The text that follows is, apart from a few minor changes, the economic part of the report on the situation in Britain for the 19th Congress of the ICC’s section in Britain. We thought it would be useful to publish it to the outside since it provides a number of factors and analyses which enable us to grasp how the world economic crisis is expressing itself in the world’s oldest capitalist power.

The international context

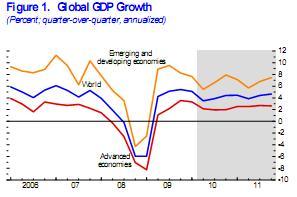

In 2010 the bourgeoisie announced the end of the recession and predicted that the world economy would grow over the next two years led by the emerging economies. However, there are serious uncertainties about the global situation, reflected in differing projections of growth. The IMF in its World Economic Outlook Update of July 2010 predicted global growth of 4.5% this year and 4.25% next. The World Bank in its Global Economic Prospects report for summer 2010 envisaged growth of 3.3% this year and next and 3.5% in 2012 if things go well but of 3.1% this year, 2.9% next and 3.2% in 2012 if things do not go well. The concern is particularly centred on Europe where the World Bank’s higher estimate is dependent on “Assuming that measures in place prevent today’s market nervousness from slowing the normalization of bank-lending, and that a default or restructuring of European sovereign debt is avoided”.[1] The lower growth rate if this is not achieved will affect Europe particularly, with predicted growth rates of 2.1, 1.9 and 2.2 percent between 2010 and 2012.

Source: IMF World Economic Outlook Update, July 2010

The situation remains fragile with concern about high levels of debt and low levels of bank lending and the possibility of further financial shocks, such as that in May this year that saw global stock markets lose between 8 and 17% of their value. The scale of the bailout is itself one of the causes of concern: “the size of the EU/IMF rescue package (close to $1 trillion); the magnitude of the initial market reaction to the possibility of a Greek default and eventual contagion; and continued volatility, are indications of the fragility of the financial situation…a further episode of market uncertainty could entail serious consequences for growth in both high-income and developing countries.”[2] The prescription of the IMF, as one might expect, is to reduce state spending, with the inevitable result that the working class will face austerity: “high-income countries will need to cut government spending (or raise revenues) by 8.8 percent of GDP for a 20 year period in order to bring debt levels down to 60 percent of GDP by 2030.”

For all their appearance of objectivity and sober analysis, these recent reports by the IMF and World Bank suggest there is a depth of uncertainty and fear within the ruling class about its ability to overcome the crisis. The possibility of other countries following Ireland back into recession remains real.

The evolution of the economic situation in Britain

This section draws on official data to give an overview of the course of the recession and the response from the government. However, it is important to begin by recalling that the crisis began within the financial sector, stemming from the crisis in the US housing market and encompassing the major banks and financial bodies around the globe that had become involved in lending where there was a real risk of the loans not being paid back. This was at its most extreme in the sub-prime mortgage market in the US, the contagion from which spread through the financial system because of the trading that developed based on the financial instruments derived from these loans. However, other countries, notably Britain and Ireland, had contrived to produce their own housing bubbles that contributed, together with a massive rise in unsecured personal borrowing, to create a level of debt that in Britain ultimately exceeded the country’s annual GDP. The crisis that developed flowed across into the ‘real’ economy leading to recession. The whole situation evoked a very forceful response from the British ruling class that poured unprecedented sums of money into the financial system and cut interest rates to a historic low.

Official figures show that Britain went into recession in the second quarter of 2008 and came out in the fourth quarter of 2009 with a peak to trough fall of 6.4% of GDP.[3] This figure, which was recently revised downwards, makes this recession the worst since the Second World War (the recessions of the early 1990s and 1980s saw falls of 2.5% and 5.9% respectively). Growth in the second quarter of 2010 was 1.2%, increasing significantly from the 0.4% of the fourth quarter 2009 and 0.3% of the first quarter 2010. However, it is still 4.7% below the pre-recession level as can be seen in the graph above.

The manufacturing sector has been the most affected by the recession, registering a peak to trough decline of 13.8% between the fourth quarter in 2007 and the third quarter of 2009. Since then manufacturing has expanded by 1.1% in the last quarter of 2009 and by 1.4% and 1.6% in the two quarters since.

The construction industry showed a sharp rebound in growth of 6.6% in the second quarter of 2010, contributing 0.4% to the overall growth rate for that quarter. However, this follows very substantial declines in both house building (down 37.2% between 2007 and 2009) and commercial and industrial work (down 33.9% between 2008 and 2009).

The service sector recorded a peak to trough fall of 4.6% with business and financial services falling by 7.6% “much stronger than in earlier downturns, making the largest single contribution to the fall”.[4] In the last quarter of that year it returned to growth of 0.5% but in the first quarter of 2010 this fell to 0.3%. Although the decline in this sector was less than in others, its dominant position in the economy meant that it was the largest contributor to the overall decline in GDP during this recession. The decline in the service sector was also greater in this recession than those of the early 1980s and early 1990s where the falls were 2.4% and 1% respectively. More recently, the business services and finance sector has shown stronger growth and contributed 0.4 percentage points to the overall GDP figure.

As might be expected both exports and imports declined during the recession. This was most marked in the trade in goods (although the balance actually improved slightly): “In 2009 the deficit fell by £11.2 billion to £81.9 billion. There was a record fall in exports of 9.7 per cent – from a record £252.1 billion to £227.5 billion. However, this was accompanied by a fall in imports of 10.4 per cent, the largest year-on-year fall since 1952, which had a much larger impact since total imports are significantly larger than total exports. Imports fell from a record £345.2 billion in 2008 to £309.4 billion in 2009. These large falls in both exports and imports were a result of a general contraction of global trade associated with the worldwide financial crisis which began late in 2008.”[5] The decline in services was smaller, with imports falling by 5.4% and exports by 6.9% with the balance, which remained positive, going from £55.4bn in 2008 to £49.9bn in 2009. The total trade in services in 2009 was £159.1bn in exports and £109.2bn in imports, which is significantly less than that of the trade in goods.

Between 2008/9 and 2009/10 the current account deficit doubled from 3.5% of GDP to 7.08%. The Public Sector Net Borrowing Requirement, which includes borrowing for capital spending, went from 2.35% of GDP in 2007/8, to 6.04% in 2008/9 and 10.25% in 2009/10. In 2008 it was £61.3bn and in 2009 £140.5bn. Total government net debt was calculated to be £926.9bn in July this year or 56.1% of GDP, compared to £865.5bn in 2009 and £634.4bn in 2007. In May 2009 Standard and Poor raised the possibility of downgrading Britain’s debt status from the highest triple A rating, which would have led to significant increases in borrowing costs.

The number of companies going bankrupt increased during the recession, rising from 12,507 in 2007 (which was one of the lower figures for the decade) to 15,535 in 2008 and 19,077 in 2009. The number of acquisitions and mergers rose during the second half of the decade to reach 869 in 2007 before falling over the next two years to 558 and 286 respectively. Figures for the first quarter of 2010 do not suggest any increase is taking place. This suggests that while there has been destruction of the capital associated with the businesses going insolvent this has not yet led to a general process of consolidation as might be expected coming out of a crisis, which itself may indicate that the real crisis remains with us.

During the crisis the pound fell sharply against a number of other currencies, losing over a quarter of its value between 2007 and the start of 2009, prompting the Bank of England to comment “The fall of more than a quarter since mid-2007 is the sharpest over a comparable period since the breakdown of the Bretton Woods agreement in the early 1970s”[6] There has been a recovery since but the pound remains about 20% below its 2007 exchange rate.

House prices fell sharply after the bursting of the property bubble and although they began to rise again this year they remained substantially below their peak and in September fell again by 3.6%. The number of sales remains at a historic low.

The stock market suffered sharp falls from mid 2007 and, although it has recovered since then, there is still uncertainty. The concerns about the debts of Greece and other countries prior to the intervention of the EU and IMF led to a significant fall in May this year as the graph below shows.

Source: The Guardian

Inflation rose to nearly 5% in September 2008 before falling to below 2% a year later. It has since risen to over 3% during 2010, above the Bank of England's target of 2%.

Unemployment is estimated to have increased by about 900,000 during the recession, which is considerably less than in previous recessions. In July 2010 the official figures were 7.8% of the workforce totalling some 2.47 million people.

State intervention

The British government intervened robustly to limit the crisis, initiating a range of policies that were taken up by many other countries. Gordon Brown basked in this glory for a few months, famously stating that he had saved the world in a slip of the tongue during a debate in the House of Commons. There were a number of strands to the state’s intervention:

- cuts in the Bank of England base interest rate. Between December 2007 and March 2009 the rate was progressively cut from 5.5% to 0.5%, bringing it down to the lowest rate on record and below the rate of inflation;

- intervention to directly support the banks, leading to nationalisation or part nationalisation. This started with Northern Rock in February 2008 and was followed by Bradford and Bingley. In September the government brokered the take-over of HBOS by Lloyds TSB. In October £50bn was made available to the banks for recapitalisation. In November 2009 a further £37bn investment resulted in the de-facto nationalisation of RBS/Nat West and the partial nationalisation of Lloyds TSB/HBOS;

- quantitative easing, also known as the asset purchase facility. In March 2009 plans to inject £75bn over three months were announced. This was gradually increased and at present the total stands at £200bn. The Bank of England explains that the purpose of quantitative easing is to put more money into the economy to keep the rate of inflation at its target of 2% and this became necessary when further reductions of the base rate were no longer possible after it had been reduced to 0.5%. This is achieved by the bank purchasing assets (mainly gilts) from private sector institutions and crediting the sellers’ account, effectively creating new money. This sounds simple, but according to the Financial Times “No one is sure whether or how quantitative easing and other unorthodox monetary policies works”[7]

- intervention to encourage consumption. In January 2009 VAT was cut from 17.5% to 15% and in May 2009 the car scrappage scheme was introduced. The increase in the guarantee on bank deposits to £50,000 in October 2008 can be seen as part of this since its aim was to reassure consumers that their money would not just disappear in the event of a bank collapse.

The result was the containment of the immediate crisis with no further bank collapses. The price was a substantial increase in debt as noted above. Official figures give the cost of government intervention as £99.8bn in 2007, £121.5bn in 2009 and £113.2bn in July this year. These figures do not include the cost of purchasing assets such as the stakes in the banks or the expenditure on quantitative easing (which would add another £250bn or so to the total) on the grounds that these assets will only be held temporally by government before being sold back. Whether this is so remains to be seen, although Lloyds TSB has paid back some of the money it received.

The interventions have also been partly credited for the lower than expected rise in employment during the recession. This will be dealt with in more detail below.

However, the longer-term prospects seem more questionable:

- interventions to manage inflation and theoretically encourage spending have not brought the headline rate to target, although it is suggested that the underlying trends are lower than the headline rate suggests. However, the cost of food is rising globally so may affect the rate over time, particularly as it affects those who are less well off;

- the efforts to inject liquidity into the system, by reducing the cost of borrowing and increasing the supply of money, have not produced the increase in lending that was hoped for, leading to repeated calls from politicians for the banks to do more;

- the impact of the VAT cut and car scrappage scheme contributed to the initial recovery at the end of 2009 but have now ended. There was a slight fall in car sales in the first quarter of 2010 but the car scrappage scheme was still in place then. Overall, there have been reductions in most areas of household consumption, growth in personal debt has begun to reduce and the rate of savings has increased. Given the central role played by debt-funded household consumption in the boom this clearly has implications for any recovery.

The consensus forecasts for GDP growth in 2010 and 2011 in Britain are 1.5% and 2.0% respectively. This is above the 0.9% and 1.7% predicted for the Euro Area but below the 1.9% and 2.5% forecast for the OECD as a whole[8] and below the forecasts for Europe from the IMF quoted at the start of this report.

However, to grasp the real significance of the crisis it is necessary to penetrate below these surface phenomena to examine aspects of the structure and functioning of the British economy.

Historical and structural issues

Changes within the composition of the British economy: from production to services

To understand the situation of British capitalism and the significance of the recession it is necessary to look at the main structural changes within the economy over recent decades. The article published in

Bilan in 1934/1935 (n

° 13 and 14)

[9] noted that in 1851 24% of men were employed in agriculture. By 1931 this had shrunk to 7% and that in the same period the proportion of men employed in industry declined from 51% to 42%. Today this has undoubtedly gone much further. In the 1930s Britain still had an empire, albeit decaying, that it could draw on. This has not been the case since the Second World War. The historical trend has been a shift away from production towards services and within this sector to finances in particular as the two charts below show.

Both of these are taken from the

Blue Book for 2010, which sets out the national accounts. It made the following comments about these two charts: “

In 2006, the latest base year, just over 75 per cent of total gross value added was from the services sector, compared to 17 per cent from the production sector. Most of the remainder was attributed to the construction sector.”

[10] In 1985 the service sector made up 58% of GVA. “

An analysis of the 11 broad industrial sectors shows that in 2008 the financial intermediation and other business services sector provided the largest contribution to gross value added at current basic prices, at £420 billion out of a total of £1,295.7 billion (32.4 per cent). The distribution and hotels sector contributed 14.2 per cent; the education, health and social work sector accounted for 13.1 per cent; and the manufacturing sector 11.6 per cent.”

[11] Note that in two years from 2006 to 2008 the contribution of the manufacturing sector shrank by around a third (from 17% to 11.6%).

Some idea of the pace of these developments over the last 30 years is given in the table below entitled “Structural change in UK Services” which attempts to quantify the development within the various sectors that make up the service sector. “

Total service output has more than doubled during this period, but in the business services and finance sector output grew almost five-fold.”

[12] In comparison, the same table for manufacturing shows that the sector grew by just 18.1% during the same period with wide variations between industries.

Source: Economic and Labour Market Review

The service sector as a whole is more profitable than the manufacturing sector as the table below shows. In the first quarter of 2010 the net rate of return in manufacturing was 6.4% and in services it was 14.4%. However, these are the lowest rates of return since 1991 and 1995 respectively.

The rise of the financial sector

The figures published about the profitability of the service sector cited above are for private non-financial companies and one particular feature of the situation in Britain is the significance of the financial sector, so this needs further examination. Five of the top ten banks in Europe in 2004 by capitalisation, including numbers one and two, were based in Britain. Globally, the four largest British banks are in the top seven banks (the US banks Citicorp and UBS are the top two). According to the Director of Financial Stability at the Bank of England: “

As a share of whole-economy output, the direct contribution of the UK financial sector rose to 9% in the last quarter of 2008. Financial corporations’ gross operating surplus (GVA less compensation for employees and other taxes on production) increased by £5.0bn to £20bn, also the largest quarterly increase on record.”

[13] This reflects the trend in Britain for over a century and a half: “

Over the past 160 years, growth in financial intermediation has outstripped whole economy growth by over 2 percentage points per year. Or put differently, growth in financial sector value added has been more than double that of the economy as a whole since 1850”.

[14] From accounting for about 1.5% of the economy’s profits between 1948 and 1970 the sector has grown to account for 15%. This is a global phenomenon with pre-tax profits of the top 1,000 world banks reaching £800bn in 2007/8, an increase of 150% from 2000/1. Crucially, the return on capital in the banking sector has far outstripped that in the rest of the economy as the chart below shows.

The weight of the banking sector within the economy can be gauged by comparing its assets to the total GDP for the country. This can be seen in the chart above. By 2006 British banks’ assets were over 500% of national GDP. In the US assets rose from 20% to 100% of GDP over the same period, thus the weight of the banking sector in Britain is proportionately far greater. However, its capital ratio (this is the capital held by the bank in comparison to that lent) did not keep pace, falling from 15-25% at the start of the 20th century to about 5% at the end. This increased sharply over the last decade and just before the crash leverage of the major global banks was about 50 times equity. This underlines that the global economy has been built on a tower of fictitious capital over the last few decades. The crisis of 2007 threatened to topple the whole edifice and this could have been catastrophic for Britain given its reliance on this sector. This is why the British bourgeoisie had to respond as it did.

The nature of the service sector

It is also worth looking at the service sector as a whole more closely. The sector is broken down in various ways in official publications providing greater or lesser detail. Here we will refer to those listed in the table above (“Structural change in UK services”) although it is worth noting that sometimes construction, which is a productive activity, is included within the service sector. The bourgeoisie records the value each industry is supposed to add to the economy but this does not tell us whether they actually produce surplus value or, while performing a necessary function, they do not add value.

Some of these sectors are what Marx described as costs of circulation.

[15] Within this he distinguishes between those that relate to the transformation of the commodity from one form to another, that is from the commodity form to the money form or vice versa, and those that are a continuation of the productive process.

Changes in the form of the commodity, although they are a necessary part of the total production process, do not add value and are a cost against the surplus value that is extracted. In the list we are considering this includes retail and wholesale distribution (other than where this comprises transport of commodities – see below), hotels and restaurants (to the extent that they are the point of sale of finished commodities– the preparation of meals may be seen as a productive process producing surplus value), large parts of communications (where these are concerned with purchases of raw materials or the sale of finished products), business services and computers (where these are concerned with things like ordering and stock control and market strategy). The whole marketing and advertising industry, which is not separately identified here, falls under this category since it is concerned with maximising sales.

Marx argues that those activities that are a continuation of the productive process include activities like transport that involve getting the commodity to its point of consumption and others, such as storage, that are concerned with the preservation of the value of the commodity. These activities tend to increase the cost of the commodity without adding to its use value; they are unproductive costs so far as society is concerned but may produce surplus value for the individual capitalist. In our list this category includes transport and air transport and retail and wholesale distribution where these involve the transportation or storage of commodities.

A third area concerns those activities linked to appropriating a share of the total surplus value through interest or rent. Many of the activities within business services and finance, financial intermediation and services, computer activities and auxiliary finance are aspects of the administration of the stock market and banking where fees and commissions are charged as well as interest. Financial bodies also invest money and speculate on their own account. Ownership of dwellings is probably related to lettings and hence the receipt of surplus value in the form of rent.

A fourth area is the activity of the state, which covers most of the last five in our list. Since these are funded from surplus value through taxation of industry none of these produce surplus value, although state orders may produce profits for individual businesses. In

International Review n

°114 we pointed out that the way the bourgeoisie produces its national accounts tends to overestimate GNP (Gross National Product) because “

national accounting partly counts the same thing twice. In practice, the selling price of products in the market incorporates the taxes that are used to pay national expenditure, namely the costs of non-market services (teaching, social security, public sector personnel…). The bourgeois economy calculates the value of these non-market services as being equal to the sum of wages paid to personnel who provide them. Now, in national accounting, this sum is tacked on to the added value produced in the market sector (the only productive sector), even though it is already included in the selling price of market products…”

[16]Taking the service sector as a whole, it is clear that it does not actually add the value to the economy that is claimed for it. Some parts reduce the total surplus value produced, others, notably the financial and business services, take a share in the surplus value produced, including that produced in other countries.

What are the reasons for the changes in the structure of the British economy? In the first place, increasing productivity means that a growing mass of commodities is produced by a falling number of workers. This is the reality behind the figures from

Bilan quoted above. Secondly, the growing organic composition and the falling rate of profit results in the shift of production to areas with cheaper costs for labour and constant capital.

[17] Thirdly, the same factors prompt capital to move into activities where the returns are greater, notably in banking and finances, where Britain’s initial dominance (

Bilan referred to Britain as the “

world’s banker”) allowed it to extract more surplus value. The deregulation of this sector in the 1980s did not reduce the costs but rather strengthened the dominance of the major banks and financial companies and the reliance of the bourgeoisie on the profits they produce. Fourthly, as the mass of commodities grows the contradiction between the scale of production and the capacity of the market increases, drawing in more resources to effect the transition of capital from its commodity form to its money form. Fifthly, the growing complexity of the economy and the social strains this produces results in the growth of the state, which aims to manage the whole of society in the interests of the national capital. This includes the direct forces of control, but also those parts of the state tasked with producing workers with the right skills, with keeping them reasonably healthy and with managing the various social problems that arise from a society based on exploitation.

Conclusion

Two somewhat contradictory conclusions can be drawn from this part of the report. The first and most important is that the evolution of British capitalism left it exposed to the full force of the crisis when it broke and there was a real danger that the collapse of the financial sector would cripple the economy. The perspective was of a sharp acceleration of the decline of the global strength of British capitalism with all the consequences at the economic, imperialist and social level this would entail. It is no exaggeration to say that the British bourgeoisie looked into the abyss in 2007 and 2008. The response confirmed again the continuing skill and determination of the ruling class as it united to throw all of its forces into combating the immediate danger: the longer term consequences would have to be left for another day.

The second conclusion is that it would be a mistake to write off the manufacturing sector. There are two reasons for saying this. Firstly, it still makes an important contribution to the overall economy, even if the rate of profit is lower. The contribution of 17% or even 11.6% to the total economy is not insignificant (and in reality is probably larger once the non-productive parts of the service sector are taken into account), and while the balance on the trade in goods has remained negative for many decades, it accounts for the major part of exports from Britain. Secondly, the present crisis exposes the danger of over reliance on one part of the economy. This explains why the Cameron government is giving prominence to the role that manufacturing can play in any recovery and why the promotion of British trade has recently become a more important part of Britain’s foreign policy. Whether this is realistic is another matter as it will require attacks on the costs of production beyond anything achieved by Thatcher and will go against both the historical and more immediate trends of the global economy. Britain cannot compete directly with the likes of China so will have to look for particular niches.

All of this brings us to the question “What hope for an economic recovery?”

What hope for an economic recovery?

The global context

“…

recent data indicate the global recovery is slowing after an initially rapid recovery. Output in the west is still far below pre-2008 trends. Stubbornly high US unemployment is blighting lives and souring politics. Europe narrowly avoided sparking a second worldwide crisis in May when its big economies agreed a bail-out fund for Greece and other highly indebted countries at risk of sovereign default. Japan has intervened in currency markets for the first time in six years to stop an appreciation of the yen hurting its exports” These are the words of an article in the

Financial Times[18] on the eve of the bi-annual gathering of the IMF and World Bank in early October and reflect the concerns of the bourgeoisie.

We can note that the recovery plans in Europe had so far failed to produce very strong rates of growth and emphasised above all the growth of national debt that in some countries has led to questions about the state’s ability to repay its debts. Greece is at the forefront of this group of countries but Britain is also included amongst those where the level of debt presents a risk. The graph below, despite its reassuring title, shows that in the US and many European countries the level of debt poses a risk. Britain may not have as much total debt as some countries (the horizontal axis) but its current account deficit is the highest (the vertical axis), indicating the rapidity with which it has recently been accumulating debt.

Two different strategies have been adopted to deal with the recession: that favoured by the US of continuing to use debt; and that increasingly being adopted across Europe of cutting the deficit and imposing programmes of austerity. The US is in a position to do this because the continuing role of the dollar as the global reference currency allows it to fund its deficit by printing dollars, an option unavailable to its rivals. Other countries are more constrained by their debts and this fact in itself presents some elements towards answering the question we have posed on the limits of debt. A recent international development has been an increase in efforts to use exchange rates to gain advantage. One cause of this is the effort to use exports to restore the economy. A second cause is the struggle between surplus and deficit countries over exchange rates. This is led by China and the US where a devaluation of the dollar against the yuan would not only reduce the competitiveness of Chinese goods but would also devalue its massive holdings of US dollars (this is one of the reasons it has used some of its reserves to buy assets in a number of countries, including Britain). There is a suggestion that quantitative easing plays a role in devaluing currencies since it increases the supply of money, which gives a new perspective to the recent announcement by Japan of a further round of QE and the suggestion that the US and Britain are considering the same. What this poses is the loss of the unity seen in the midst of the crisis and its replacement by the attitude of looking after number one. Commenting on these developments a columnist in the

Financial Times recently wrote, “

As in the 1930s, everyone is looking to export their way out of trouble, which everyone, by definition, cannot do. So global imbalances are on the rise again, as is the risk of protectionism.”

[19] The pressures are growing but we cannot yet say whether the bourgeoisie will succumb to them.

What this means is that all options carry real dangers and there is no obvious route out of the crisis. The lack of solvent demand will renew the pressure that has led to the escalation of debt and reanimate the protectionist reflex that has been long contained, while austerity policies risk further reducing demand and thus provoking a further recession, greater protectionism and strengthening pressure to return to the use of debt. In this perspective the resort to further debt seems the most immediately obvious since it will be a continuation of developments over the last decades, but it poses the question of whether there are limits to debt and, if there are, what they are and whether we are at those limits. For this report, we can conclude from recent developments and the crisis sparked off by Greece that there are limits to debt – or rather a point at which the consequences of increased debt begin to undermine its effectiveness and destabilise the world economy. If Greece was unable to make its payments, not only would there have been a serious depression within the country but there would also have been a significant disruption of the international financial system. The fall in the stock market prior to the EU/IMF bailout shows the sensitivity of the bourgeoisie to this.

The options for British capitalism

The British bourgeoisie is at the forefront of those choosing austerity with its plan to eliminate the deficit in four years requiring cuts of around a quarter in state spending. Beyond the state sector, its plan to cut benefits to make work more attractive is clearly aimed at lowering the cost of labour throughout the economy in an effort to increase the competitiveness and profitability of the British capitalism. This is being sold under the flag of the national interest and an attempt to suggest that the crisis was the fault of the Labour Government rather than global capitalism (we will look at this ideological campaign in more detail in the part of this report that deals with the life of the bourgeoisie).

In previous reports we have analysed that British capitalism has recently produced surplus value by increasing the rate of absolute exploitation of the working class and has realised it through an increase of debt, in particular of private debt fuelled by the housing boom and the explosion of unsecured lending. Building on this, the report to the last WR congress emphasised the overall importance of the service sector while the current report has confirmed this but clarified that it does not stem from the sector as a whole and has emphasised the particular role played by the financial sector. On the basis of this framework, it is worth considering how the three elements of the response to the crisis – debt, austerity and exports – relate to the situation facing Britain.

Prior to the crisis personal debt underpinned economic growth for several years, both directly through the debt accumulated by households in Britain and indirectly through the financial institutions’ role in the global debt market. Once the crisis broke state debt was used to protect these financial institutions and, to a much lesser extent, to offer protection to households (the increase in protection to savings to £50,000) while the rate of growth of personal debt declined and some individuals were pushed into insolvency. At present the level of private debt is falling very slightly while savings are increasing and the government has announced its determination to halve the deficit. Unless there is a reversal of these developments it seems unlikely that debt will contribute to any recovery. The austerity ahead may have two opposing impacts on the working class. On the one hand it may push many to limit expenditure and to try to repay debts in order to protect themselves. On the other hand it may drive others to resort to debt to make ends meet. However, this is likely to come up against the reluctance of banks to lend. The financial sector was dependent on the development of global debt for much of its growth prior to the crash and at present there are attempts to find alternatives, resulting, for example, in the increased activity in food markets. However, such activity still ultimately depends on the presence of solvent demand, which returns us to our starting point. If the US continues on the path of increasing debt, British capitalism may be able to benefit given its position within the global financial system; which suggests that for all the rhetoric of the likes of Vince Cable,

[20] action will not be taken to rein in the bankers and that the strategy of deregulation begun under Thatcher will continue.

Austerity seems to be the main strategy at present. The overt aim is to reduce the deficit, with the implicit promise that once this has been done things will return to normal. But to have any lasting impact on the competitiveness of British capital permanent changes will need to be made. Hopes may be placed on a dramatic increase in productivity, but this has failed to materialise for decade after decade. Unless there is substantial investment in areas related to rising productivity, such as research and development, education and infrastructure, this is unlikely to happen. The evidence already points to cuts in these areas so the more likely option will be an effort to permanently reduce the proportion of surplus value taken by the state and the proportion of the total value produced assigned to the working class. In short, a reduction in the size of the state and lower wages. However, to be effective the scale of attacks on the working class required will be massive, while a reduction in the size of the state goes against the trend seen throughout the period of decadence where the state is required to increase its domination of society in order to defend its economic and imperialist interests and to prevent the contradictions at the heart of bourgeois society from tearing it apart.

Exports can only play a role if the bourgeoisie is successful in its efforts to make British capitalism more competitive. This will come up against the efforts of all of its rivals to do the same. The service sector in Britain is profitable and it may be possible to increase its relatively low level of exports. However, this runs into the difficulty that the most profitable parts of this sector seem to be those linked to the global financial system, which makes it development dependent on a global recovery.

In summary, there is no easy path for British capitalism. The most likely direction seems to be a continued reliance on its position within the global financial system alongside a programme of austerity to bolster profits. In the longer term however, it can only face a continued deterioration of its position.

The impact of the crisis on the working class

The impact of the crisis on the working class provides the objective basis for our analysis of the class struggle. This section will concentrate on the material situation of the working class. The questions of the ideological offensive of the ruling class and the development of class consciousness will be taken up other parts of the report…

One of the immediate impacts of the crisis on the working class was an increase in unemployment. The rate rose steadily during most of 2008 and 2009, increasing the total by 842,000 to 2.46 million or 7.8% of the working population. However, this was below the increases seen in the recessions in the early 80s and 90s when the rates rose to 8.9% (an increase of 932,000) and 9.2% (an increase of 622,000) respectively. This is despite the fact that the fall in GDP has been greater in the present recession than the previous two.

One recent study has suggested that the fall in GDP in this recession might have been expected to increase unemployment by a million more than it actually has,

[21] which poses the question of why this has not happened. The study cited suggests this was due to “

firms’ strong financial position at the start of the recession and the smaller financial squeeze on firms in this recession”, which in turn was due to three factors: “

Firstly policies aimed at assisting the banking system, cutting interest rates and the large government deficit creating a strong stimulus. Secondly, the flexibility of workers in allowing real falls in wage costs to firms aided by low interest rates which sustained real wage growth for consumers. Finally, firms holding on to valuable labour, whilst facing the pressure on profits and the severity of the financial crisis.”

The evidence certainly supports the argument about falls in wage costs, which were achieved through reductions in the hours worked (and thus paid) and in below inflation pay rises. Part time working has increased since the late 70s when it was just over 16% of the workforce and reached 22% in 1995. It has risen further in this recession with the majority taking part time work because they had no alternative.

[22] The number of such under-employed people rose to over 1 million. There has been a small fall in the average hours worked each week, from 32.2 to 31.7, but across the workforce this equates to 450,000 jobs with average hours.

The reduction in real wages stemmed from both low settlements and rising inflation??. The overall result was that firms saved about 1% of real wage costs.

However, this is not the whole picture. While recent years have seen efforts to force people off benefits and while there has been no increase during the present recession, the legacy of the use of things like incapacity benefit to mask unemployment continues to have an impact, as the graph below shows.

Further, in the last two recessions unemployment continued to rise long after the recession formally ended. In the 1980s it took 8 years for employment levels to reach those at the start of the recession and in the 1990s it took nearly nine years. While the rate of increase in this recession may have levelled off sooner than in the previous two there are reasons why this may only be a temporary interlude since not only will the austerity measures lead to hundreds of thousands of state employees being sacked but the possible double-dip recession these measures may produce, coupled with the uncertain global situation means that unemployment may well begin to increase again. Annual growth rates of 2% are considered necessary before employment starts to rise and of 2.5% if modest population growth is also allowed for. None of the projections for Britain are currently at this level.

Those who become unemployed remain out of work for longer as the number of vacancies remains substantially below the number looking for work. The longer the period of unemployment the more likely the person is to become unemployed again in the future. By the start of 2010 700,000 people were classed as long term unemployed, having been without a job for 12 months or more. It is worth noting here the impact of unemployment on those affected: “

An indication of the real cost of this flexibility was provided in a recent study of the impact of the recession on mental health. This found that 71% of people who have lost a job in the past year have experienced symptoms of depression, with those aged 18-30 most affected. Around half said they have experienced stress or anxiety.”

[23]One aspect of the reduction in wages and the general worsening of conditions is a fall in consumption. Although some of the studies cited suggest there has been little reduction others suggest there was a fall of 5% during 2008 and 2009. Quite obviously for most people this is not a matter of choice but the simple consequence of losing a job, working fewer hours or taking a direct pay cut.

Official figures show falls in child and pensioner poverty during the period of the Labour government and average living standards rising at 2% a year. However this has slowed in recent years. At the same time inequality has grown and poverty amongst working age adults is at its highest level since 1961.

[24] Overall, poverty has increased by between 1% and 1.8% over the last four or five years (0.9 or 1.4 million people) to 18.1% or 22.3% (the difference depends on whether income is measured before or after housing costs).

Although there has recently been a slight decline in the level of personal debt (at the rate of 19p a day), in July this year the annual growth rate was still 8% and the total owed was £1,456bn,

[25] which as we have pointed out before is more than the total produced in the country each year. This comprises £1,239bn in secured lending on homes and £217bn consumer credit lending. It is estimated that average families have to spend 15% of their net income to service debt payments.

This situation has resulted in an increase in the number of personal bankruptcies and Individual Voluntary Arrangements. This increased significantly from 67,000 in 2005 to between 106,000 and 107,000 in during 2006 to 2008 before jumping again to reach 134,000 in 2009. The first quarter of this year saw another 36,500, which if continued would mean a further increase.

[26] This rate is very substantially above that seen in previous recessions, although legal changes make direct comparisons difficult.

[27]Accompanying the fall in the growth of personal debt, the ONS reports an increase in the rate of household saving from -0.9% at the start of 2008 to 8.5% at the end of 2009.

[28] It seems that many workers are trying to prepare for the hard times ahead.

Perspectives

Although the impact of the crisis on the working class is greater than the publications of the bourgeoisie tend to present it as, it has nonetheless been relatively contained both at the level of employment and of income. In part this is due to circumstances, in part to the strategy adopted by the bourgeoisie including the use of debt, and in part to the response of the working class, which seems to have focussed more on surviving the recession than combating it. However, it is unlikely that this situation will continue. Firstly, the overall global economic situation will remain very difficult, as the bourgeoisie is unable to resolve the fundamental contradictions undermining the foundations of its economy. Secondly, the strategy of the British ruling class has now switched to one of imposing austerity, partly because of the global situation. It could conceivably return to the use of debt in the short term but the cost would be to worsen the long-term problems. Thirdly, the impact on the working class will increase in the period ahead and so will contribute to further developing the objective conditions for a development of the class struggle.

10/10/10

[1]. World Bank,

Global Economic Prospects, Summer 2010, Key Messages.

[3]. Much of the data in this section is taken from the

Economic and Labour Market Review of August 2010, published by the Office for National Statistics. Other data is taken from the

Blue Book, that deals with the UK’s national accounts, the

Pink Book that deals with the balance of payments and

Financial Statistics, all of which are published by the ONS.

[4].

Economic and Labour Market Review, August 2010, p.57.

[5]. ONS

Pink Book, 2010 Edition, p.34.

[6]. Bank of England,

Inflation Report, February 2009, p.17

[7].

Financial Times, “That elusive spark”, 06/10/10.

[8]. These figures are from the

Economic and Labour Market Review, September 2010, p.19. The

Review took the forecasts for the Euro area and the OECD from the OECD’s

Economic Outlook of November 2009.

[9]. Republished in

World Revolution n

° 312 and 313.

[10].

Blue Book 2010, p.22.

[12].

Economic and Labour Market Review, August 2010, p.57.

[13]. Andrew Haldane, “The Contribution of the Financial Sector: Miracle or Mirage”, Bank of England, July 2010.

[15]. See

Capital, Vol. II, Chapter VI, “Costs of Circulation”.

[16].

IR no.114, “The reality of ‘economic prosperity’ laid bare by the crisis”, p.16.

[17]. The development of production in China and other low-cost producers is credited with keeping the rate of global inflation relatively stable over recent decades and with reducing the costs of labour throughout the world, including in the developed countries, since the supply of workers has massively increased (it has been suggested that the entry of China into the world economy has doubled the supply of labour). Consequently, not only is the rate of profit likely to be higher in the low wage economies themselves, it is also likely to decrease the cost of labour and push up the rate of profit in the developed countries too, resulting in the increase in the average rate of profit that we have noted in a number of articles in the

International Review. Whether this is sufficient to create the necessary mass of profit is another matter however.

[18]. “That Elusive Spark”, 06/10/10.

[19]. John Plender, “Currency demands make a common ground elusive”, 06/10/10.

[20]. Member of the Liberal Democrat Party and Secretary of State for Business, Innovation and Skills in the coalition government.

[21]. “Employment in the 2008-2009 recession”,

Economic and Labour Market Review, August 2010.

[22]. See:

Economic and Labour Market Review, September 2010, p.15.

[24]. Institute for Fiscal Studies,

Poverty and Inequality in UK 2010.

[25]. The figures in this paragraph are taken from

Debt Facts and Figures for September 2010 compiled by Credit Action.

[26]. Source: ONS,

Financial Statistics, August 2010, p.120.

[27]. Economic and Labour Market Review, August 2010, p.61. Between 1979 and 1984 the increase was from 3,500 to 8,229 and between 1989 and 1993 it was from 9,365 to 36,703.

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace