Submitted by International Review on

The weakest of the super-indebted national economies must be rescued before they go bankrupt and ruin their creditors; austerity plans designed to contain the debt only aggravate the risk of recession and a cascade of bankruptcies; attempts at recovery by printing money merely re-launch inflation. There is an impasse at the economic level and the bourgeoisie is incapable of proposing policies with the slightest coherence.

The “rescue” of European economies

At the very moment that Ireland negotiated its rescue plan, the International Monetary Fund admitted that Greece would not be able to fulfill the plan that they and the European Union devised in April 2010. Greece’s debt would have to be restructured, even if they didn’t use this word. According to D. Strauss Khan, the boss of the IMF, Greece must be allowed to repay its debt not in 2015 but in 2024. That is, on the 12th of Never, given the course of the present crisis in Europe. Here is a perfect symbol of the fragility of some if not most European countries undermined by debt.

Of course this concession to Greece must be accompanied by supplementary measures of austerity. After the austerity plan of April 2010 - which was financed by the non-payment of pensions for two months, the lowering of indemnities in the public sector, and price rises resulting from an increase in taxes on electricity, petrol, alcohol, tobacco, etc - there are also plans to cut public employment.

A comparable scenario unfolded in Ireland where the workers were presented with a fourth austerity plan. In 2009 public sector wages were lowered between 5 and 15%, welfare payments were suppressed and retired workers were not replaced. The new austerity plan negotiated with the rescue plan included the lowering of the minimum wage by 11.5%, the lowering of welfare payments, the loss of 24,750 state jobs and the increase in sales tax from 21 to 23%. And, as in Greece, it is clear that a country of 4.5million people, whose GNP in 2009 was 164 billion euros, will not be able to pay back a loan of 85 billion euros. For these two countries, these violent austerity plans presage future measures that will force the working class and the major part of the population into unbearable poverty.

The incapacity of new countries (Portugal, Spain, etc) to pay their debts is shown in their attempt to avoid the consequences by adopting draconian austerity measures and preparing for worse, as in Greece and Ireland.

What are the austerity plans trying to save?

A reasonable question since the answer is not obvious. One thing is certain: their aim is not to alleviate the poverty of the millions who are the first to suffer the consequences. A clue lies in the anxiety of the political and financial authorities about the risk that more countries would in turn default on their public debt. More than a risk since nobody can see how this scenario will not come to pass.

At the origin of the bankruptcy of the Greek state is a considerable budget deficit due to an exorbitant mass of public spending (armaments in particular) that the fiscal resources of the country, weakened by the aggravation of the crisis in 2008, cannot finance. As for the Irish state, its banking system had accumulated a debt of 1,432 billion euros (on a GDP of 164 billion euros) which the worsening of the crisis had made impossible to reimburse. As a consequence, the banking system had to be largely nationalised and the debt was transferred to the state. Having paid a relatively small amount of these debts of the banking system the Irish state found itself in 2010 with a public deficit corresponding to 32% of GDP! Beyond the fantastic character of such figures, we can see that whatever the different histories of these two national economies, the result is the same. In both cases, faced with an insane level of indebtedness of the state or of private institutions, it is the state which must assume the integrity of the national capital by showing its capacity to reimburse the debt and pay the interest on it.

The inability of the Greek and Irish economies to repay their debt contains a danger that extends way beyond the borders of these two countries. And it is this aspect which explains the panic at the top levels of the world bourgeoisie. In the same way that the Irish banks were supported by credit from a series of world states, the banks of the major developed countries held the colossal debts of the Greek and Irish states. There are different opinions concerning the level of the claims of the major world banks on the Irish state. Let’s take the “average”: “According to the economic daily Les Echos de Lundi, French banks have a 21.1 billion euro exposure to Ireland, behind the German banks (46 billion), British (42.3 billion) and American (24.6billion).”[1] And concerning the exposure of the banks by the situation in Greece: “The French institutions are the most exposed with 55 billion euros in assets. The Swiss banks have invested 46 billion, the Germans 31 billion”.[2] The non-bailout of Greece and Ireland would have put the creditor banks in a very difficult situation, and thus the states on which they depend. It would have been even more the case for countries in a critical financial situation (like Spain and Portugal) that are also exposed in Greece and Ireland and for whom such a situation would have proved fatal.

That’s not all. The non-bailout of Greece and Ireland would have signified that the financial authorities of the EU and the IMF would not guarantee the finances of countries in difficulty. This would have led to a stampede of creditors away from these countries and the guaranteed bankruptcy of the weakest of them, the collapse of the euro and a financial storm that would make the failure of Lehman Brothers in 2008 look like a mild sea breeze. In other words, the financial authorities of the EU and the IMF came to the rescue of Greece and Ireland not to save these two states, still less the populations of these two countries, but to avoid the meltdown of the world financial system.

In reality, it is not only Greece, Ireland and a few other countries in the South of Europe whose financial situation has deteriorated. “.. the following figures show the level of total debt as a percentage of GDP [January 2010]: 470% for the UK and Japan, gold medals for total indebtedness; 360% for Spain; 320% for France, Italy and Switzerland; 300% for the US and 280% for Germany.”[3] In fact, all countries, whether inside or outside the Euro zone, are indebted beyond their ability to repay. Nevertheless the Euro zone countries have the supplementary difficulty that its states are unable to create the monetary means to “finance” their deficits. This is the exclusive preserve of the European Central Bank. Other countries like the UK and the US, equally indebted, do not have this problem since they have the authority to create their own money.

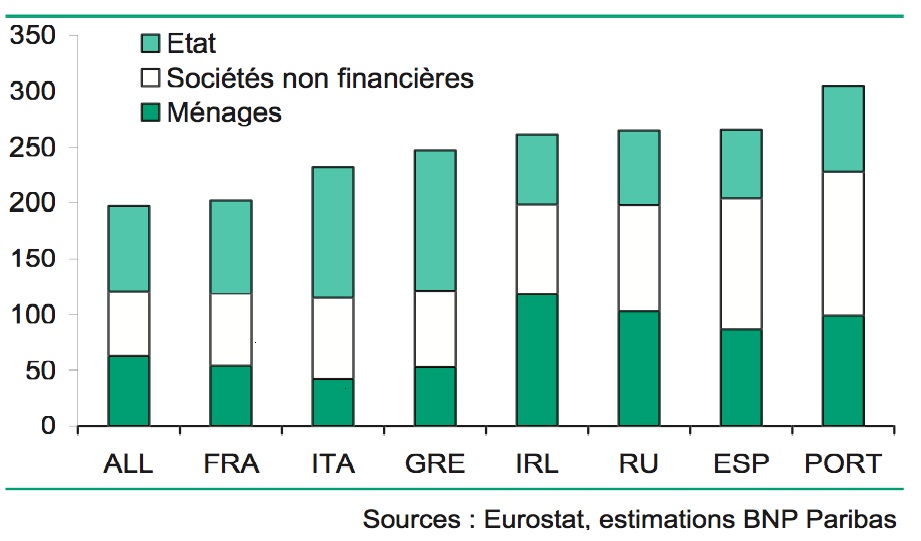

Public and private debt in 2009 excluding financial institutions (% of the GDP)[4]

The levels of indebtedness of all these states show that their commitments exceed their ability to pay to an absurd degree. Calculations have been made which show that Greece needs a budget surplus of at least 16 or 17% to stabilise its public debt. In fact these are all countries that are indebted to a point where their national production doesn’t permit the repayment of their debt. In other words the states and private institutions hold debt that can never be honoured.[5] The table above, which shows the debt of each European country (outside of financial institutions, contrary to the figures mentioned above) gives a good idea of the immensity of the debts contracted as well as the fragility of the most indebted countries.

Given that the rescue plans have no chance of success, what else is their significance?

Capitalism can survive only thanks to plans of permanent economic support

The Greek rescue plan cost 110 billion euros and Ireland’s 85 billion. These massive financial contributions from the IMF, the Euro zone and the UK (which gave 8.5billion euros when Cameron’s government was making its own austerity plan to reduce public expenses by 25% in 2015[6]) are only money issued against the wealth of the different states. In other words the money extended to the rescue plan is not based on newly created wealth but is nothing but the result of printing money, Monopoly money.

Such support to the financial sector, which finances the real economy, is in fact a support to real economic activity. Thus on the one hand draconian austerity plans are put in place, announcing still more draconian austerity plans, and on the other, threatened by the collapse of the financial system and the blockage of the world economy, plans of support are adopted whose content is very similar to what are known as “recovery plans”.

In fact the US is going furthest in this direction: Quantitative Easing nº2, creating 900 billion dollars,[7] has no other meaning than the attempt to save the American financial system whose ledgers are full of bad debts, and to support the anaemic economic growth of the US, which cannot overcome its sizeable budget deficit.

Having the advantage that the dollar is the money of world exchange the US does not suffer the same constraints as Greece, Ireland and other European countries. That’s why, as many think, a Quantitative Easing nº3 cannot be ruled out.

Thus the support of economic activity by budgetary measures is much stronger in the US than in the European countries. But that does not stop the US from trying to drastically slash its budget deficit, as illustrated by Obama’s proposal to block the wages of federal employees. In fact one finds in every country in the world such contradictions revealed in the policies adopted.

The bourgeoisie has exceeded the limits of indebtedness that capitalism can sustain

We thus have plans of austerity and plans of recovery at the same time! What is the reason for such contradictions?

As Marx showed, capitalism suffers genetically from a lack of outlets because the exploitation of labour power necessarily leads to the creation of a value greater than the outlay in wages, because the working class consumes much less than it produces. Up until the end of the 19th century, the bourgeoisie had to offset this problem by the colonisation of non-capitalist areas where it forced the population, with various means, to buy the merchandise produced by its capital. The crises and wars of the 20th century illustrate that this way of answering overproduction, inherent to capitalist exploitation, was reaching its limits. In other words, non-capitalist areas of the planet were no longer sufficient for the bourgeoisie to realise the surplus product that was needed for enlarged accumulation. The deregulation of the economy at the end of the 1960s, manifested in monetary crises and recessions, signified the quasi-absence of the extra capitalist markets as a means of absorbing the surplus capitalist production. The only solution henceforth has been the creation of an artificial market inflated by debt. It has allowed the bourgeoisie to sell to states, households and businesses without the latter having the real means to buy.

We have often shown that capitalism has used debt as a palliative to the crisis of overproduction that has ensnared it since the end of the 1960s. But we should not confuse debt with magic. Actually debt must be progressively repaid and the interest paid systematically, otherwise the creditor will not only stop lending but risk bankruptcy himself.

Now the situation of a growing number of European countries shows that they can no long pay the part of the debt demanded by their creditors. In other words these countries must reduce their debt, in particular by cutting expenses, when 40 years of crisis have shown that the increase of the latter was an absolutely necessary condition to avoid a world recession. All states, to a greater or lesser degree are faced with the same insoluble contradiction.

The financial storms shaking Europe at the moment are thus the product of the fundamental contradictions of capitalism and illustrate the absolute impasse of this mode of production.

We will now deal with other characteristics of the present situation.

Developing inflation

At the very moment when most countries have austerity plans that reduce internal demand, including for basic necessities, the price of agricultural raw materials has sharply increased. More than 100% for cotton in a year;[8] more than 20% for wheat and maize between July 2009 and July 2010[9] and 16% for rice between April-June 2010 and the end of October 2010.[10] Metals and oil went in a similar direction. Of course, climatic factors have a role in the evolution of the price of food products, but the increase is so general that other causes must be at play. All countries are preoccupied by the level of inflation that is increasing in their economies. Some examples from the “emerging countries”:

- officially inflation in China reached an annual rate of 5.1% in November 2010 (in fact every specialist agrees that the real figures for inflation in this country is between 8 and 10%);

- in India inflation reached 8.6% in October;

- in Russia it was 8.5% in 2010.[11]

The development of inflation is not an exotic phenomenon reserved for the emerging countries. The developed countries are more and more concerned: a 3.3% rate in November in the UK was seen as worrying by the government; 1.9% in virtuous Germany caused disquiet because it occurs alongside rapid growth.

What then, is the cause of this return of inflation?

Inflation is not always the result of vendors raising their prices because demand exceeds supply and therefore carries no risk of losing sales. Another factor entirely can cause this phenomenon. The increase in the money supply over the past three decades for example. The printing of money, that is the issuing of new money when the wealth of the national economy does not increase in the same proportion, leads inevitably to a depreciation of the money in circulation and thus to an increase in prices. Now, all the official statistics show that since 2008 there has been a strong increase in the money supply in the great economic zones of the planet.

This increase encourages the development of speculation with disastrous consequences for the working class. Given that demand is too weak as a result of the stagnation or lowering of wages, businesses cannot raise their market prices without losing sales. These same businesses or investors turn away from productive activity which is not profitable enough or too risky, and use the money created by the central banks for speculation. Concretely that means buying financial products, raw materials or currencies with the hope that that they can be resold with a substantial profit. Consumer products become tradable assets. The problem is that a good part of these products, in particular agricultural products, are also commodities consumed by vast numbers of workers, peasants, unemployed, etc. Consequently, as well as a lowering of income, a great part of the world population is hit by the rise in the price of rice, bread, clothes, etc.

Thus the crisis, which obliges the bourgeoisie to save its banks by means of the creation of money, leads the workers to suffer two attacks:

- the lowering of their wages;

- the increase in the price of basic commodities.

Prices of basic necessities have been rising since the beginning of the century for these reasons. From the same causes today, the same effects. In 2007 – 2008 (just before the financial crisis) great masses of the world population were forced into hunger riots. The consequences of the present price explosion have immediately led to the revolts in Tunisia, Egypt and Algeria.

The level of inflation won’t stop rising. According to Cercle Finance from 7th December, the rate of 10 year T bonds[12] has increased from 2.94% to 3.17% and the rate of 30 year T bonds has increased from 4.25% to 4.425%. That clearly shows that the capitalists anticipate a loss of the value of the money they invest and thus demand a higher rate of return on it.

The tensions between national capitals

During the Depression of the 1930s, protectionism and trade war developed to such an extent that one could speak of a “regionalisation” of exchange. Each of the great industrialised countries reserved a zone for its domination which allowed it to find a minimum of outlets. Contrary to the pious intentions published by the recent G20 in Seoul, according to which the different participants declared a voluntary ban on protectionism, reality is quite different. Protectionist tendencies are clearly at work today behind the euphemism of “economic patriotism”. It would be too tedious to list all the protectionist measures adopted by different countries. Let us simply mention that the US in September 2010 was taking 245 anti-dumping measures; that Mexico from March 2009 had taken 89 measures of commercial retaliation against the US and that China recently decided to drastically limit the export of its “rare earths” needed for a lot of high technology products.

But, in the present period, it’s currency war that will be the major manifestation of trade war. We have already seen that Quantitative Easing Nº2 was a necessity for American capital. At the same time, to the extent that the creation of money can only lead to the lowering of its value, and thus the price of Made in USA products on the world market (relative to the products of other countries) QE is a particularly aggressive protectionist measure. The under-valuation of the Chinese yuan has similar objectives.

However, despite the trade war, the different countries have agreed to prevent Greece and Ireland from defaulting on their debt. The bourgeoisie is obliged to take very contradictory measures, dictated by the total impasse of its system.

What solutions can the bourgeoisie propose?

Why, in the catastrophic situation of the world economy do we find articles like those of the Tribune or Le Monde entitled “Why growth will come”[13] or “The US wants to believe in the economic recovery”?[14] Such headlines, which are only propaganda, are trying to send us to sleep, and above all make us think that the bourgeoisie’s economic and political authorities still have a certain mastery of the situation. In fact the bourgeoisie only has the choice between two policies, rather like the choice between the plague and cholera:

- either it proceeds by creating money as it has done with Greece and Ireland, since all the funds of the EU and the IMF come from the printing of money by its various member countries. But then it heads towards a devaluation of currencies and an inflationist tendency that can only get worse;

- or it tries a particularly draconian austerity in order to stabilise the debt. This is the German solution for the Euro zone, since the major part of the cost of support for countries in difficulty is borne by German capital. The end result of such a policy can only be the rapid fall into depression, as indicated by the fall of production that we have seen in 2010 in Greece, Ireland and in Spain following the adoption of austerity plans.

Recently published texts by a number of economists propose their solutions to the present impasse. But they are either pure propaganda to make us think that capitalism, despite everything, has a future, or an exercise in self-hypnosis. To take one example, according to Professor M Aglietta[15] the austerity plans adopted in Europe are going to cost 1% of growth in European Union which will be about 1% in 2011. His alternative solution reveals that the greatest economists have nothing realistic to offer: he was not afraid to say that a new “regulation” based on the “green economy” would be the solution. He only “forgot” one thing: such a “regulation” implies considerable expense and thus an even more gigantic creation of money than at present, when the bourgeoisie is particularly worried about the resumption of inflation.

The only true solution to the capitalist impasse will emerge from the more and more numerous, massive and conscious struggles of the working class against the economic attacks of the bourgeoisie. It will lead naturally to the overthrow of this system whose principle contradiction is that of the production for profit and accumulation and not the satisfaction of human needs.

Vitaz 2/1/11

[3]. Bernard Marois, professor emeritus at HEC: www.abcbourse.com/analyses/chroniquel-economie_shadock_analyse_des_dette...

[4]. Key to abbreviations: Etat = country; Societies non financieres = non-financial companies; Menages = Households

[5]. J. Sapir “Can the Euro survive the crisis?” Marianne, 31 December 2010.

[6]. But it is revealing that Cameron is beginning to fear the depressive effect of the plan on the British economy.

[7]. QE2 had been fixed at $600billion but the FED was obliged to renew the purchase of matured debt at $35billion a month.

[8]. Blog-oscar.com/2010/11/las-flambee-du-cours-du-coton (the figures on this site date from the beginning of November. Today they have been largely surpassed).

[9]. C. Chevré, MoneyWeek, 17 November 2010

[10]. Observatoire du riz de Madagascar; iarivo.cirad.fr/doc/dr/hoRIZon391.pdf

[11]. Le Figaro,16 Decembre 2010, www.lefigaro.fr/flash-eco/2010/1216/97002-20101216FILWWW00522-russie-l-i...

[12]. American Treasury Bonds

[13]. La Tribune 17 December 2010

[14]. Le Monde 30th December 2010

[15]. In the broadcast “L’éspirit public” on “France Culture” radio, 26 December 2010

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace