Submitted by International Review on

The so-called ‘economic explanations’ that the ruling class soaks into the public mind through the press, radio and TV, almost always have one clear and avowed purpose: to justify in the name of ‘economic science’ the sacrifices which capital demands from those it exploits.

The ‘experts’ take the floor and quote their statistics only to ‘explain’ why we have to accept the growth of unemployment, resign ourselves to a decline in real wages, pay more taxes but still work harder; why immigrant workers have to be thrown out of the country -- in short, why we have to remain forever under the domination of the laws of capitalism even though these laws are leading humanity to ruin and despair.

To refuse these laws and to fight against them means rejecting the ‘economic’ justifications governments use to impose their system of exploitation. It is not enough to say: “It doesn’t matter what they say because it is all lies anyway”. The how and the why has to be understood if we want to be able to build something really different tomorrow.

The proletarian revolution is and must be a conscious revolution. The proletariat cannot rid humanity of the paralyzing obstacles of capitalism without knowing what they are. Understanding the economic situation of capitalism is essential to any conscious action in society because up to now humanity has been dominated by economic needs.

Under capitalism, as in all social systems in history, understanding the world is first of all understanding economic life. Understanding how to destroy capitalism is understanding how it is weakening, understanding its crises.

The aim of this article is to elucidate recent developments in the crisis and to clarify the perspectives. Its intention is to show that today’s aggravation of the crisis is the harbinger of a recession in the 1980s of unprecedented proportions since the end of World War II.

The article contains a considerable amount of statistics but these dry figures are necessary to an analysis of the crisis, to seeing where it is heading. The article uses ‘official’ statistics despite an awareness of their limitations. Economic statistics suffer from ideological as well as technical distortions. Because the so-called ‘economic science’ is part and parcel of the ideology and propaganda of the ruling class, statistics can always be manipulated to justify the defense and survival of the system. The ‘experts’ of the bourgeoisie do not necessarily do this with Machiavellian forethought: they themselves are the victims of the ideological poison they secrete. But it is not only a question of ideological distortions. The statistics also suffer from technical errors due to the decomposition of the economic system itself. In fact, the measurement used in most economic statistics is money, the dollar or another currency. But inflation and the increasingly violent convulsions of international exchange rates make monetary values less and less valid as measurements of real economic activity. This is particularly true for the measurement of economic aggregates in terms of volume (the volume of the gross national product, for example), that is, in terms of ‘constant money’, a theoretical abstraction of money which is not devalued by inflation.

But whatever the known faults of existing economic statistics, they are the only ones available. If they lack precision, they do, however, in one way or another, reflect the direction of major economic trends. In any case, using capitalism’s own statistics to demonstrate the bankruptcy of the system and the possibility of destroying it does not weaken the force of the arguments; on the contrary, it tends to strengthen it.

***********************

The world economy enters the 1980s sliding into a new recession, the fourth since 1967.

In the eastern bloc countries, growth rates have fallen to the lowest level since World War II (4 per cent growth in 1978).

The Secretariat of the OECD, an organization which groups the twenty-four most industrialized countries of the western bloc, announced a growth rate of 3% in 1979 for the whole of its zone and predicted a decline to 1.5% in 1980. This means a quasi-stagnation of economic activity.

The US and Great Britain are the first to slide into this new recession. The first and fifth greatest powers in the bloc -- which together account for 40% of the production of the OECD countries -- will have a negative growth in 1980. This means that the mass of production realized everyday will not only cease to grow but will actually diminish in absolute terms.

What will be the extent of this recession? How many countries will it affect? How long will it last? How deep will it be?

The recession gives indications of being the most geographically widespread since World War II: for the first time all regions of the planet will be simultaneously affected.

It risks being the longest lasting.

It will probably be the most profound in terms of the decline in growth and thus in terms of unemployment.

In other words, the workers of the entire world will experience the most brutal degradation of their living conditions since World War II. Millions more workers will be laid off in all countries, even those who seemed to be able to keep their head above water. Wages will be drastically cut by the combined effects of wage-freeze policies and inflation.

The last crumbs given by capitalism in the years of the relative prosperity of reconstruction are being taken back by capitalism ... and they will not think of offering them again. The various nations of this world are preparing to undergo another round of economic and social convulsions.

But what allow us to assert that the recession capitalism is sliding into will be the longest and the deepest since the war?

Three types of factors:

-- first of all, the broad scope of the present decline in the world economy;

-- secondly, the increasing inadequacy of the means at capitalism’s disposal to re-launch the economy;

-- thirdly, the growing impossibility for the different national governments to continue to use reflation policies.

In other words, the fatal disease of capitalism is passing through a phase of major decline; not only are the usual drugs administered by the different governments having less and less of an effect but the abusive use of these remedies have poisoned the patient. Like the doctors who frantically tried to keep the dying Franco ‘alive’, the bourgeoisie today is using desperate therapies even though they serve no scientific purpose!

Each of the three aspects mentioned will be further expanded in the article: the intensification of the present crisis on the one hand, and on the other the inadequacy of present methods available to induce recovery and the impossibility of increasing their scope without further accelerating the crisis.

The present deepening of the crisis

For the moment, among the major industrial countries of the western bloc the US and Great Britain are the hardest hits. Growth rates have declined most sharply in these countries in the course of 1979 as the following table shows:

|

Table I Rate of Growth Of the Gross National Product (Percentage of Variation) |

||

|

|

1978 |

1979 |

|

United States |

4.0 |

2.8 |

|

Great Britain |

3.2 |

1.3 |

|

Japan |

5.6 |

5.5 |

|

France |

3.3 |

3.0 |

|

Canada |

3.4 |

3.5 |

|

Italy |

2.6 |

4.3 |

|

Source: Economic Perspectives of the OECD, July 1979 |

But no-one has any illusions about the possibility of other countries of the bloc keeping up their growth rates for very long if the US goes into a recession because the economies of Japan and Europe are totally tied to their economic and military leader.

This dependency, which rests primarily on the absolute supremacy of the leader of the bloc within its sphere (and the same is true in the Russian bloc), has in fact increased since the beginning of the 1970s. By reducing the growth of their production, the US hopes to reduce their imports. But by reducing their buying power on the world market, they directly or indirectly limit outlets for European and Japanese production.

Contrary to the assertions of certain economists, present growth rates in Europe and Japan cannot be maintained to compensate for a collapse in the US. On the contrary, like in 1969, the fall in growth in the US is simply an immediate precursor of the fall in all other industrial countries.

The annual report of the Common Market Commission, which published its forecasts for the 1980s in October, has already announced a slowdown of 3.1% in growth for EEC countries in 1979 and 2% in 1980; an acceleration of inflation and an increase in unemployment from 5.6% to 6.2%, “the highest increase foreseen since the Commission began to establish its statistics in 1973” (Le Soir, Bruxelles).

At the end of 1979 lay-off announcements proliferated in all western countries. But the specificity of these announcements was that they concerned not only sectors already in difficulty, but also sectors which had been considered relatively safe from the effects of the crisis up to now. The lay-offs continue to grow in hard-hit sectors: the largest steel producer in the US, US Steel, has announced the closing of ten factories and lay-offs affecting 13,000 workers in Great Britain the British Steel Corporation intends to reduce its workforce by 50,000 workers.

But now it is also the motor industry and electronics, the sectors considered to be the ‘locomotives of the economy’ which are being hit. In the US, motor car production fell by 25% between December 1978 and December 1979. “One hundred thousand car workers (one out of every seven) are from now on indefinitely unemployed and forty thousand others are temporarily unemployed following one--or-two-week shutdowns in several states” (Le Monde, France). In Germany, whose economy is the envy of governments all over the world, car production fell 4% in a year. Opel had to put 16,000 on partial unemployment for two weeks and Ford-Germany 12,000 for twenty-five days. The vanguard sector, electronics, has just been hit by the collapse of the German company, AFG-Telefunken, which predicts 13,000 lay-offs.

In the underdeveloped countries, the economic crisis, which has long since plunged most of them into total economic atrophy, has now hit certain countries which used to be considered economic ‘miracles’. Whether we look at countries which experienced a relative industrial development in recent years like South Korea or Brazil, or oil-producing countries like Venezuela or Iran, these countries are now experiencing a violent degradation of their economic situation ... and along with this, the collapse of all the myths about their eventual ‘economic take-off’.

The eastern bloc countries too are experiencing a powerful exacerbation of their economic difficulties. Despite policies designed to reduce their debt to the west, these debts have only increased.

According to the UN Economic Commission for Europe, these debts have increased more than 17% in 1978 in relation to the previous year. If we turn to the internal situation, the investigation of the economic situation undertaken by Russian leaders for the Autumn 1979 Session of the Supreme Soviet drew a particularly somber balance sheet in such important areas as transportation, agricultural production and oil production. In the satellite countries, such as Poland, governments are beginning to speak officially of unemployment and especially inflation. Inflation, that disease which Stalinist dogma pretends to reserve only for western countries, is increasing on an unprecedented scale.

So much for the immediate situation. In itself, by the scope and rapidity of the economic decline, the situation can be seen as but the beginning of a new recession of which the worst is yet to come.

The techniques of ‘recovery’

I. The Growing Inadequacy of Reflation Techniques

One of the major characteristics of the economic evolution of the world, particularly in the west since the 1974-75 recession, is that contrary to what happened after the recessions of 1967 or 1970, reflation policies have brought more and more mediocre results, if any at all, despite all the considerable governmental efforts.

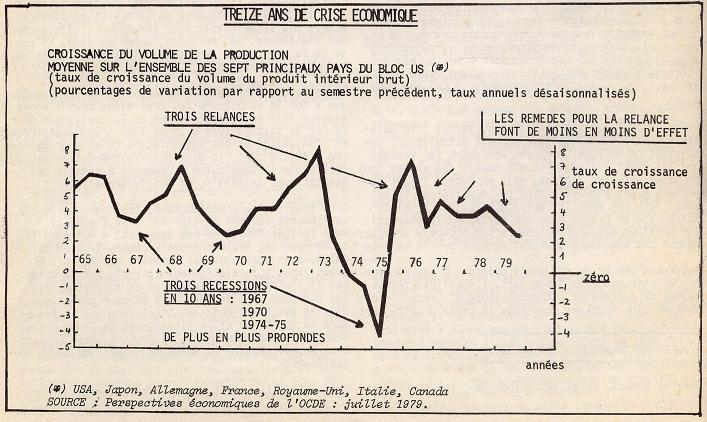

With the definitive end of the mechanisms of reconstruction in the mid-sixties, western capitalism has had to adapt itself to a life of perpetual downward swings whose scope is increasingly large and violent. Like an enraged animal striking its head against the bars of its cage, western capitalism has more and more violently come up against two dangers: on the one hand deeper and deeper recessions and on the other hand more and more difficult and inflationary recoveries. The graph below, which traces the evolution of the growth in production for the seven major powers of the western bloc (the US, Japan, West Germany, France, Great Britain, Italy and Canada) shows how these swings have been more and more drastic, ending in the striking failure of reflation policies from 1976 to 1979.

graph 1

The major stages of the crisis in the western economy since 1967 can be summarized as follows:

-- in 1967 slowdown in growth;

-- in 1968 recovery;

-- from 1969 to 1971 a new recession, deeper than 1967;

-- from 1972 to the middle of 1973 a second recovery breaking up the international monetary system with the devaluation of the dollar in 1971 and the floating of the major monetary parities; governments financed the general recovery with tons of new paper money;

-- at the beginning of 1973 the seven major powers had the highest growth rate in eighteen years (8 and a third as an annual base in the first half of 1973);

-- the end of 1973 to the end of 1975 a new recession, the third, the longest and deepest; in the second half of 1973 production increased at a rate of only 2% a year; more than a year later in early 1975 it regressed at more than a rate of 4.3% per year;

-- 1976-1979, third recovery; but this time despite recourse to the Keynesian policy of reflation through the creation of state budgetary deficits, despite the new market created by the OPEC countries which due to the rise in oil prices represented a strong demand for manufactured goods from the industrialized world1, despite the enormous deficit in the trade balance of the US which due to the international role of the dollar, created and maintained an artificial market by importing much more than it exported, despite all these methods put into place by governments, economic growth after the brief recovery in 1976 kept losing ground, slowly but surely.

Yet the doses of the remedies applied by the governments were particularly strong:

|

Table 2 Growth in the Volume of GNP (Percentage of annual variation) |

||||

|

|

1976 |

1977 |

1978 |

1979 |

|

The 7 great powers |

5.4 |

4.1 |

4.0 |

3.5 |

|

All 24 of the OECD countries |

5.1 |

4.1 |

4.0 |

3.5 |

|

Source: Economic Perspectives of the OECD, July 1979 |

Budget deficits: since 1975 the major industrial countries have had recourse to uninterrupted increases in state expenditures over and above that of revenues in order to create a demand capable of re-launching growth. This led to permanent budget deficits which reached levels equivalent to more than 5% of national production in some cases (5.8% for Germany in 1975; 5.4% for Japan in 1979) and went above 10% for weaker countries like Italy (11.7% in 1975; 11.5% in 1979). The average of these budget deficits for the five year period between 1975 and 1979 is in itself eloquent enough.

|

Table 3 Public Administration Deficits (As a percentage of GNP) Average 1975-1979 |

|

|

United States |

1.9 (a) |

|

Japan |

4.1 |

|

Germany |

4.7 |

|

France |

1.7 |

|

Great Britain |

4.3 |

|

Canada |

2.7 |

|

Italy |

10.2 |

|

Source: Idem (a) 1975-1978 |

The financing of growth in the bloc through the trade deficit of the US: by buying much more than they managed to sell, the US was an important factor in the growth of the economy of their bloc from 1976-79. In fact, since the conclusion of the reconstruction of Europe and Japan at the end of the sixties and with the war in Vietnam, the growth of the western bloc has, in part, been artificially financed by the trade deficit of the US. Because the US dollar serves as the medium of exchange and reserve on the world market, other countries are obliged to accept the artificial money of the US as payment.

Thus the recovery after the 1970 recession was ‘stimulated’ by two years of a particularly large US deficit. And after the 1974-75 recession, the US again had recourse to this policy to an unprecedented extent. In the last three years the US has increased its imports more rapidly than the other powers in its bloc as the following figures show:

|

Table 4 Increase in the Volume of Imports (Percentages of annual variation) Average 1977-1979 |

|

|

Unites States |

8.1 |

|

Japan |

6.6 |

|

Germany |

6.6 |

|

France |

5.3 |

|

Great Britain |

4.8 |

|

Italy |

5.5 |

|

Canada |

4.2 |

|

Source: Idem |

This policy led to a dizzying growth of the trade deficit of the US. This deficit momentarily allowed the other countries of its bloc to have positive trade balances.

|

Table 5 Current Trade Balance of the Major Countries of Western Bloc (in Billions of dollars, averages 1977-1979) |

|

|

United States |

-14.3 |

|

Japan |

+9.3 |

|

Germany |

+6.1 |

|

France |

+1.4 |

|

Great Britain |

+0.5 |

|

Italy |

+4.4 |

It is clear that both the ‘budget deficit’ remedy and the ‘US trade deficit’ remedy (“injecting dollars into the economy”) have been administered in massive doses over the past few years. The mediocrity of the results obtained proves only one thing: their effectiveness is steadily decreasing. And that is the second reason why we foresee an exceptionally deep recession for the beginning of the 1980s.

But there are even more serious reasons. Because governments have had such extensive recourse to these artificial stimulants in increasing doses, they have ended up by completely poisoning the body of their economies.

II. The Impossibility of Continuing to Use the Same Remedies

Among other economic shocks, the year 1979 was marked by the most spectacular monetary alert that the system has experienced since the war. While capitalism celebrated the fiftieth anniversary of the 1929 crash, the price of gold shot up to incredible heights. In several weeks the price of gold went over $400 an ounce. The alert was not simply an accident due to speculation. At the beginning of the seventies the official price of gold was S38 an ounce (after the first devaluation of the dollar in 1971). Nine years later ten times more greenbacks were needed for an ounce. But the price of gold has not just increased in dollar terms. It has shot up in terms of all currencies. This really means that the buying power of all currencies has drastically fallen.

The recent gold crisis represented nothing less than the real threat of a definitive collapse of the international monetary system, the threat of the disappearance of the tool which conditions all the economic transactions of capitalism from the buying of soap powder to the joint financing of a dam in a third world country.

The monetary crisis sanctions the impossibility not only of continuing to run capitalism through national and international monetary manipulations but in fact, the impossibility of even surviving in the endless spiral of inflation and monetary credits. The debt of the entire world economy has reached critical proportions in all spheres: the debts of third world countries which for years bought factories on credit without being able to find any markets for their products; the debts of eastern bloc countries which are continually growing without any hope of repayment. The debts of the US have flooded the world market with dollars (Eurodollars or petro-dollars); in recent years the US has experienced a wild acceleration of its domestic debts.

According to Business Week one of the most coherent spokesmen of big business in the US: “Since the end of 1975 the US has stimulated the economy through indebtedness and has provoked such a wild explosion of credit that it has left far behind even the fever which marked the beginning of the 1970s” (16 October, 1978). According to the same article from 1975-78 the debts of the state (government loans) have increased 47% reaching $825 billion in 1978, more than a third of the GNP of the country. This year’s debts of all economic agents (that is, companies, individuals, the government etc) has reached 3900 billion dollars, almost double the GNP! Faced with the growing impossibility of selling what it is able to produce, capitalism is increasingly living on indebtedness towards the future. Credit in all its forms has allowed it to put off facing the real, fundamental problems for a while. But this has not solved the problem, on the contrary, it has only aggravated it. By continuing to push payment deadlines forward, world capitalism has become highly fragile and unstable as the ‘gold crisis’ of Autumn 1979 proves.

Capitalism, at the beginning of the 80s, faces two alternatives: either to continue reflation policies in which case the monetary system will completely collapse, or to stop the artificial remedies and face recession.

The US government has already been forced to choose the latter ‘solution’ ... and so has made the choice for the entire world.

A false alternative for the workers

In this context all the governments in the world try to convince the workers that they must accept wage cuts and lay-offs so that ‘things can get better tomorrow’. 'Restructure our national economy and we'll make it’ is supposed to be the precondition for recovery.

Certainly market difficulties oblige national capitals to become as competitive as they can (and this implies lay-offs and wage-cuts). The few existing markets will go to those capitalists who manage to sell at the best price. But dying last is not escaping from death. All countries are facing the scarcity of markets; the world market is shrinking. And whatever the order in which countries fall, they will all fall.

The restructuration of the productive apparatus today is not a preparation for a new take-off, it is a preparation for death. Capitalism is not experiencing growing pains but the death rattle. For the workers, accepting sacrifices today will not solve the problems of tomorrow. The only thing they will gain is getting an even more brutal attack from capitalism later. Submitting to capitalism in its death throes is simply preparing the way for the only solution to its crises that capitalism has been able to find in sixty years: war. But resisting the attack now is in fact forging the will and the strength to destroy the old world and build a new one.

RV

1 According to the GATT’s 1978-79 annual report on international trade in 1978, underdeveloped countries absorbed 20% of the manufactured products exported by Western Europe and 46% of these products exported by Japan, largely on the basis of the revenues of the OPEC countries.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace