Submitted by International Review on

In International Review n°133 we began the publication of a debate within the ICC on the underlying causes of the period of post-war prosperity during the 1950s-60s, which has proven to be an exceptional one in the history of capitalism since World War I. In that article, we posed the terms and framework of the debate, and presented briefly the main positions around which it has turned. We are publishing below a new contribution to the discussion.

This contribution supports the thesis presented in n°133 under the title "Keynesian-Fordist state capitalism", and attributes the creation of solvent demand during the post-war boom essentially to the Keynesian mechanisms set up by the bourgeoisie.

In future issues of the Review we will publish articles presenting the other positions in the debate, as well as a reply to this position in particular as regards the nature of capitalist accumulation and the factors determining capitalism's entry into its decadent phase.

The origins, dynamics, and limits of Keynesian-Fordist state capitalism

In 1952, our predecessors of the GCF[1] brought their group's activity to an end because "The disappearance of the extra-capitalist market leads to a permanent crisis of capitalism (...) We can see here the striking confirmation of Rosa Luxemburg's theory (...) In fact, the colonies are no longer an extra-capitalist market for the colonial homeland (...) We are living in a state of imminent war...".[2] Written on the eve of the post-war boom, these repeated mistakes reveal the need to go beyond "the striking invalidation of Rosa Luxemburg's theory", and to return to a more coherent understanding of the functioning and limits of capitalism. Such is the aim of this article.

I. Capitalism's motive forces and internal contradictions

1) The constraints on extended reproduction and its limits

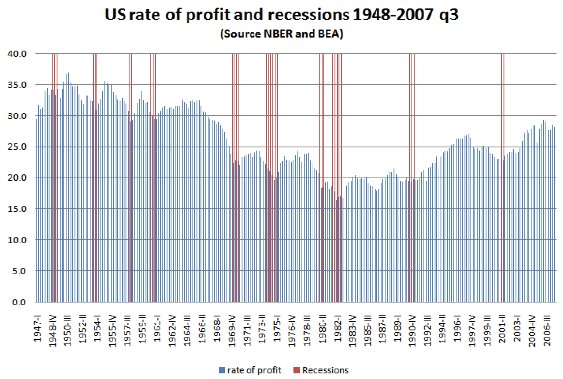

The appropriation of surplus labour is fundamental to capitalism's survival.[3] Unlike previous societies, capitalist appropriation has its own inbuilt, permanent dynamic towards the expansion of the scale of production which goes far beyond simple reproduction. It generates a growing social demand through the employment of new workers and reinvestment in extra means of production and consumption: "These limits of consumption are extended by the exertions of the reproduction process itself. On the one hand, this increases the consumption of revenue on the part of labourers and capitalists, on the other hand, it is identical with an exertion of productive consumption".[4] This dynamic of extension takes form in a succession of cycles, roughly every decade, when the increasing weight of fixed capital tends to reduce the rate of profit and provoke crises.[5] During these crises, bankruptcies and the depreciation of capital create the conditions for a recovery which expands the markets and productive potential: "The crises are always but momentary and forcible solutions of the existing contradictions. They are violent eruptions which for a time restore the disturbed equilibrium (...)The ensuing stagnation of production would have prepared - within capitalistic limits - a subsequent expansion of production. And thus the cycle would run its course anew. Part of the capital, depreciated by its functional stagnation, would recover its old value. For the rest, the same vicious circle would be described once more under expanded conditions of production, with an expanded market and increased productive forces."[6] Graph n°1 perfectly illustrates all the elements of this theoretical framework established by Marx: each of the ten cycles of rising and falling profit rates ends in a crisis (recession).

|

|

Graph n°1: Quarterly rate of profit and recessions, USA 1948-2007 (the nine recessions which marked the ten cycles are indicated by the lines from top to bottom: 1949, 1954, 1958, 1960, 1970-71, 1974, 1980-81, 1991, 2001) |

Capitalist accumulation for more than two centuries has lived to the rhythm of some thirty cycles and crises. Marx identified seven during his lifetime, the Third International sixteen,[7] and the left in the International completed the picture for the inter-war period.[8] This is the recurring material basis for the cycles of over-production whose origins we will now examine.[9]

2) The circuit of accumulation, a play in two acts: production of profit and the realisation of commodities

The extraction of a maximum of surplus labour, crystallised in a growing quantity of commodities, constitutes what Marx calls "the first act in the process of capitalist production". These commodities must then be sold in order to transform the material surplus labour into surplus value in the form of money for reinvestment: this is "the second act of the process". Each of these two acts contains its own contradictions and limits. Although they influence each other, the first act is driven above all by the rate of profit, while the second is a function of the various tendencies limiting the market.[10] These two limits engender periodically a final demand which is unable to absorb production: "Over-production is specifically conditioned by the general law of the production of capital: to produce to the limit set by the productive forces, that is to say, to exploit the maximum amount of labour with the given amount of capital, without any consideration for the actual limits of the market or the needs backed by the ability to pay".[11]

What is the origin of this inadequate solvent demand?

a) Society's limited capacity for consumption, which is reduced by the antagonistic relations in the division of surplus labour (class struggle): "The ultimate reason for all real crises always remains the poverty and restricted consumption of the masses as opposed to the drive of capitalist production to develop the productive forces as though only the absolute consuming power of society constituted their limit".[12]

b) The limits resulting from the process of accumulation which reduce consumption as the rate of profit declines: the inadequate surplus value extracted relative to invested capital puts a break on investment and the employment of new labour power: "The limitations of the capitalist mode of production come to the surface: 1) In that the development of the productivity of labour creates out of the falling rate of profit a law which at a certain point comes into antagonistic conflict with this development and must be overcome constantly through crises...".[13]

c) An incomplete realisation of the total product when the proportions between the sectors of production are not respected.[14]

3) A threefold conclusion on capitalism's internal dynamic and contradictions

Throughout his work, Marx constantly underlines this dual root cause of crises, whose determinations are fundamentally independent: "The foundation of modern overproduction is on the one hand, the absolute development of the productive forces and consequently the mass production of producers shut up in the circle of life's necessities, and on the other its limitation by capitalist profit".[15] In fact, if the level and the recurrent fall in the rate of profit mutually influence the way in which surplus value is shared out, Marx nonetheless insists that these two root causes are fundamentally "independent", "logically divergent", "not identical".[16] Why is this? Simply because the production of profit and the markets are, for the most part, subjected to different conditions. This is why Marx categorically rejects any theory which attributes crises to a single cause.[17] It is thus theoretically incorrect either to make the evolution of the rate of profit dependent on the size of the market, or the reverse. The time-scales of these two underlying root causes are thus necessarily different. The first contradiction (the rate of profit) has its roots in the need to increase constant capital at the expense of variable capital, and its timescale is thus tied essentially to the cycles of rotation of fixed capital. Since the second contradiction turns around the distribution of surplus labour, its timescale is determined by the balance of forces between the classes which evolves over longer periods.[18] While these two timescales may come together (the process of accumulation influencing the balance of forces between the classes and vice versa), they are fundamentally "independent", "not identical", "logically divergent", for the class struggle is not strictly tied to the ten-year cycles, nor are the latter tied to the balance of class forces.

II. An empirical validation of the marxist theory of the crises of overproduction

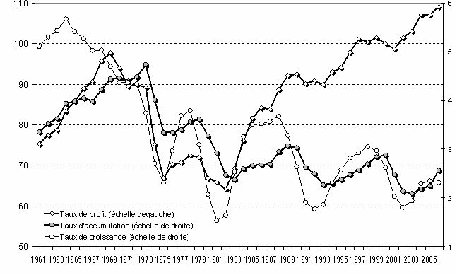

The period from the end of World War II to the present day is a good example confirming Marx's analysis of the crises of overproduction, and of its three main implications. In particular, it allows us to disprove all the single-cause crisis theories, whether they be the theory based solely on the falling rate of profit which is incapable of explaining why accumulation and growth do not start up again despite the fact that the rate of profit has been rising for a quarter-century, or that based on the saturation of solvent demand which cannot explain the rise in the rate of profit since the markets are totally exhausted (which logically should be expressed in a zero rate of of profit). All this can readily be understood from the two graphs (n°1 and n°3) which show the evolution of the rate of profit.

The exhaustion of post-war prosperity and the worsening economic climate during 1969-82 are fundamentally the product of a downturn in the rate of profit,[19] despite the fact that consumption was maintained by the indexation of wages and measures to support demand.[20] The gains of productivity declined by the end of the 1960s,[21] cutting the rate of profit in half by 1982 (see Graph n°3). Since then, a recovery in the rate of profit has only been possible by increasing the rate of surplus value (lowering wages and increasing exploitation). This has implied an inevitable deregulation of the key mechanisms which ensured a growth in final demand during the post-war boom (see below). This process began at the beginning of the 1980s and can be seen in particular in the constant decline in wages as a proportion of total wealth produced.

|

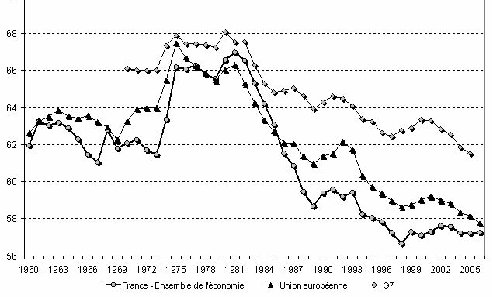

| Graph n°2

Wages in relation to total wealth produced: G7, Europe, France |

Overall then, during the 1970s the "rate of profit" contradiction weighed on capitalism, while final demand was maintained. The situation was reversed from 1982 onwards: the rate of profit has been spectacularly restored, but at the price of a drastic compression of final demand (the market): essentially of wage earners (see Graph n°2), but also (to a lesser extent) of investment, since the rate of accumulation has remained at its low-water mark (see Graph n°3).

Hence, we can now understand why the economic decline is continuing despite a restored rate of profit: the failure of growth and accumulation to take off again, despite a spectacular improvement in company profitability, is explained by the compression of final demand (wages and investment). This drastic reduction in final demand leads to listless investment for enlarged accumulation, continued rationalisation through company take-overs and mergers, unused capital pouring into financial speculation, delocalisation of industry in search of cheap labour... all of which further depresses overall demand.

|

| Graph n° 3

Profit, accumulation and economic growth, USA, Europe, Japan: 1961-2006 |

As for the recovery of final demand, this is hardly possible under present conditions since the increase in the rate of profit depends on keeping it low! Since 1982, in a context of improved company profitability, it is thus the "restriction of solvent markets" timescale which plays the leading role in explaining the continued listlessness of accumulation and growth, even if fluctuations in the rate of profit can still play an important part in the short term in sparking off recessions, as we can readily see in Graphs n°1 and n°3.

III. Capitalism and its surrounding world

Capitalism's dynamic towards enlargement necessarily gives it a fundamentally expansive character: "The market must, therefore, be continually extended, so that its interrelations and the conditions regulating them assume more and more the form of a natural law working independently of the producer, and become ever more uncontrollable. This internal contradiction seeks to resolve itself through expansion of the outlying field of production. But the more productiveness develops, the more it finds itself at variance with the narrow basis on which the conditions of consumption rest".[22] That said, when Marx pointed out all the dynamics and limits of capitalism, he did so in abstraction from its relationships with the external (non-capitalist) sphere. We now need to understand what is the latter's role and importance during capitalism's development. Capitalism was born and developed within the framework of feudal, then mercantile social relations, with which it inevitably developed important ties to obtain the means of its own accumulation (import of precious metals, looting, etc.), for the sale of its own commodities (direct sale, triangular trade, etc.), and as a source of labour.

Once capitalism's foundation was assured after three centuries of primitive accumulation (1500-1825), this environment continued to supply a whole series of opportunities throughout the ascendant period (1825-1914) as a source of profit, an outlet for the sale of commodities suffering from overproduction, and as an extra source of labour power. All these reasons explain the imperialist rush for colonies between 1880 and 1914.[23] However, the existence of an external regulation of a part of capitalism's internal contradictions does not mean either that the former were more effective for its development, nor that capitalism is incapable of creating internal modes of regulation. It is first and foremost the extension and domination of wage labour on its own foundations which progressively allowed capitalism to make its growth more dynamic, and while the various relations between capitalism and the extra-capitalist sphere gave it a whole series of opportunities, the size of this milieu and the overall balance-sheet of its exchanges with it, were nonetheless a brake on its growth.[24]

IV. The historical obsolescence of the capitalist mode of production and the basis for going beyond it

This formidable dynamism of capitalism's internal and external expansion is nonetheless not eternal. Like every mode of production in history, capitalism also undergoes a phase of obsolescence where its social relationships become a brake on the development of its productive forces.[25] We must therefore seek for the historical limits to the capitalist mode of production within the transformation and generalisation of the social relations of wage labour production. Once it reaches a certain stage, the extension of wage labour and its domination through the formation of the world market constitute capitalism's apogee. Instead of continuing to eradicate old social relationships and develop the productive forces, the henceforth obsolete character of the wage-labour relationship tends to freeze the former and put a brake on the latter: it remains incapable of integrating a large part of humanity, it engenders crises, wars and disasters of ever-growing magnitude, to the point where it threatens humanity with extinction.

1) Capitalism's obsolescence

The progressive generalisation of wage labour does not mean that it has taken root everywhere, far from it, but it does mean that its domination of the world creates a growing instability where all the contradictions of capitalism find their fullest expression. World War I opens this era of major crises whose dominant feature is that they are world-wide and anchored in the wage-labour relationship: a) the national framework has become too narrow to contain the onslaught of capitalism's contradictions; b) the world no longer offers enough opportunities and shock-absorbers providing capitalism with an external regulation of its internal contradictions; c) with hindsight, the failure of the regulation set up during the post-war boom reveals capitalism's historical inability to adjust internally in the long term to its own contradictions, which consequently explode with increasingly barbaric violence.

Inasmuch as it was a world conflict, not for the conquest of new spheres of influence, zones for investment, and markets, but to share out those that already existed, World War I marked the capitalist mode of production's definitive entry into its phase of obsolescence. The two, increasingly violent, world wars, the greatest crisis of overproduction ever (1929-1933), the severe restriction on the growth of the productive forces between 1914 and 1945, capitalism's inability to integrate a large part of humanity, the development of militarism and state capitalism throughout the planet, the increasing growth of unproductive expenditure, and capitalism's historic inability to stabilise internally its own contradictions - all these phenomena are material expressions of this historical obsolescence of the social relations of production based on wage labour which have nothing to offer humanity but a perspective of growing barbarism.

2) Catastrophic collapse, or a historical, materialist and dialectical vision of history?

Capitalism's obsolescence does not imply that it is condemned to catastrophic collapse. there are no predefined quantitative limits within capitalism's productive relations (whether it be a rate of profit, or a given quantity of extra-capitalist markets) which determine a single point beyond which capitalist production would die. The limits of modes of production are above all social, the product of their internal contradictions and the collision between these now-obsolete relations and the productive forces. Henceforth it is the proletariat which will abolish capitalism, capitalism will not die of itself as a result of its "objective" limits. During capitalism's obsolescence, the same tendencies and dynamics that Marx analysed continue to operate, but they do so within a profoundly modified general context. All the economic, social, and political contradictions inevitably appear on a higher level, either in social struggles which regularly pose the question of revolution, or in imperialist conflicts which threaten humanity's very future. In other words, the world has entered the "epoch of wars and revolutions" announced by the Third International.

V. Keynesian-Fordist state capitalism: the foundation of the post-war boom

Marxists have no reason to be surprised at recoveries that take place during a mode of production's obsolescence: we can see these for example in the reconstitution of the Roman Empire under Charlemagne, or in the formation of the great monarchies during the Ancien Régime. However, it is not because we are standing at a bend in the river that we can conclude that it is flowing uphill and away from the sea! The same is true of the post-war boom: the bourgeoisie proved capable of creating a brief phase of strong growth in a general course of obsolescence.

The Great Depression of 1929 in the United States showed how violently capitalism's contradictions could break out in an economy dominated by wage labour. One might therefore have expected that it would be followed by increasingly violent and frequent economic crises, but this was not the case. The situation had evolved considerably, both in the process of production (Fordism) and in the balance of forces between the classes (and within them). Moreover, the bourgeoisie had learned certain lessons. The years of crisis and the barbarism of World War II were thus followed by a good thirty years of strong growth, a quadrupling of real wages, full employment, the creation of a social wage, and an ability by the system not to avoid, but to react to its cyclical crises. How was all this possible?

1) The foundations of Keynesian-Fordist state capitalism

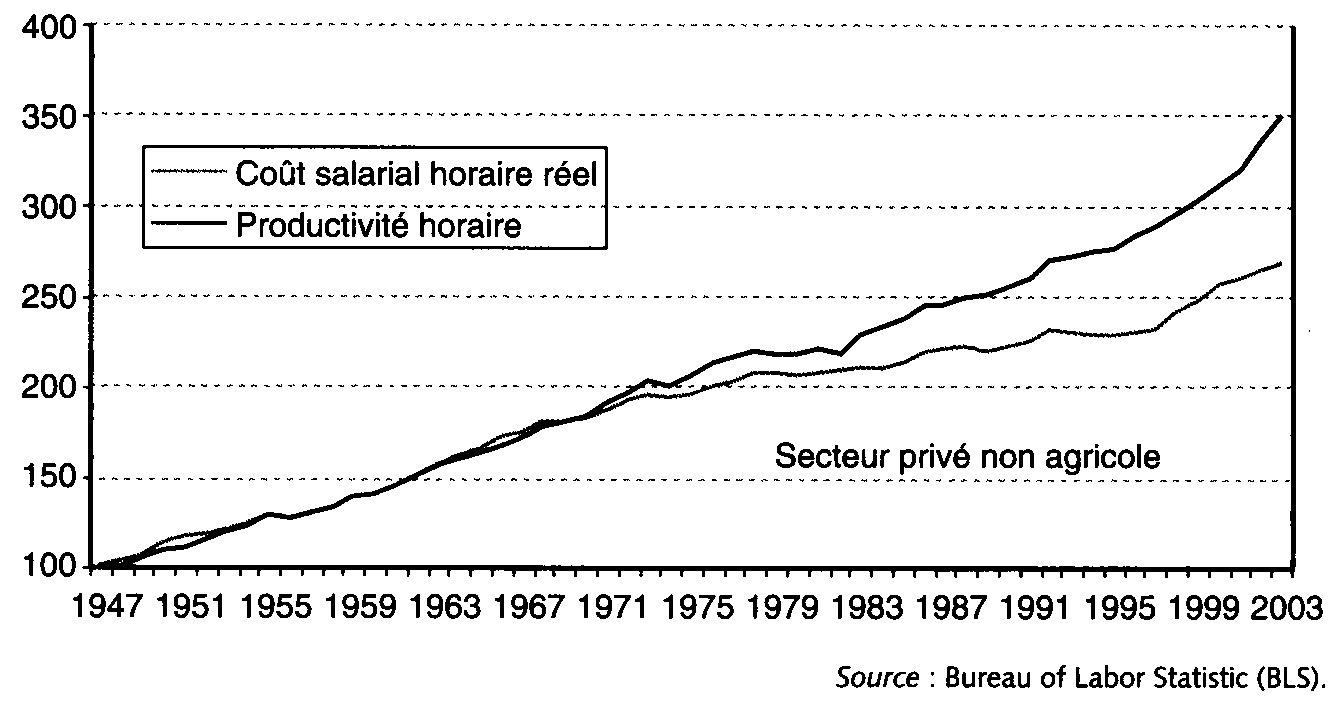

Henceforth, in the absence of adequate external outlets for its contradictions, capitalism had to find an internal solution to its dual constraint at the level of profits and markets. The high rate of profit was made possible by the strong gains in labour productivity thanks to industrial Fordism (assembly-lines combined with shift work). Meanwhile, the markets on which to sell this enormous mass of commodities were guaranteed by the expansion of production, state intervention, and various systems indexing real wages to productivity. This made it possible to increase demand in parallel with production (see Graph n°4). By stabilising the share of wages in total wealth produced, capitalism was thus able for a while to avoid "Over-production [which] arises precisely from the fact that the mass of the people can never consume more than the average quantity of necessaries, that their consumption therefore does not grow correspondingly with the productivity of labour".[26]

This was the analysis that Paul Mattick and other revolutionaries of the time were to adopt to analyse post-war prosperity: "It is undeniable that wages have risen in the modern epoch. But only in the framework of the expansion of capital, which presupposes that the relationship of wages to profits should remain in constant in general. Labour productivity should therefore rise with a rapidity which would make it possible both to accumulate capital and to raise the workers' living standards".[27] This is the main economic mechanism of Keynesian-Fordist state capitalism. This is attested empirically by the parallel evolution of wages and labour productivity during this period.

|

| Graph n° 4

US wages and productivity A comment on this graph: the increase in productivity and wages remains almost identical from World War II onwards. From the 1980s onwards, the two increasingly diverge. Ever since capitalism began, this divergence has been the rule, and their parallel development during the post-war boom the exception. In effect, this divergence is the material expression of capitalism’s permanent tendency to increase production (the upper line of productivity) beyond the growth of the most important element of solvent demand: real wages (the lower line). |

Given the spontaneous dynamics of capitalism (competition, pressure on wages, etc.), such a system could only be viable with the straitjacket of a state capitalism which contractually guaranteed a threefold division of increased productivity between profits, wages, and state revenues. A society dominated henceforth by wage labour imposes de facto a social dimension on all the policies adopted by the ruling class. This presupposes setting up multiple social and economic controls of the working class, social shock-absorbers, etc. The purpose of this unprecedented explosion of state capitalism was to contain the system's explosive social contradictions within the limits of capitalist order: predominance of the executive over the legislative, the significant growth of state intervention in the economy (almost half of GNP in the OECD countries), social control of the working class, etc.

2) Origins, contradictions and limits of Keynesian-Fordist state capitalism

Following the German defeat at Stalingrad (January 1943), the political, employer, and trade union representatives in exile in London began intense discussions on the reorganisation of society following the now inevitable collapse of the Axis powers. The memory of the Depression years and the fear of social movements at the end of the war, the lessons learned from the crisis of 1929, the increasingly widespread acceptance of the necessity of state intervention, and the bipolarisation created by the Cold War, were to be the elements that pushed the bourgeoisie to modify the rules of the game and to work out more or less consciously this Keynesian-Fordist state capitalism which was to be pragmatically and progressively implanted in all the developed countries (OECD). The sharing out of gains in productivity was all the more easily accepted by all inasmuch as: a) they were increasing strongly, b) this redistribution guaranteed the increase in solvent demand in parallel with production, c) it offered social peace, d) social peace was all the easier to obtain in that the proletariat in reality emerged defeated from World War II, under the control of parties and unions in favour of reconstruction within the framework of the system, e) but at the same time long term it guaranteed long-term profitability of investments, f) as well as a high rate of profit.

The system was thus able temporarily to square the circle of increasing the production of profit and markets in parallel, in a world where demand was henceforth largely dominated by that coming from wage labour. The guaranteed growth in profits, state spending and the rise in real wages, were able to guarantee the final demand so vital if capital were to continue its accumulation. Keynesian-Fordist state capitalism is the response that the system has been able to find temporarily to the crises of capitalism's obsolescent phase, whose dominant features are their world-wide nature and their basis in wage labour. It allowed a self-centred functioning of capitalism, without the need to have recourse to delocalisations despite high wages and full employment, while at the same time enabling it to get rid of its colonies which henceforth had only minor usefulness, and eliminating the internal extra-capitalist farming activity whose activity had now to be subsidised.

From the end of the 1960s until 1982, all the conditions which had allowed these measures to succeed deteriorated, beginning with a progressive slowing in the rise of productivity which overall was cut to a third, and drew all the other economic variables down with it. The internal regulation temporarily discovered by Keynesiano-Fordist state capitalism thus had no lasting foundation.

However, the reasons which had demanded the creation of this system were still there: wage labour is dominant in the working population, and capitalism was therefore forced to find a means of stabilising final demand in order to avoid its decline leading to a depression. Since company investments are conditioned by demand, it was necessary to find other means of maintaining consumption. The answer inevitably was found in the twin factors of declining saving and rising debt. This created a formidable machine for producing financial bubbles and feeding speculation. The constant aggravation of the imbalances in the system is thus not the result of errors in the conduct of economic policy, it is an integral part of the model.

3) Conclusion: and tomorrow?

This descent into hell is all the more inevitable in the present situation inasmuch as the conditions for a recovery in productivity gains and a return to their three-way redistribution are socially absent. There is nothing tangible in economic conditions, in the present balance of forces between the classes, and inter-imperialist competition at the international level which leaves open any way out: all the conditions are there for an inexorable descent into hell. It is up to revolutionaries to contribute to the consciousness of the class struggles which will inevitably arise from capitalism's deepening contradictions.

C Mcl.

[1] Gauche Communiste de France (French Communist Left).

[2] Internationalisme n°46, 1952.

[3] This is the motor of "the tendency to accumulate, the drive to expand capital and produce surplus-value on an extended scale. This is law for capitalist production, imposed by incessant revolutions in the methods of production themselves, by the depreciation of existing capital always bound up with them, by the general competitive struggle and the need to improve production and expand its scale merely as a means of self-preservation and under penalty of ruin." (Marx, Capital, Vol. III Part III). The quotes from Capital can all be found on https://marxists.org

[4] Marx, Capital, Vol. III Part V

[5] "As the magnitude of the value and the durability of the applied fixed capital develop with the development of the capitalist mode of production, the lifetime of industry and of industrial capital lengthens in each particular field of investment to a period of many years, say of ten years on an average (...) the cycle of interconnected turnovers embracing a number of years, in which capital is held fast by its fixed constituent part, furnishes a material basis for the periodic crises." (Marx, Capital, Vol. II Part II).

[6] Marx, Capital, Vol. III Part III, our emphasis.

[7] "Crisis and boom blend with all the transitional phases to constitute a cycle or one of the great circles of industrial development. Each cycle lasts from 8 to 9 or 10 to 11 years (...) In January of this year the London Times published a table covering a period of 138 years - from the war of the 13 American colonies for independence to our own day. In this interval there have been 16 cycles, i.e., 16 crises and 16 phases of prosperity. Each cycle covers approximately 8 2/3, almost 9 years" (Trotsky, Report on the World crisis and the new tasks of the Communist International).

[8] "...beginning a new cycle to produce new surplus value remains the capitalist's supreme goal (...) this almost mathematical periodicity of crises is one of the specific traits of the capitalist system of production" (Mitchell, Bilan n°1°, "Crises et cycles dans le capitalisme agonisant".

[9] In Graph n°1, the nine recessions which punctuated the ten cycles are indicated by groups of lines from top to bottom of the graph: 1949, 1954, 1958, 1960, 1970-71, 1974, 1980-81, 1991, 2001.

[10] "As soon as all the surplus-labour it was possible to squeeze out has been embodied in commodities, surplus-value has been produced. But this production of surplus-value completes but the first act of the capitalist process of production - the direct production process. Capital has absorbed so and so much unpaid labour. With the development of the process, which expresses itself in a drop in the rate of profit, the mass of surplus-value thus produced swells to immense dimensions. Now comes the second act of the process. The entire mass of commodities, i.e. , the total product, including the portion which replaces the constant and variable capital, and that representing surplus-value, must be sold. If this is not done, or done only in part, or only at prices below the prices of production, the labourer has been indeed exploited, but his exploitation is not realised as such for the capitalist, and this can be bound up with a total or partial failure to realise the surplus-value pressed out of him, indeed even with the partial or total loss of the capital." (Marx, Capital, Vol. III Part III).

[11] Marx, Theories of Surplus Value, Ch.XVII

[12] This analysis by Marx obviously has nothing to do with the theory of under-consumption as the cause of crises - a theory which he in fact criticised: "It is sheer tautology to say that crises are caused by the scarcity of effective consumption, or of effective consumers. The capitalist system does not know any other modes of consumption than effective ones, except that of sub forma pauperis or of the swindler. That commodities are unsaleable means only that no effective purchasers have been found for them, i.e., consumers (since commodities are bought in the final analysis for productive or individual consumption). But if one were to attempt to give this tautology the semblance of a profounder justification by saying that the working-class receives too small a portion of its own product and the evil would be remedied as soon as it receives a larger share of it and its wages increase in consequence, one could only remark that crises are always prepared by precisely a period in which wages rise generally and the working-class actually gets a larger share of that part of the annual product which is intended for consumption" (Marx, Capital, Vol. II Part III).

[13] Marx, Capital, Vol. III Part III.

[14] Each of these three factors is identified by Marx in the following passage: "The conditions of direct exploitation, and those of realising it, are not identical. They diverge not only in place and time, but also logically. The first are only limited by the productive power of society, the latter by [c)] the proportional relation of the various branches of production and [a)] the consumer power of society. But this last-named is not determined either by the absolute productive power, or by the absolute consumer power, but by the consumer power based on antagonistic conditions of distribution, which reduce the consumption of the bulk of society to a minimum varying within more or less narrow limits. [b)] It is furthermore restricted by the tendency to accumulate, the drive to expand capital and produce surplus-value on an extended scale" (Marx, Capital, Vol. III Part III).

[15] Marx, Theories of surplus value (our translation from the French edition).

[16] "Since the market and production are independent factors, the extension of one does not necessarily correspond to the growth of the other" (our translation from the French version of Marx's Grundrisse, La Pléiade, Economie II, p489). Or again: "The conditions of direct exploitation, and those of realising it, are not identical. They diverge not only in place and time, but also logically." (Marx, Capital, Book III).

[17] It is all the more important to reject the idea that crises of overproduction have a sole cause in that their causes, both for Marx and in reality, are far more complex: the anarchy of production, disproportion between the two main sectors of the economy, opposition between "loaned capital" and "productive capital", the disjunction between purchase and sale due to hoarding, etc. Nonetheless, the two root causes most fully analysed by Marx, and also the most important in reality, are the two that we have insisted on here: the fall in the rate of profit and the laws governing the distribution of surplus labour.

[18] Such as, for example, the long period of rising real wages during the second half of capitalism's ascendancy (1870-1914), during the post-war boom (1945-82), or of their relative and even absolute decline since then (1982-2008).

[19] It goes without saying that a crisis of profitability leads inevitably to an endemic state of overproduction of both capital and commodities. However, these phenomena of overproduction followed and were the target of policies of reduction of production both by the state (production quotas, restructuring, etc.) and private (mergers, rationalisation, take-overs, etc.).

[20] During the 1970s, the working class suffered from the crisis essentially through a decline in working conditions, restructuring and redundancies, and hence in a spectacular increase in unemployment. However, unlike the crisis of 1929 this unemployment did not lead to a spiral of recession thanks to the use of Keynesian social shock-absorbers: unemployment benefit, retraining measures, planned lay-offs, etc.

[21] For Marx, the productivity of labour is the real key to capitalism's evolution, since it is nothing other than the inverse of the law of value, in other words of the average socially necessary labour time for the production of commodities. Our article on the crisis in International Review n°115 includes a graph showing the productivity of labour from 1961-2003 for the G6 (USA, Japan, Germany, Britain, France, Italy). It shows clearly that the decline of labour productivity predates all the other variables which were to follow it afterwards, as well as its continuing low level since then.

[22] Marx, Capital, Vol. III Part III.

[23] Each regime of accumulation that has marked capitalism's historical development has engendered specific relations with its external sphere: from the mercantilism of the countries of the Iberian peninsula, to the self-centred capitalism of the post-war boom, via the colonialism of Victorian Britain, there is no uniformity in the relations between capitalism's heart and its periphery, as Rosa Luxemburg thought, but a mixed succession of relationships which are all driven by these different internal necessities of capital accumulation.

[24] During the 19th century, when colonial markets were most important, ALL the NON-colonial capitalist countries grew more rapidly than the colonial countries (71% more rapidly on average). This observation is valid throughout the history of capitalism. Sales outside pure capitalism certainly allow individual capitalists to realise their commodities, but they hinder the global accumulation of capitalism since, as with armament, they correspond to material means leaving the circuit of accumulation.

[25] "...the capital relation becomes a barrier for the development of the productive powers of labour. When it has reached this point, capital, ie wage labour, enters into the same rlation towards the development of social wealth and of the forces of production as the guild system, serfdom, slavery, and is necessarily stripped off as a fetter" Grundrisse, "The chapter on capital, notebook 7", p 749 in the Penguin edition 1973.

[26] Marx, Theories of surplus value.

[27] Paul Mattick, Intégration capitaliste et rupture ouvrière, EDI, p151, our translation.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace