Submitted by ICConline on

For several weeks there has been such a torrent of unexpected good news about the British economy that our rulers have become quite excited. It has given a shot in the arm to the markets, because of an expectation of an earlier than predicted rise in interest rates. And it has helped push the IMF to a humbling re-appraisal of the criticisms it has previously made of the British government’s economic policy. In fact the IMF is now praising the British government’s approach to economic management as the light of the world, replacing the old fashioned idea that China and the other emerging countries offered hope to us all.

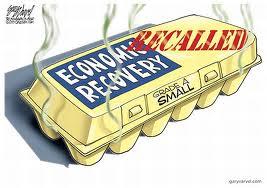

The bourgeois media’s commentary on this alleged recovery has been quite informative, and we can largely let them tell the story in their own words. Unfortunately for the bourgeoisie, it’s a recovery that turns out not to have lasted very long.

When Cameron and Osborne came to power, they gave the impression that a short but severe bout of austerity measures would be sufficient to rein in the deficit and pave the way to recovery in fairly short order. Therefore, although austerity is not enjoyable in itself, the rewards would soon be available and effectively cancel out the necessary reductions in living standards. As the bourgeoisie themselves admit, the reality has been that they have not managed to steer the economy even back to the level of economic output that prevailed prior to the financial crisis of 2007. An important consideration that partially accounts for the governing team in particular now talking confidently about ‘recovery’ is that they could foresee getting back to that level of output prior to the next election. That would have given them enough to suggest that the original promises of the government were not completely hollow.

Except during the admittedly extended periods when it was actually in recession, there has not been an absolute lack of good news about the British economy since the outbreak of the financial crisis. The difficulty for the bourgeoisie in creating a convincing story of good news about the economy is that each piece of good news has been followed almost straight away by bad news. If industrial output was up, services were down, and vice versa. If exports were up, consumer demand was down. If employment was up, unemployment (surprisingly) was not down. And so on, along those lines, the evidence has gone for years.

The difference over recent weeks was a series of reports on different aspects of the economic situation that all tended to exceed the rather cautious expectations of forecasters who were used to getting their fingers burnt by over-optimistic predictions. As the Financial Times said on September 5th:

“Expert economic opinion regularly bends with the wind. Rarely has it been blown so far so quickly. Talk of a ‘flatlining’ economy was universal until the spring, when fears of a ‘triple-dip’ (recession) disappeared. But after a string of good economic figures and the release of an extraordinarily strong services sector business survey yesterday, economists rushed to judge that growth was running at boom-time rates. …

If the economy is growing at 1 per cent this quarter ... that rate of growth is roughly the pace of former rapid recoveries from recession. If sustained, output would finally climb back above the level of its previous peak (before the financial crash) in spring 2014, a year before the general election.…

Civil servants and central bankers know that the speed of recovery says little about its breadth or durability and are still struggling to explain the turnaround. Before they swap caution for confidence, they will want to take stock of the wider picture which remains mixed.”

Without going through the FT’s retailing of the mixed evidence, we can skip to the following day, September 6th when the run of good headline news fell apart:

“A damper was put on rapid recovery hopes today with disappointing industrial production figures and a widening of Britain’s stubbornly high trade deficit in July.

Industrial output was flat over the month after a healthy 1.1% expansion in June. Economists had expected production to edge up slightly. The trade in goods deficit rose to £9.8 billion, considerably larger than City traders’ forecasts of 8.15 billion.

The monthly gap was higher than the £7.3 billion deficit recorded in July 2012. There were also signs of problems in emerging markets beginning to affect British firms, with export to non-European countries plunging by almost 16%.” (from The Evening Standard)

The fact that “problems in emerging markets” are affecting the hopes of the bourgeoisie for a broadly based recovery in the British economy should give the International Monetary Fund pause for thought. Again we can refer to an article in the FT of September 5th:

“Turmoil in emerging markets this summer has forced the IMF into a humbling series of U-turns over its global assessments.

In a confidential note seen by The Financial Times, the IMF has dropped its view of emerging economies as the dynamic engine of the world economy, instead noting that ‘momentum is projected to come mainly from advanced economies where output is expected to accelerate’.”

This is very sound, except for the last point. Presumably we are due to hear much less, at least from the IMF, about China, the Brics and ‘globalisation’ being the light of the world in economic terms. That’s a relief! As the ICC has always pointed out, the basic foundations of globalisation, of a world economy, had already been achieved by the end of the ascendant period of capitalism, i.e. by the beginning of the twentieth century, and it was precisely at this point that the system entered into its historic crisis.

The bourgeoisie have essentially come to use the term globalisation to express their (ill-founded) hope that huge dynamic growth in emerging economies and China in particular will somehow succour the stagnating economies of the west. But since the rise of China, in particular, underlines precisely how uncompetitive the western economies are, it is difficult to follow this line of reasoning. Of course, the west has sold huge volumes of raw materials to China and also sophisticated engineering (even Britain sells in the latter category to China). But the overall trade deficit of the west with China shows the real balance of economic power and the decline of the older industrial economies.

At the same time, countries like China are highly dependent on the western countries as markets for the mass of commodities that they have been churning out at a frenetic rate thanks to the brutal exploitation of their workforce. With the recession in the west, China and the other Brics are now beginning to falter in their turn.

Faced with this rather worrying scenario, the IMF is proposing now to institute British economic management as the new beacon of the world to replace China! This is quite a turnaround:

“In April, Olivier Blanchard, IMF chief economist, singled out the UK as a country that should lighten up on austerity, but the fund now recommends that countries follow the British policy of ‘achieving structural fiscal targets and allowing automatic stabilisers to play freely’.” (FT)

But, as The Evening Standard commentators note, discussing the retardation in Britain’s export performance, the “problems in emerging markets” are very likely to undermine the objective of the British bourgeoisie to achieve a balanced and durable recovery. The fact that the world economy is indeed interconnected is not some kind of automatic solution to the crisis as so many bourgeois commentators placidly assume. On the contrary, it is the guarantee that all the components of the capitalist system are doomed to sink together.

Hardin, 6.9.13

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace