evasion accounts for 25,500 billion euros, more than the combined GNP of the US and Japan. This comes at a time when every big state has to increase its military expenses to face up to the spread of imperialist war around the world, and to deal with an explosion of unemployment and poverty. While each state is trying by all possible means to reduce the benefits conceded to the sectors of the proletariat who have been ejected from work, this also involves maintaining an increasingly expensive police control over these sectors and the population as whole. So behind the international ideological campaign around the Paradise Papers we can find a ferocious fiscal competition. As much as possible, states must prevent their rivals from attracting capital to the tax havens within their sphere of influence and thus allowing companies to avoid paying taxes in the countries where their profits are being made. In other words, in every country state capitalism is stepping up the trade war. Behind these famous “discoveries” by the so-called “independent” inquiries by all the big newspapers we can discern the demands of capitalism in crisis. Along with the need to get their hands on liquidities and deal with tax fraud, the capitalist states are above all trying to get a better control over the companies acting in their sphere of influence, and this means regulating the obscure world of finances at some level. The big international organisms have been trying to do this for some time, especially in the mid-90s:

“Following the Group of Seven summit in Halifax in 1995, a series of initiatives aimed at a better functioning of financial markets was launched, to a large extent under the auspices of the International Monetary Fund and the Bank of International Settlements. These had the object of improving transparency and the way that financial and economic data is divulged, of strengthening surveillance of national and international financial systems and putting in place mechanisms of support for periods of crisis and providing training in the supervision of the finance sector”[3]

Despite the measures taken, the reality of the economic crisis, the short-term vision and irresponsible policies of certain private or even public operators, and the overall trend towards every man for himself - all this has increased the danger of a fragmentation of trade and of the world economy. The endless scandals like the Panama Papers and the Paradise Papers, blown up by the media, serve to underline the need for greater control by the state, the need to rein in those who flout discipline and work in the shadows to the detriment of the economic needs of the major states. As we can see from the whole history of the complex and fragile efforts to keep finance under control, tax havens will still be useful and are not going to disappear. But the state has to remain the chief gangster, retain the monopoly of a whole mass of capital which could escape its control if it doesn’t act firmly. This is all the more true at a time when corruption, “affairs” and what the bourgeoisie prudishly calls “conflicts of interests” are becoming more and more commonplace, undermining the higher interests of the state. The height of hypocrisy is that it is the heads of government themselves who are often the leading tax cheats and specialists in “tax optimisation”. Among the revelations in the Paradise Papers, let’s not forget all the politicians who are often the most zealous defenders of austerity and of anti-working class measures[4].

The working class has nothing to gain from increasing regulations on tax havens

Capitalism in crisis breeds both tax havens and attempts to regulate them. Just as it breeds more and more unemployment, insecure jobs, and poverty. This degradation of working class living standards has nothing to do with whether tax havens are regulated or not. It’s in capitalism’s interest to make a profit from the exploitation of the working class. A worker who doesn’t add to the growth of capital is a useless commodity that is maintained at the lowest price in order to preserve social peace. It’s an unprofitable mouth to feed and the mass of workers without work is rising inexorably. Given the level of state debt today, a bit of extra tax revenue isn’t going to solve the growing budgetary difficulties. Only a reduction in what the bourgeoisie calls “social spending” is on the agenda. Behind a supposed moralisation of capitalism, the so-called struggle against tax paradises and fraud, the real future of this system is the accelerating decline of every aspect of proletarian living conditions.

Stephen, 28.12.17

[1] L’État conserve un role majeur dans l’innovation’, Le Monde, 27.1.14

[2] On a “little by little” market, transactions are concluded directly between buyer and seller, without any commission to the stock exchange through which the transaction takes place

[3] ‘The globalisation of financial markets and monetary policy’, a speech by Gordon Thiessen, a former governor of the Bank of Canada

[4] A few names revealed in the Panama and Paradise papers:

- The American Secretary of Trade, close to Donald Trump

- The former Tory treasurer Michael Ashcroft

- The Icelandic Prime Minister Gunlausson

- In Brazil, the ministers of the Economy and Agrculture, Henrique Meirelles and Blairo Maggi

- The Argentine president Mauricio Macri

- A close associate of Canadian Prime Minister Justin Trudeau

- Ian Cameron, the father of David Cameron

- A number of Russian oligarchs close to the Kremlin

- The business lawyer Arnaud Claude, associated with the former president of the Republic in the Sarkozy cabinet

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace